At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not...

Market Commentary

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

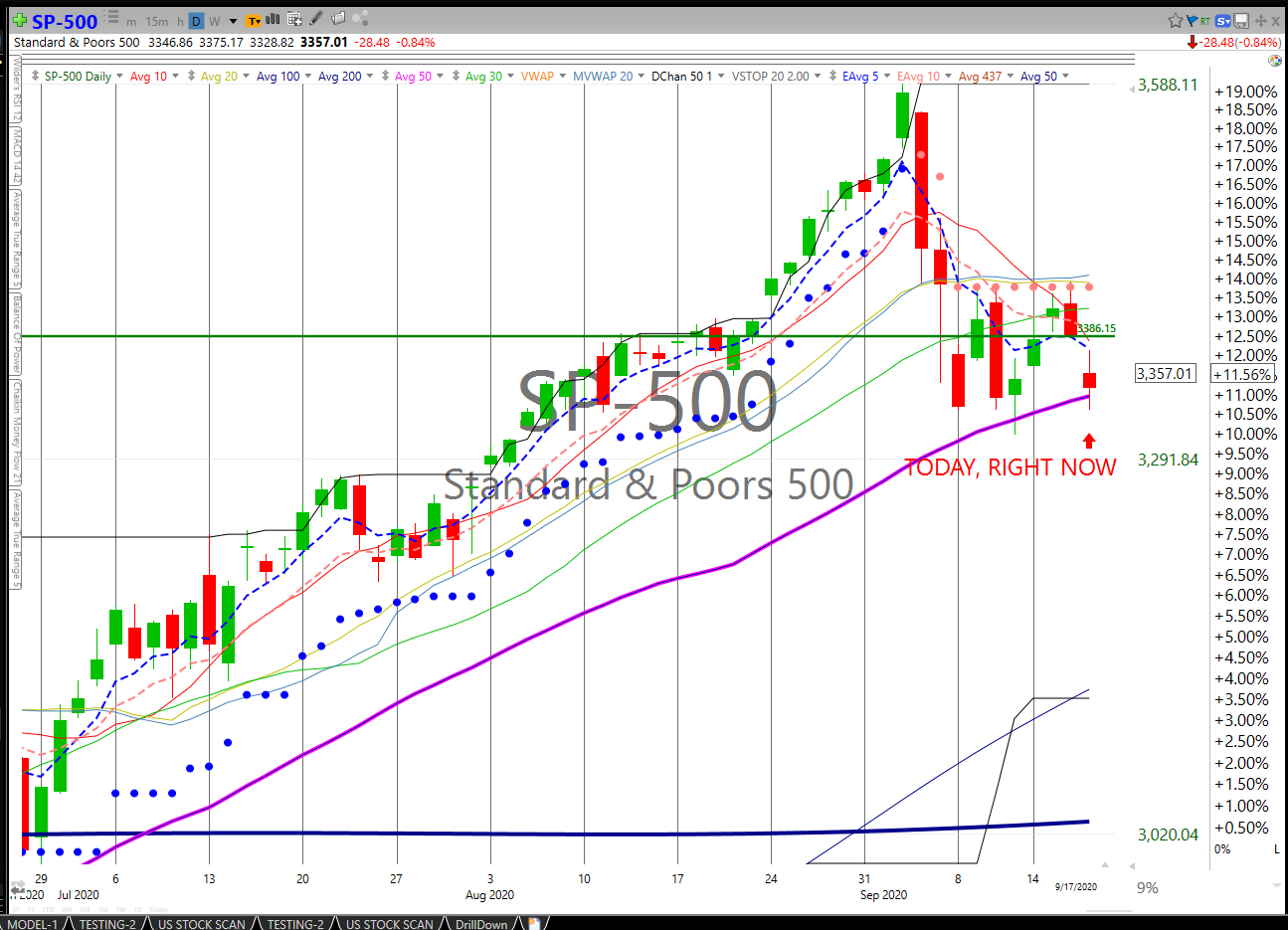

For four weeks, the U.S. stock market has sparked and sputtered like a campfire in light rain.

Today, pandemic-driven demand is providing fuel for the investors. The need for certain types of products and services has accelerated and innovation is creating new opportunities. Consider:

- Technology. Today, digital technologies support nearly all group interactions, which has accelerated innovation. Traditional video communications platforms are in high demand, and multi-person virtual platforms are emerging. Robotics innovations are racing ahead, too. Robotic dogs enforce social distancing in Singaporean parks, reported Other types of robots sanitize streets and facilitate contactless delivery around the globe.

- Consumer products and services. COVID-19 increased demand for staples, cleaning, and personal hygiene products. The virus may have inspired deeper and longer-lasting changes in consumer behavior, too. Accenture reported people are favoring healthier lifestyles, consuming goods more conscientiously, and showing a preference for locally-sourced goods.

- Healthcare, drug development/delivery, and medical equipment. Last Friday, 316 COVID-19 treatments and 212 vaccines were in development around the world, reported the Milliken Institute. In some places, humans are collaborating with artificial intelligence to streamline drug discovery processes. Demand for telehealth services has increased dramatically. So has demand for personal protective equipment, reported Pankaj Singh of Plastics Today.

Throughout 2020, investors’ enthusiasm has pushed markets higher. However, concerns about a variety of issues have dampened enthusiasm in recent weeks. Last Friday, Ben Levisohn of Barron’s reported:

“In a week filled with headlines about government stimulus (or the lack thereof), Supreme Court nominations, the election, the gain in the Nasdaq…suggests that it was the fear of another COVID-19 wave that really got the market down. And for good reason. The week began with the U.K. talking about a second shutdown and ended with all of Europe facing down a second wave of infection…In the U.S., the number of cases is rising and the death toll passed 200,000 midweek…”

Many of these concerns aren’t likely to dissipate soon, and volatility is likely to continue.

Last week, the Standard & Poor’s 500 Index and Dow Jones Industrial Average lost value, while the Nasdaq Composite gained value.

Preparing for A pandemic halloween. In many neighborhoods across the United States, Halloween decorations have begun to appear. If you’ve been wondering whether Halloween celebrations and trick-or-treating are possible when the COVID-19 virus is still spreading across the country and the world, you may be interested in the Halloween guidelines issued by the Centers for Disease Control:

Low risk activities:

- Carving or decorating pumpkins at home and displaying them

- Carving or decorating pumpkins outside, at a safe distance, with neighbors or friends

- Decorating your house, apartment, or living space

- Holding a virtual Halloween costume contest

- Having a Halloween movie night at home with your family or roommates

- Having a Halloween scavenger hunt with lists of Halloween-themed things to look for while walking outdoors, at a safe distance from other participants

- Having a scavenger-hunt style trick-or-treat event with your household members in or around your home instead of trick-or-treating from house to house

Moderate risk activities:

- Participating in one-way trick-or-treating. Individually wrapped treats are lined up for families to take while remaining at a safe social distance (end of a driveway or at the edge of a yard)

- Small group, outdoor, open-air costume parades or parties with participants remaining at safe social distances (six feet apart)

- Going to an open-air, one-way, walk-through haunted forest where appropriate mask use is enforced, and people can remain more than six feet apart (if screaming is likely, distances should be increased)

- Having an outdoor Halloween movie night with local family friends with people spaced at least six feet apart (again, if screaming is likely, distances should be increased)

With a little planning, everyone can have a safe and fun Halloween.

Weekly Focus – Think About It

“In three words, I can sum up everything I’ve learned about life. It goes on. In all the confusions of today, with all our troubles…with politicians and people slinging the word fear around, all of us become discouraged…tempted to say this is the end, the finish. But life – it goes on. It always has. It always will. Don’t forget that.”

–Robert Frost, Poet, on his 80th birthday in 1954

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day,...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.accenture.com/us-en/blogs/technology-innovation/carrel-billiard-out-innovating-covid-19-a-new-perspective-on-our-2020-technology-vision-trends

https://www.accenture.com/us-en/insights/consumer-goods-services/coronavirus-consumer-behavior-research

https://covid-19tracker.milkeninstitute.org

https://www.plasticstoday.com/medical/pandemic-puts-ppe-sector-7-growth-path-through-2026

https://www.barrons.com/articles/the-stock-market-dropped-last-week-why-its-not-time-to-panic-51601079593?mod=hp_LEAD_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-28-20_Barrons-The_Stock_Market_Had_a_Bad_Week-At_Least_It_Wasnt_a_Terrible_One-Footntote_5.pdf)

https://www.cdc.gov/coronavirus/2019-ncov/daily-life-coping/holidays.html#halloween

https://quoteinvestigator.com/2018/04/01/life-goes/