Weekly Market Insights: Plenty of Treats for Wall Street This Week

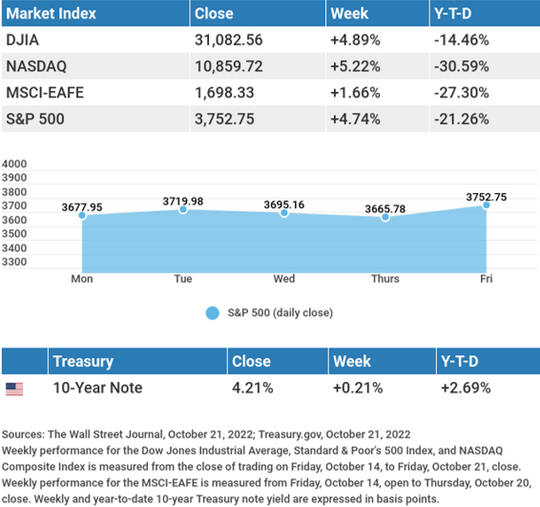

Stocks overcame poor earnings results from some of America’s largest companies to post gains last week as investors cheered positive earnings surprises, easing inflation and a rebound in economic growth.

The Dow Jones Industrial Average rose 5.72%, while the Standard & Poor’s 500 advanced 3.95%. The Nasdaq Composite index added 2.24% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 4.89%.1,2,3

A “Spook-tacular” Week

Some mega-cap technology companies were under pressure last week on weak earnings and tepid fourth-quarter guidance. They reported multiple headwinds, including declining advertising revenues, loose expense control, and a slowdown in cloud growth.

Meanwhile, positive earnings surprises from “old economy” companies powered markets higher. This market bifurcation was evident in the divergence in the performance of the Dow Industrials and the Nasdaq. The S&P 500 posted a substantial gain despite its disproportionate weighting of mega-cap stocks, which helped illustrate the power of the rally. Momentum accelerated into Friday, aided by an easing in inflation and a solid third-quarter Gross Domestic Product (GDP) report.

Economic Growth Exceeds Expectations

After two straight quarters of negative economic growth, the initial estimate of the third quarter’s GDP came in at a solid 2.6%, exceeding economists’ 2.3% estimate. The surprising economic performance was largely attributable to an increase in exports, which narrowed the trade deficit, a development that may not repeat going forward.4

Particularly encouraging was the personal consumption expenditure price index, a report used by the Fed to track inflation. It increased 4.2%, well below the 7.3% jump from a quarter ago.5

This Week: Key Economic Data

Tuesday: Institute for Supply Management (ISM) Manufacturing Index. Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Federal Open Market Committee (FOMC) Announcement. Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims. Factory Orders. Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation.

Source: Econoday, October 28, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Pfizer, Inc. (PFE), Eli Lilly & Company (LLY), Marathon Petroleum Corporation (MPC).

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), Fortinet, Inc. (FTNT), Humana, Inc. (HUM), Cigna Corporation (CI), Booking Holdings, Inc. (BKNG), Prudential Financial, Inc. (PRU).

Thursday: Block, Inc. (SQ), PayPal Holdings, Inc. (PYPL), Amgen, Inc. (AMGN), ConocoPhillips (COP), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: Dominion Energy, Inc. (D), EOG Resources, Inc. (EOG).

Source: Zacks, October 28, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“We should all do something to right the wrongs that we see and not just complain about them.”

– Jacqueline Kennedy Onassis

Using the IRS2Go App

Did you know that the IRS has an app that makes it easy to check some things off your tax to-do list? Using the app, you can:

- Check your refund status. Your refund status is available within 24 hours after the IRS receives your e-filed return (or four weeks after receiving a paper return).

- Access IRS Free File. Free File is a tax prep software for taxpayers whose 2021 total adjusted gross income was $73,000 or less.

- Find payment options, including IRS Direct Pay which allows you to pay tax bills directly from your bank account.

- Get tax help.

- Stay up to date with updates from the IRS.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Satisfy Your Sweet Tooth With Dates

Do you have a sweet tooth but want to limit the amount of refined sugar you eat? Dates are just the answer! These nutrient-rich powerhouses are sweet, succulent, and good for you!

Dates are high in fiber, potassium, magnesium, and Vitamin B6, among many other nutrients. In addition, dates are high in antioxidants and may promote brain health, bone health, and blood sugar control.

Dates are easy to add to your diet. Snack on them, add them to dishes as a natural sweetener or blend them in a smoothie. These nutritious and delicious treats are perfect for kicking cookies and cakes without giving up an indulgent taste.

Tip adapted Healthline, November 27, 20197

What is worn by the foot and often bought by the yard?

Last week’s riddle: They can run side by side for thousands of miles; they are made of steel. While they constantly touch the ground, they seldom meet or touch each other. What are they? Answer: Railroad tracks.

Cathedral Rock at twilight, Sedona, Arizona

Footnotes and Sources

1. The Wall Street Journal, October 28, 2022

2. The Wall Street Journal, October 28, 2022

3. The Wall Street Journal, October 28, 2022

4. CNBC, October 27, 2022

5. CNBC, October 27, 2022

6. IRS.gov, July 25, 2022

7. Healthline, November 27, 2019

| Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. |