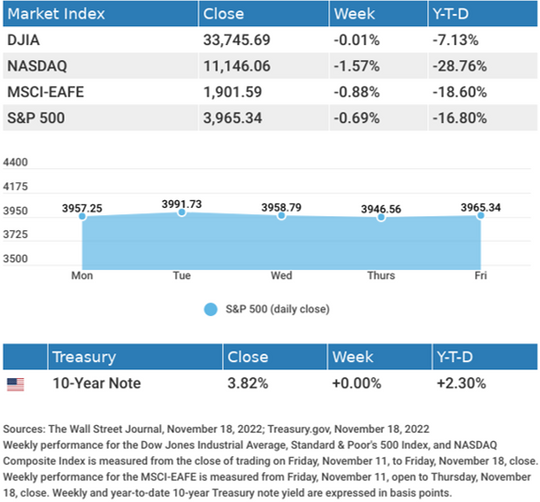

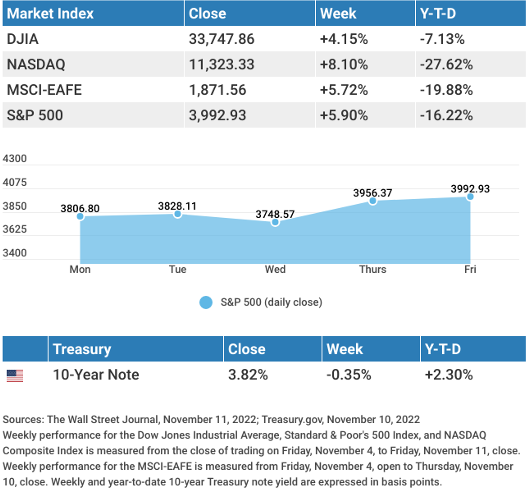

Stocks Surge

A lower-than-expected inflation report triggered the biggest one-day stock market gain in more than two years as the news raised investors’ hopes that the Fed might consider easing the pace of future rate hikes. The day’s gains were pronounced in the hard-hit technology sector, as the tech-heavy Nasdaq added 7.35%.4

Stocks initially rallied to start the week, but gave up some of the gains on Wednesday following a muddy and indecisive outcome to the midterms. Friday saw stocks build on their gains to close out an exceptional week.

Inflation Moderates

Consumer prices rose slower in October, increasing 0.4% for the month and 7.7% from 12 months ago. Both numbers were below market expectations of 0.6% and 7.9%. The core CPI (excludes energy and food sectors) rose a more modest 0.3% on a monthly basis and 6.3% from a year ago.5

The deceleration in prices was mainly attributable to price declines in used cars (-2.4%), apparel (-0.7%), and medical care services (-0.6%). Despite the progress, inflation remains well above the Fed’s 2% target rate. A look behind the numbers shows that October’s 7.7% CPI was fueled by the largest monthly jump in shelter costs since 1990 (+0.8%). Shelter costs account for one-third of the CPI. Energy was up 1.8%, while food costs rose 0.6% for the month.6

This Week: Key Economic Data

Tuesday: Producer Price Index (PPI).

Wednesday: Retail Sales. Industrial Production.

Thursday: Housing Starts. Jobless Claims.

Friday: Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, November 11, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Tyson Foods, Inc. (TSN).

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD).

Wednesday: Nvidia Corporation (NVDA), Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX).

Thursday: Applied Materials, Inc.(AMAT), Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST).

Source: Zacks, November 11, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.