At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not...

Market Commentary – October 28, 2019

More money managers are feeling less bullish, but you sure couldn’t tell by the performance of U.S. stock markets last week.

So far, 2019 has been a tremendous year for U.S. stocks. Through the end of last week, the Standard & Poor’s 500 Index had gained more than 20 percent year-to-date, the Dow Jones Industrial Index was up more than 15 percent, and the Nasdaq Composite had risen more than 24 percent.

All three indices finished last week in positive territory. Lawrence Strauss of Barron’s reported signs that global markets are stabilizing supported investors’ optimism. In addition, yields on 10-year U.S. Treasury notes increased, which suggested “investors are more optimistic about growth and overall economic prospects.”

Despite strength in U.S. markets year-to-date, Barron’s most recent Big Money Poll found fewer money managers are bullish than just one year ago when 56 percent anticipated gains in the months ahead. When 134 money managers across the United States were asked about their outlook for the next 12 months:

- 27 percent were bullish

- 42 percent were neutral

- 31 percent were bearish

That’s the lowest level of bullishness in 20 years and the highest level of bearishness since the mid-1990s.

Barron’s reported there could be a variety of reasons for the change in attitude, including high valuations, an uncertain economic outlook, or the divisive political environment.

One money manager commented, “There are so many different headlines to watch right now…Brexit, trade, the economy, elections. Trying to predict them all correctly is like trying to predict what the weather will be like in November 2020. We might get things directionally correct, but getting them exactly right is a matter of luck more than skill.”

How much is too much? In 1986, Fortune magazine asked Warren Buffett his thoughts on inheritance. He responded children should receive, “…enough money so that they would feel they could do anything, but not so much that they could do nothing.”

It’s an important question, even though relatively few Americans may need to grapple with it. According to the Federal Reserve:

- 55 percent of inheritances are less than $50,000

- 85 percent of inheritances are less than $250,000

- 93 percent of inheritances are less than $500,000

- 98 percent of inheritances are less than $1 million

- 2 percent of inheritances are more than $1 million

A 2015 survey conducted by Merrill Lynch’s Private Banking and Investment Group found, “a majority (91 percent) of people plan to leave the lion’s share of their wealth to family members, motivated by a desire to positively influence the lives of loved ones. Yet the results indicate that many see significant risk in passing on wealth without context, conversation, guidance, or accountability.”

So, how much is too much? Is there an amount of inheritance that will sap your children’s motivation and undermine their work ethic? The answer may depend on the source of the wealth, reported The Atlantic: “Perspectives on what constitutes ‘too much’ seem to vary depending in part on whether parents inherited their wealth or earned the majority of it themselves. When significant wealth gets passed down through multiple generations, inheritors can get the sense that ‘they’re just the caretakers of it’, which means they might be more inclined to keep up the family tradition and will it to their own children…Self-made rich people can have a different relationship to their fortune, because they have firsthand knowledge of what was required to amass it. As such, they might be more interested in bequeathing not just money to their children, but a good work ethic as well.”

If you would like to discuss your legacy and its potential impact on your heirs, give us a call.

Weekly Focus – Think About It

“We should not forget that it will be just as important to our descendants to be prosperous in their time as it is to us to be prosperous in our time.”

–Theodore Roosevelt, 26th President of the United States

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

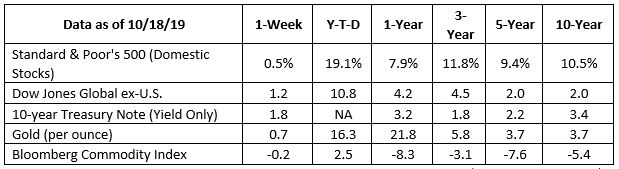

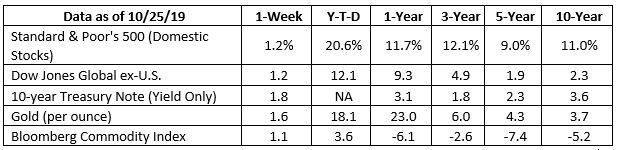

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day,...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/barrons-big-money-poll-why-wall-street-is-scared-of-washington-51572045878?mod=hp_HERO (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-28-19_Barrons-Big_Money_Poll-Why_Wall_Street_is_Scared_of_Washington-Footnote_1.pdf)

https://www.barrons.com/market-data?mod=BOL_HAMNAV

https://www.barrons.com/articles/s-p-500-closes-the-week-with-a-record-just-out-of-reach-51572062633?refsec=the-trader (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-28-19_Barrons-The_SandP_Closed_Out_the_Week_Strong_but_Not_Strong_Enough-Footnote_3.pdf)

https://archive.fortune.com/magazines/fortune/fortune_archive/1986/09/29/68098/index.htm

https://www.federalreserve.gov/econres/notes/feds-notes/how-does-intergenerational-wealth-transmission-affect-wealth-concentration-accessible-20180601.htm

https://newsroom.bankofamerica.com/press-releases/global-wealth-and-investment-management/study-finds-parents-worry-large-inheritance

https://www.theatlantic.com/family/archive/2019/10/big-inheritances-how-much-to-leave/600703/

https://www.goodreads.com/quotes/tag/inheritance