At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Market Commentary – July 29, 2019

The Markets

It has been said there are two sides to every story. Just look at world financial markets. Stock markets and bond markets are telling very different stories.

In the United States, stock markets were blue ribbon winners last week.

The Standard & Poor’s 500 Index rebounded to a record high. The Nasdaq Composite also set a new record. Barron’s reported U.S. stock markets were supported by abundant optimism inspired by expectations for solid earnings growth and a Federal Reserve rate cut in July.

Optimism pushed stocks higher in Europe last week, too. CNBC reported investors were receptive to news suggesting the European Central Bank would ease monetary policy to support the European economy. A significant number of national stock indices in Europe, the Middle East, and Asia finished last week higher, according to Barron’s.

Bond markets have been telling a less optimistic story.

In many regions of the world, bond yields have sunk below zero, and bond buyers have been locking in losses by investing in bonds with negative yields.

In the United States, the 10-year Treasury yield remains positive, but it has dropped from 3.2 percent in November 2018 to 2.1 percent at the end of last week.

So, what are bond markets saying? Barron’s suggested some possibilities: “…bond buyers locking in subzero yields aren’t doing it, of course, for love of losses. They might think that the certainty of small losses will prove a better deal in the years ahead than whatever stocks provide…There’s something else that negative yields could be telling us. Investors need bonds for things like diversification and setting aside money at known rates to offset known liabilities. For an investor who must buy bonds, a purchase here with negative yields isn’t necessarily a bet against stocks. It could just be a wager that bond yields won’t get much better – that slow growth and meager inflation will loom for many years.”

Time will tell.

music, earworms, and data storage. Anyone who has ever suffered an earworm (known in scientific circles as Involuntary Musical Imagery) understands the power of music. Some tunes that repeatedly pop into people’s heads may include:

- It’s a Small World (Disney)

- Don’t Stop Believing (Journey)

- Who Let the Dogs Out? (Baha Men)

- Silver Bells (Bing Crosby)

- We are the Champions (Queen)

Let’s face it. Music can be potent. In The Power of Music, Elena Mannes writes, “…science today is showing that music is in fact encoded in our bodies and brains.” She discusses research suggesting music may be able to help people heal, change behavior, and treat neurological disorders.

It may be used in other ways, too. Soon, you may experience a new music phenomenon called Imperceptible Audio Communication. That’s when data is secretly coded into music. You won’t be able to hear it, but your smartphone and other devices will.

At the 44th IEEE (Institute of Electrical and Electronics Engineers) International Conference on Acoustics, Speech and Signal Processing, a pair of doctoral students shared their work, which focuses on storing data in music.

Imagine, someday you may be:

- Walking through an airport, not really listening to the piped-in sounds, when your phone picks up a data feed from the music and lets you know your flight is delayed.

- Pushing your cart down a grocery aisle and Muzak® advises your smartphone cauliflower is on sale.

- Checking into a hotel and having the lobby music send the Wi-Fi password and other check-in data directly to your smartphone.

- Dancing in a club and having your smartphone flash a drink special.

The times – they are changing.

Weekly Focus – Think About It

“Any sufficiently advanced technology is indistinguishable from magic.”

–Arthur C. Clarke, British writer and inventor

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

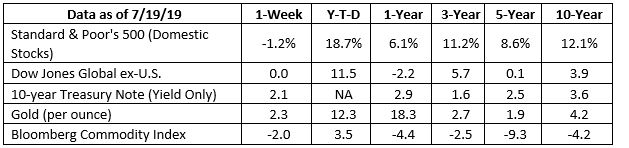

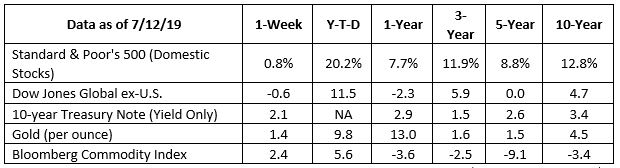

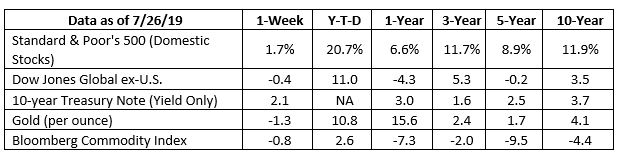

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over? Many of us believe that the party may be over. Last Friday, SPY rose. Well, it climbed back to...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our investment strategy has remained unchanged since my last email on August 22, 2024: we have...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/why-some-investors-are-buying-bonds-that-lose-money-51564179385?mod=hp_DAY_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-29-19_Barrons-Why_Some_Investors_are_Buying_Bonds_that_Lose_Money-Footnote_1.pdf)

https://www.barrons.com/articles/the-s-p-500-hit-a-new-high-because-the-market-still-expects-the-federal-reserve-to-cut-interest-rates-51564195482?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-29-19_Barrons_The_S_and_P_Hit_a_New_High_Because_the_Market_Still_Expects_the_Federal_Reserve_to_Cut_Interest_Rates-Footnote_2.pdf)

https://www.cnbc.com/2019/07/26/europe-stock-markets-ecb-holds-interest-rates-and-earnings-in-focus.html

https://www.barrons.com/market-data/stocks/emea?mod=md_usstk_view_emea (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-29-19_Barrons-UK_FTSE_100_Stock_Index-Footnote_4.pdf)

https://www.barrons.com/market-data/stocks/asia?mod=md_emeastk_view_asia (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-29-19_Barrons-Hong_Kong_Hang_Seng_Stock_Index-Footnote_5.pdf)

https://finance.yahoo.com/quote/%5ETNX/history?p=%5ETNX

https://www.amazon.com/Poamazon%20Power%20of%20Musicwer-Music-Pioneering-Discoveries-Science/dp/0802719961/ref=sr_1_1?keywords=Elena+Mannes+POwer+of&qid=1564244240&s=dmusic&sr=8-1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-29-19_Book_Excerpt-The_Power_of_Music-Footnote_7.pdf)

https://www.sciencedaily.com/releases/2019/07/190709122014.htm

https://www.goodreads.com/quotes/tag/technology