At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not...

Market Commentary July 25, 2022

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

A lot of people are worried that a recession may be in our future. Some think it may already be here.

Unemployment is low (3.6 percent), and inflation is high (9.1 percent). Both tend to occur when an economy is experiencing strong growth. That makes it difficult to believe the United States is in a recession, but some data is pointing that way.

Last week, the Atlanta Federal Reserve’s GDPNow estimated that economic growth in the United States was -1.6 percent for the second quarter of 2022, after adjusting for inflation. They measured economic growth using gross domestic product or GDP, which is the value of all goods and services produced in the United States over a specific period of time. GDPNow is based on a simple, unadjusted mathematical model. It is not an official reading, and the model tends to be a bit volatile. For example:

- On April 29, when relatively little data was available for the second quarter, it was +1.9 percent.

- On May 17, as retail trade and industrial production statistics filtered in, it was +2.5 percent.

- On July 1, when construction spending and manufacturing data came out, it was -2.1 percent.

- Last week, after housing starts were released, it was -1.6 percent.

The Atlanta Fed’s estimate becomes more accurate as more data is added. It tends to be most accurate near the Bureau of Economic Analysis (BES)’s official GDP release date, reported a source cited by Jeff Cox of CNBC.

Since the United States economy shrank by 1.6 percent in the first quarter of 2022, that would mean the U.S. has experienced two quarters of declining economic growth. Technically, that’s a recession.

Not everyone expects GDP to shrink. Bloomberg surveyed economists and found they anticipate 0.5 percent growth in the second quarter, which would be an improvement on the first quarter.

There is an important distinction between the two quarters. The slowdown in the first quarter was caused by surging imports and slowing exports, which is unusual. The slowdown in the second quarter may be caused by a slowdown in consumer spending, which is the primary driver of U.S. economic growth, and business spending.

The next BEA’s GDP numbers will be released this Thursday, July 28.

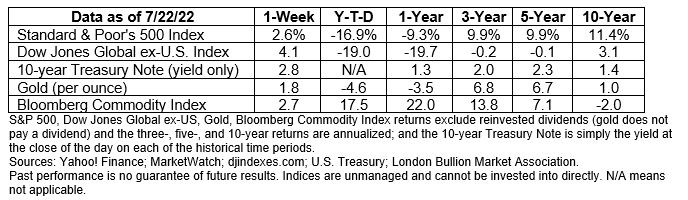

Last week, Randall Forsyth of Barron’s reported that major U.S. stock indices gained. Yields on shorter maturity Treasuries rose last week, while yields on Treasuries with maturities of one year or longer fell.

THE CHALLENGES OF DATING. As if the pandemic didn’t create enough dating challenges, inflation is now pushing the cost of dating a lot higher. More than 40 percent of people on the dating app Hinge said they think more about the cost of dating today than they did a year ago, especially members of Gen Z (the oldest Gen Zers are age 25), reported Paulina Cachero of Bloomberg.

Instead of meeting for drinks (the cost of alcoholic beverages was up 4 percent year-over-year in June) or sharing a meal in a restaurant (the cost of full-service dining was up 8.9 percent year-over-year in June) many people are opting for less expensive options, such as meeting for coffee, taking a walk, or cooking a meal at home.

Another challenge is keeping up with ever-evolving dating slang. “When you’re looking for love these days, it’s totally possible you might get breadcrumbed and orbited on your way to the soft launch,” reported Ashley Austrew on Dictionary.com. Here are a few definitions to know.

- Breadcrumbing. This is slang for leading someone on. Usually, breadcrumbing is chatting or flirting online through text or social media.

- Orbiting. When an ex – or someone else – stops communicating completely (i.e., they ghosted you) but they immediately offer a reaction when you post a picture or story on social media, they are orbiting you, reported Sophie Lloyd of Newsweek.

- Soft launching. When a product is soft launched, it goes through testing in limited groups. It’s the same with dating. A soft launch gives a person’s friends and followers the chance to get used to the idea of a significant other. It’s a slow-motion version of the boyfriend or girlfriend reveal, reported Kaitlyn Tiffany of The Atlantic.

The bad news is that it’s never easy to learn a new language. The good news is that the price of gas is dropping so the cost of dating should, too.

Weekly Focus – Think About It

“Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice.”

—Adam Smith, economist and philosopher

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day,...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.atlantafed.org/cqer/research/gdpnow (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/07-25-22_GDP%20Now_3.pdf [Choose GDPNow Model Data and Historical Forecasts in the right-hand column for historical data. May 17 data is below the chart under maximum estimate.]

https://www.cnbc.com/2022/07/01/atlanta-fed-gdp-tracker-shows-the-us-economy-is-likely-in-a-recession.html

https://www.bea.gov/data/gdp/gross-domestic-product

https://www.investopedia.com/terms/r/recession.asp

https://www.bloomberg.com/news/articles/2022-07-23/us-growth-is-looking-sickly-as-fed-keeps-hiking-rates-eco-week (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/07-25-22_Bloomberg_US%20Growth%20is%20Looking%20SIckly%20as%20Fed%20Keeps%20Hiking%20Rates_7.pdf)

https://www.reuters.com/business/us-goods-trade-deficit-widens-sharply-march-2022-04-27/

https://www.barrons.com/articles/the-stock-market-is-entering-its-weakest-months-what-to-watch-out-for-51658535766?mod=hp_LEAD_2 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/07-25-22_Barrons_The%20Stock%20Market%20is%20Entering%20its%20Weakest%20Months_9.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202207

https://www.bloomberg.com/news/articles/2022-07-21/cheap-dates-how-inflation-is-making-it-more-expensive-to-find-love? (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/07-25-22_Bloomberg_Its%20Not%20You%2c%20Its%20Inflation_11.pdf)

https://www.dictionary.com/e/dating-slang-terms/

https://www.newsweek.com/new-dating-terms-trends-relationships-love-romance-1695489

https://www.theatlantic.com/technology/archive/2021/10/boyfriend-reveal-soft-launch/620541/

https://www.inc.com/geoffrey-james/top-10-quotes-about-economics.html