The Markets

Did last week mark the start of a new policy for the Federal Reserve?

The U.S. Federal Reserve has a reputation for providing little transparency about the timing and direction of potential rate changes. That reputation was challenged last week.

In back-to-back speeches, two of the three most influential members of the Federal Open Market Committee (FOMC) – Federal Reserve Vice-Chairman Richard Clarida and Fed Bank of New York President John Williams – made a case for lowering the Fed funds rate to support economic growth, reported Financial Times.

When asked about Fed officials’ comments, a currency strategist cited by Financial Times said, “…the communication we received seemed in many ways to be a coordinated attempt to signal the market given its timing and context…”

The magnitude of the change remains a mystery. Barron’s reported debate remains over whether the Fed will cut rates by 0.25 or 0.50 of a percentage point. On Saturday, the CME FedWatch Tool reported a 77.5 percent probability of the former.

There was some positive economic data last week, including an uptick in U.S. consumer spending and positive manufacturing data from the Philadelphia Fed’s July survey, reported Barron’s. However, the Conference Board Leading Economic Index® declined, indicating growth may remain slow during the second half of the year. The index combines 10 individual leading indicators in an effort to reveal patterns in economic data.

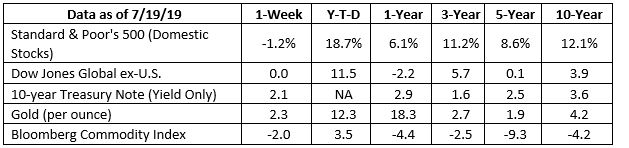

The Standard & Poor’s 500 Index was down 1.2 percent last week.

how hot was it last week?

If you were in a region of the United States that didn’t experience some of the hottest and most humid weather in years over the weekend, count your lucky stars.

The Washington Post reported, “The heat wave…comes in the midst of what may turn out to be the hottest month Earth has recorded since instrument records began in the late 19th century…”

So, how hot was it?

It was so hot:

- The National Weather Service staff in Nebraska attempted to bake biscuits inside a car, reported UPI. The biscuits didn’t bake through, but the tops were crispy. The temperature in the pan reached 185 degrees Fahrenheit.

- Paved roads were melting in France and Germany. Deteriorating road conditions caused Germany to impose speed limits on the Autobahn, which usually has no limits at all, reported Bloomberg.

- Bicycles melted and police were called to restore order at public pools in Berlin, Germany, according to tweets cited by Buzzfeed.

The U.S. heat event is expected to end by Tuesday. Forecasters were warning the heat index could rise as high as 115 degrees. If you are in an area afflicted by extreme heat, the National Weather Service advises staying out of the sun, remaining in air-conditioned places, drinking plenty of water, and checking on older or disabled friends and relatives.

Weekly Focus – Think About It

“Hold yourself responsible for a higher standard than anybody else expects of you. Never excuse yourself. Never pity yourself. Be a hard master to yourself – and be lenient to everybody else.”

–Henry Ward Beecher, American minister and speaker

Best regards,

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over? Many of us believe that the party may be over. Last Friday, SPY rose. Well, it climbed back to...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our investment strategy has remained unchanged since my last email on August 22, 2024: we have...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Wells Fargo Advisors did not assist in the preparation of this report, and its accuracy and completeness are not guaranteed. The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.ft.com/content/15c2d8c6-aa39-11e9-b6ee-3cdf3174eb89 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-22-19_FinancialTimes-Fed_Comes_Under_Fire_from_Wall_Street_Over_Rate_Confusion-Footnote_1.pdf)

https://www.barrons.com/articles/stock-market-gauges-barely-budge-as-fed-decision-looms-51563592175?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-22-19_Barrons-Stock_Market_Gauges_Barely_Budge_as_Fed_Decision_Looms-Footnote_2.pdf)

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-22-19_CMEGroup-Probabilities_of_FOMC_Rate_Moves-Footnote_3.pdf)

https://www.conference-board.org/data/bcicountry.cfm?cid=1

https://www.washingtonpost.com/weather/2019/07/19/potentially-deadly-heat-wave-grips-two-thirds-us-with-dozens-records-likely-fall/?noredirect=on&utm_term=.ffd966f965d8

https://www.upi.com/Odd_News/2019/07/19/National-Weather-Service-bakes-biscuits-in-hot-car/5931563563478/

https://www.bloomberg.com/news/articles/2019-06-26/blazing-heatwave-forces-germany-to-lower-autobahn-speed-limit

https://www.buzzfeed.com/michelleno/europe-is-so-hot-right-now-that-even-meteorologists-are

https://www.npr.org/2019/07/18/743268248/heat-wave-blankets-much-of-the-u-s-this-week

https://www.goodreads.com/quotes/tag/resilience