Weekly Market Commentary

The Markets

Like riders on a giga coaster, investors experienced fear and exhilaration during the second quarter of 2025.

From April through June, investors rode markets up and down, banking through twists of news and events that had market moving potential. They swooped through the uncertain impact of tariffs on economic growth and inflation; the implications of a U.S. Treasury downgrade; the effects of fiscal policy changes in the Big Beautiful Bill; and conflicts in Ukraine and the Middle East. Here are some highlights from the quarter:

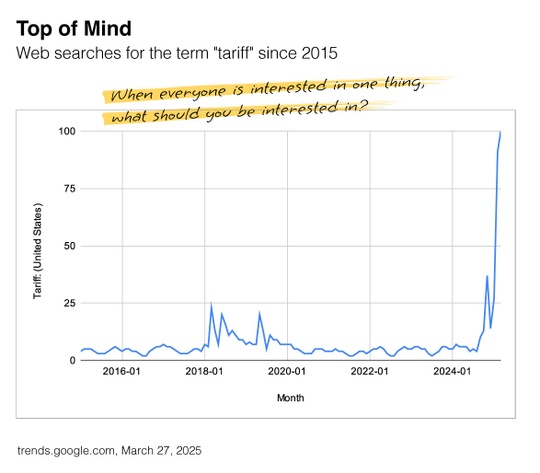

Tariff turmoil. In early April, President Trump announced tariffs on a much larger scale than anyone expected, startling investors and raising concerns about economic growth and price inflation, reported Sarah Hansen of Morningstar. The CBOE Volatility Index (VIX), which is known as Wall Street’s fear gauge, shot up to 60. (Any reading above 30 signals a high level of fear, risk, and anticipated volatility.) As the VIX rose, the stock market fell.

“The Dow shed 2,000 points in a day for the fourth time in the index’s history. All told, U.S. stocks shed some $6.6 trillion in market cap in the past two days based on preliminary figures…That’s the largest two-day market cap slide for U.S. listed stocks on record,” reported Connor Smith of Barron’s.

- A fast recovery. President Trump delayed immediate action on tariffs, opening the door to trade negotiations. His actions reassured investors, and U.S. stocks climbed to new highs. Through last week, “The S&P 500 is up 26 [percent] from the selloff low on April 8, while the Nasdaq has surged 34.9 [percent], as the worries, from supersized tariffs to the U.S.’s artificial-intelligence dominance, have slowly faded,” reported Teresa Rivas of Barron’s.

International stocks performed even better than U.S. stocks did. “European stocks, a thoroughly unloved asset class in January, have trounced the S&P 500 by 16 percentage points in dollar terms, the biggest outperformance since 2006…After underperforming the US market every year since 2017, developing-country equities are finally winning, helped by a boom in [artificial intelligence] companies from Taiwan, South Korea and China,” reported Alice Gledhill, Malavika Kaur Makol and Sagarika Jaisinghani of Bloomberg.

- Excellent earnings growth. During earnings season, companies let investors know how they performed in the previous quarter. Collectively, companies in the Standard & Poor’s (S&P) 500 Index reported earnings growth of 12.9 percent for the first quarter of 2025. It was the second consecutive quarter of double-digit earnings growth, reported John Butters of FactSet. (Earnings are a measure of profitability.)

Tariffs were the hot topic on earnings calls. They were mentioned by 427 S&P 500 companies. Some companies were concerned about tariffs. Some were not. The head of a financial firm told Sabrina Escobar of Barron’s, “The simple truth today is that we don’t yet know where trade policy will settle, nor do we know what the actual transmission effects will be on the real economy.”

- The U.S. Federal Reserve (Fed) kept rates unchanged. Despite significant pressure from the administration to stimulate the economy by lowering rates, the Fed left the federal funds rate unchanged. At the end of the quarter, inflation was near the Fed’s two percent target and unemployment remained low. Both suggest the economy remains resilient.

Major U.S. stock indexes continued to move higher last week, with the S&P 500 and Nasdaq finishing the week at record highs. Yields on U.S. Treasuries moved higher last week after a stronger-than-expected employment report lowered expectations that the Fed might cut the federal funds rate in July, reported Sean Conlon, Alex Harring, and Sawdah Bhaimiya of CNBC.

PATRIOTIC FEELINGS. Last week, Americans celebrated the Fourth of July. Independence Day has been a national holiday since 1941, but the tradition began long before that. Americans have been celebrating Independence Day since “the 18th century and the American Revolution. On July 2nd, 1776, the Continental Congress voted in favor of independence, and two days later delegates from the 13 colonies adopted the Declaration of Independence, a historic document drafted by Thomas Jefferson. From 1776 to the present day, July 4th has been celebrated as the birth of American independence, with festivities ranging from fireworks, parades and concerts to more casual family gatherings and barbecues,” according to History.com.

A recent survey asked Americans about the Fourth of July, patriotism and the American Dream. Here’s what they said:

|

63 percent |

|

71 percent |

|

74 percent |

|

68 percent |

|

21 percent |

|

31 percent |

|

36 percent |

|

32 percent |

WEEKLY FOCUS – THINK ABOUT IT

“This is your democracy. Make it. Protect it. Pass it on.”

― Thurgood Marshall, Former Supreme Court Justice

Sources:

https://www.barrons.com/articles/stock-market-fed-rate-cuts-d0252a07?mod=Searchresults or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Stocks-Are-Flying-the-Dollar-is-Falling%20-%201.pdf

https://www.morningstar.com/markets/13-charts-q2s-major-market-rebound

https://finance.yahoo.com/news/cboe-volatility-index-vix-measured-153231819.html

https://www.cboe.com/tradable_products/vix/ [Video 1:15]

https://www.barrons.com/livecoverage/stock-market-today-040425 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Nasdaq-Enters-Bear-Market%20-%205.pdf

https://www.barrons.com/articles/stock-market-hits-record-highs-tax-bill-jobs-6f818d48? or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-Stocks-Hit-Record-Hights%20-%206.pdf

https://www.bloomberg.com/news/newsletters/2025-06-30/rollercoaster-first-half-is-ending-with-stocks-at-records or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Bloomberg-Rollercoaster-First-Half-Is-Ending%20-%207.pdf

https://insight.factset.com/earnings-insight-infographic-q1-2025-by-the-numbers

https://www.barrons.com/articles/tariffs-earnings-calls-stock-ccab0e3b or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-CEOs-Are-Saying-These-2-Ominous%20-%209.pdf

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250618a.htm

https://www.barrons.com/market-data?mod=BOL_TOPNAV or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/07-07-25-Barrons-DJIA-S&P-Nasdaq%20-%2011.pdf

https://www.cnbc.com/2025/07/03/us-treasury-yields-investors-await-junes-big-jobs-report-.html

https://www.history.com/articles/july-4th

https://d3nkl3psvxxpe9.cloudfront.net/documents/July_Fourth_poll_results.pdf

https://www.usatoday.com/story/news/2024/06/19/patriotic-quotes-america-usa/74070993007/#