How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Just say NO to Pie Charts!!

At one time in the past, color pie charts were the pinnacle of timely investment management advice.

Not any more!

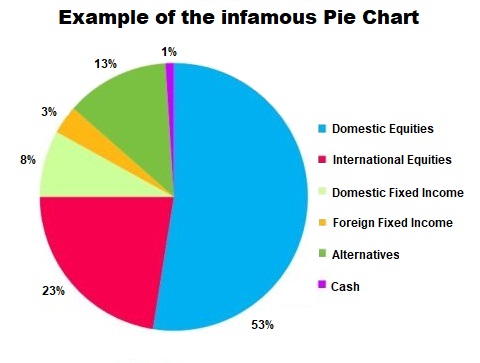

Investment Portfolio Pie Chart

You can always find one of the infamous pie charts when you thumb through your company’s 401K account on your their retirement plan provider web site. The pie chart shows you how your company retirement plan account is currently invested in a mixture of stocks, bonds, and money market funds. Easy to understand and visualize.

Most financial advisors would be willing to show you, at your earliest convenience, how your investable funds should be invested now. And in pie chart living color. This core investment management advice concept has not changed in over 75 years!

When the next market downturn comes, many investors who think they’re protected may be surprised. Merely being invested in different types of stocks and bonds isn’t good enough anymore.

At Research Financial Strategies, we learned many stock market declines ago (there have been 16 bear markets with an average loss of 38% each to date¹) that the asset allocation assumptions shown in a pie charts do not work very well when the stock market is going down.

First, it is important to understand that pie charts can not help predict what your investment returns will be in the future. All computer generated asset allocation programs are based upon historical investment returns. Pie charts are always based on the assumption that stock market investment returns will always be positive. Pie charts are not programmed to have any memory of the last 75 years of negative investment returns for the S&P 500 index during the 16 bear market corrections. This cookie cutter style of investing assumes your needs and investing expectations are the same as everyone else. A bad assumption to make, but one that is easiest for the large investment houses.

Making future investment return assumptions based upon historical relationships is financially dangerous. As a current reminder, remember how the current generation of Baby Boomers always thought that real estate values would rise forever? The housing bubble was an ugly reminder with most areas coming close to recovery a decade later.

This Webinar zeroes in on Technical Analysis and Active Management—two strategies that protect your assets in times of trouble. Our equity portfolio shows positive results year-to-date. It currently leads the S&P 500 Index by double digits.

Second, pie charts don’t react to the most important investment management decisions that have to be made periodically in a company retirement plan account. Pie charts can not react to the constantly changing worldwide political, economic and stock market events. Professional money managers can’t afford to rely on the theory behind pie chart asset allocation. Instead, these professionals make investment management decisions for their clients based on what is really happening in the financial world, instead of “what should happen” or “what has happened historically.”

Computers and students of history can’t predict the economic and stock market reactions to budget deficits, bank failures, recessions, real estate price depression, record unemployment levels and entire foreign governments defaulting on their debt. Humans have to make the investment management decisions in reaction to those events as they happen.

Third, pie charts can’t help you define or manage your investment risk level. The truth is the most company retirement plan investors have no earthly idea what their attitude towards investment risk is at any particular time. The only thing that most company retirement plan (401K) participants would ever agree on is that after the stock market goes down in a big way, they always wanted to have taken less risk with their company retirement plan account than they actually did BEFORE the stock market went down.

The Pie Chart Problem

What do all those slices of pie really mean? Do more pies, and more slices, imply greater diversity?

It is important to understand that diversification isn’t designed to boost returns. Unfortunately, for many investors, the pie chart can be misleading. The goal of “diversification” is to select different asset classes whose returns haven’t historically moved in the same direction and to the same degree; and, ideally, assets whose returns typically move in opposite directions. This way, even if a portion of your portfolio is declining, the rest of your portfolio is more likely to be growing, or at least not declining as much. Thus, you can potentially offset some of the impact that a poorly performing asset class can have on an overall portfolio. Another way to describe true diversification is correlation. We want to own asset classes that are not directly correlated.

Unfortunately, even though a pie chart may make it look like an investor is safely diversified, it’s probably not the case. They are probably much more correlated to the market than they realize. Making matters worse, investors with multiple different families of mutual funds often own the exact same companies across the different families. We call this phenomenon “stock overlap” or “stock intersection.” You may own 10 different mutual funds, but the largest holdings in each fund are the same companies.

There was a fascinating study done in the late 1970s by Elton and Gruber. They concluded that a portfolio’s diversity stopped improving once you had more than 30 different securities. In other words, increasing from one or two securities up to 30 had a big improvement. Increasing from 30 all the way up to 1,000 different securities didn’t materially improve the portfolio’s diversity.

Consider that the next time you open up your quarterly statement. How many mutual funds do you really own? How many individual stocks are inside all of those mutual funds?

So, pie charts can’t really do what they are advertised to do. The measure of how something works is a function of how well it is used, and pie charts are clearly used in the wrong way by most financial advice professionals.

They obviously don’t make pie charts that guarantee investment returns as nobody in the financial industry can, react to real world stock market price moves, or help to preserve company retirement plan principal in the early stages of a stock market decline. Their “set it and forget it” style of investing works well for them but not necessarily their clients.

Pie charts look nice coming out of a color printer, and they probably would also look great in 3D. But they can’t help manage the investment risk in your personal portfolio, college savings plan or company 401K retirement plan account.

Looking for a better investment alternative? »Click here«

Research Financial Strategies is a private wealth management firm that was established in 1991 to provide fee based investment advice. We are a registered investment advisor with the Securities Exchange Commission. Research Financial Strategies specializes in providing financial advice using a proprietary investment methodology that leverages technical analysis to identify and protect our clients against stock market risk.

Research Financial Strategies provides families, individuals and foundations with an alternative to institutionalized and impersonalized money management. A privately-owned, independent, and financially secure firm, Research Financial Strategies pursues without conflict the greatest potential in each client’s wealth.

Sources:

CNBC

¹The Dow Theory

Ready to Make a Change?

With an “education first” approach, Research Financial Strategies ensures that our clients understand how their money is being invested, and we guide the development of financial plans that help them achieve their goals for personal wealth and retirement security.