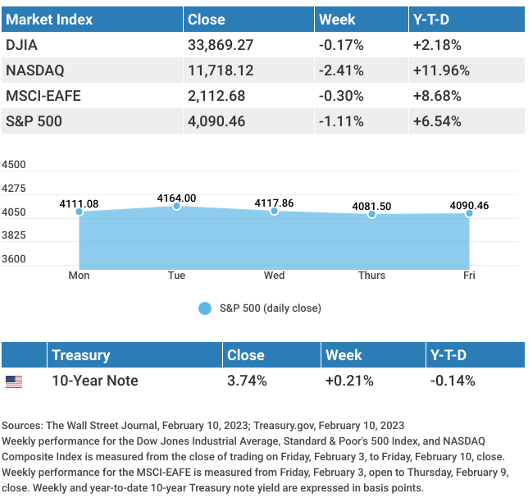

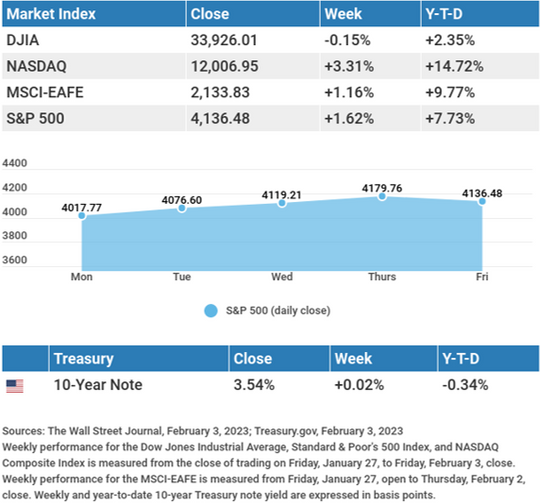

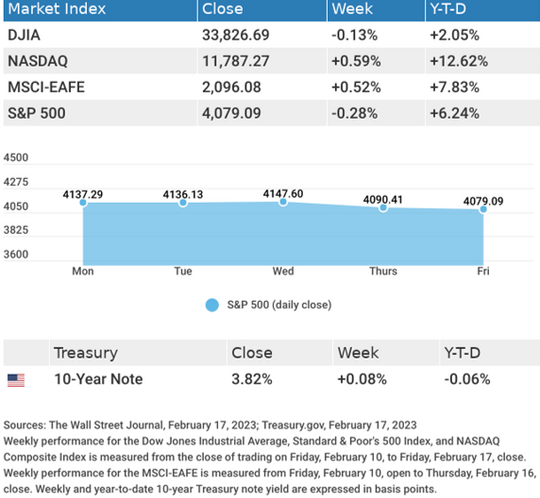

Weekly Market Insights: Mixed Results As Interest Rate Concerns Grow

Growing concerns about further interest rate hikes, prompted by fresh economic data, reversed early-week gains and left stocks mixed for the week.

The Dow Jones Industrial Average slipped 0.13%, while the Standard & Poor’s 500 fell 0.28%. The Nasdaq Composite index advanced 0.59% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.52%.1,2,3

Rate Concerns Weigh On Stocks

Stocks opened last week higher on investor hopes that a continued cooling in inflation might support a more dovish Fed. A higher-than-expected rise in the Consumer Price Index (CPI) and strong retail sales in January initially did little to dent that enthusiasm, as stocks posted solid gains through Wednesday’s close.

But that optimism faded on Thursday as a surprising rise in producer prices and another decline in initial jobless claims triggered worries the Fed would stay the course for longer. Comments from two Fed officials supporting a more aggressive rate hike stance added to the unease, erasing much of the week’s gains. Stocks ended mixed on Friday, capping a choppy week.

Inflation Moderation Pauses

Consumer prices climbed 0.5% in January, fueled by rising shelter costs and energy prices. The increase in the CPI was higher than the 0.1% rise in December and slightly above the consensus estimates of 0.4%. The year-over-year inflation number (6.4%) came in lower than December’s 12-month rise of 6.5%, making it the seventh consecutive month of declining year-over-year inflation.4

January’s product price report showed a surprise 0.7% increase, higher than the 0.4% rise expected by economists and the biggest jump since June. Year-over year, producer prices rose 6.0%, a slight improvement from December’s number.5

This Week: Key Economic Data

Tuesday: Purchasing Managers’ Index (PMI) Flash. Existing Home Sales.

Wednesday: FOMC Minutes.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Friday: New Home Sales. Consumer Sentiment.

Source: Econoday, February 17, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD), Palo Alto Networks, Inc. (PANW).

Wednesday: eBay, Inc. (EBAY), The TJX Companies, Inc. (TJX), Nvidia Corporation (NVDA), Diamondback Energy, Inc. (FANG).

Thursday: Block, Inc. (SQ), Pioneer Natural Resources Company (PXD).

Friday: EOG Resources, Inc. (EOG).

Source: Zacks, February 17, 2023

“Women, we naturally want to be the best…And I can’t be mad at the next girl for wanting to be the best! Why would I get mad at you for saying you the baddest? Why can’t we both agree that we bad, and that just be that?”

– Megan Thee Stallion (Megan Jovon Ruth Pete)

How Qualified Charitable Distributions Can Help Reduce Your Tax Burden

Generally, distributions from a traditional Individual Retirement Account are taxable in the year the account owner receives them. But, a qualified charitable distribution (QCD) is one exception to this rule.

A QCD is a nontaxable distribution made directly by the trustee of an IRA to organizations that are eligible to receive tax-deductible contributions. Of course, the main benefit of giving to a charitable organization is making a difference. Yet some tax benefits reward the philanthropic. Making a QCD can help you reduce your taxable income while supporting qualifying charitable organizations.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

What Are Polyphenols?

If you’ve researched whole foods much, you’ve likely come across the term “polyphenols.” But what are polyphenols, and why are they important?

Polyphenols are a category of plant compounds that act as antioxidants, which can neutralize harmful free radicals. Because of this, polyphenols may offer various health benefits, from boosting brain health and digestion to protecting against heart disease, type 2 diabetes, and even some cancers.

There are many sources of polyphenols, such as:

- Dark chocolate

- Tea

- Dark berries

- Apples

- Onions

- Red cabbage

- Whole grains

- Chili peppers

- Oats

- Turmeric

- Flax seeds

- Sesame seeds

There are several categories of polyphenols, including flavonoids, phenolic acids, and polyphenolic amides.

Tip adapted from WebMD7

Four grown men decided to play on the sidewalk for three hours. No one chided them for childish or immature behavior; many appreciated the noise they made. They even went home a bit richer. What were these men doing?

Last week’s riddle: They have no bodies, but you could say they have tails and heads. What are they? Answer: Coins.

Breaching Humpback whales, Monterey, California

Footnotes And Sources

1. The Wall Street Journal, February 17, 2023

2. The Wall Street Journal, February 17, 2023

3. The Wall Street Journal, February 17, 2023

4. The Wall Street Journal, February 14, 2023

5. CNBC, February 16, 2023

6. IRS.gov, 2023

7. WebMD.com, November 23, 2022

| Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. |