At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Market Commentary – June 24, 2019

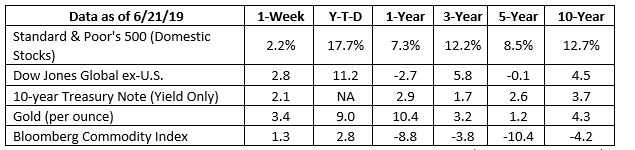

Everything went up – and that’s unusual.

Randall Forsyth of Barron’s explained, “Like our major political parties, the stock and bond markets seem to live in two different worlds these days. The former sits at record levels, suggesting we live in the best of all possible worlds. The latter sees things as bad and only getting worse.”

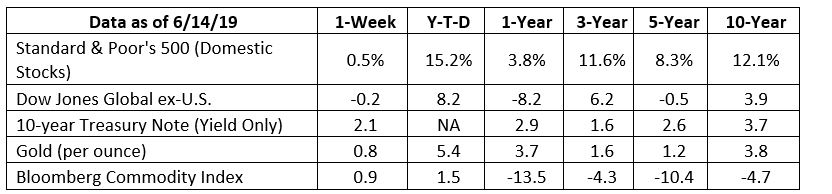

Here’s what happened last week:

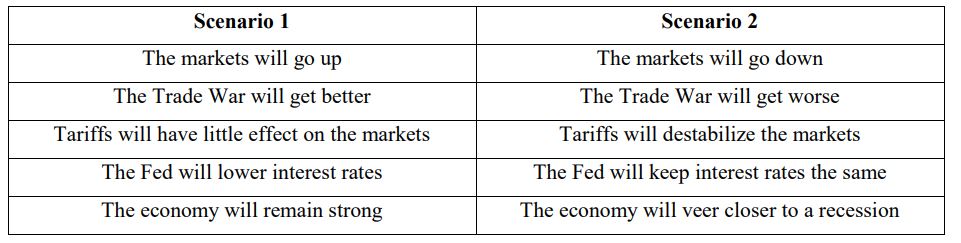

The Federal Open Market Committee met last week (they decide whether the central bank of the United States should push rates higher or move them lower). It left rates unchanged, but indicated a willingness to lower rates in support of economic expansion. That was music to the ears of some investors and the Standard & Poor’s 500 Index rose to a record high, reported Sue Chang and Mark DeCambre of MarketWatch.

The Fed’s song was the same as the one already playing across the world. Central bankers in Europe and Japan had signaled they were willing to encourage economic growth by easing rates lower and using other tools available, reported Leika Kihara and Daniel Leussink of Reuters. Their attitude helped push world stock markets higher.

Last week, the U.S. bond market gained value, too, as interest rates moved lower. Falling interest rates suggested bond investors were hearing a different tune. When investors are willing to accept lower yields, it suggests they’re worried about what may happen and are seeking safety. In some parts of Europe, investors are accepting negative yields – taking small losses to own government bonds they perceive to be safe – because they are pessimistic about the future.

There is plenty to be concerned about, including ongoing trade issues and conflict in the Middle East. Only time will tell how recent events will affect the U.S. and world economies.

A land without time. You may have heard: Sommaroey Island in Norway may do away with time. Residents of the island don’t experience time as people elsewhere do. From May to July, the sun doesn’t set on Sommaroey. From November to January, it doesn’t rise.

Proponents of a time-free island zone say it would reduce stress. “…the change would not mean that shops are open 24/7, but that residents could make better use of the daylight,” reported ABC News.

Living without time is an astonishing idea.

In modern life, time is a critical organizational tool. We divide our experience into centuries, years, daytime and nighttime, hours and minutes. Our actions are informed by schedules. We need to arrive at class, at work, at the bus stop, at a restaurant, or at a ballgame at a specific time.

However, time is not nearly as straightforward as it seems.

In a review of Why Time Flies: A Mostly Scientific Investigation, The Economist opined, “Time is such a slippery thing. It ticks away, neutrally, yet it also flies and collapses, and is more often lost than found. Days can feel eternal but a month can gallop past. So, is time ever perceived objectively? Is this experience innate or is it learned? And how long is ‘now,’ anyway? Such questions have puzzled philosophers and scientists for over 2,000 years.”

Residents of Sommaroey have been pondering life without time and whether it is actually possible. The leader of the move to abolish time told ABC News, living without time, ‘is a great solution but we likely won’t become an entirely time-free zone as it will be too complex.’

Weekly Focus – Think About It

“How did it get so late so soon?”

–Dr. Seuss, American author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/low-interest-rates-could-have-surprising-benefits-51561165445?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-24-19_Barrons-Stocks_Soar_Yields_Sink_Whats_Next-Footnote_1.pdf)

https://www.marketwatch.com/story/dow-poised-to-surge-to-highest-level-in-812-months-gold-hits-5-year-high-as-fed-signals-cuts-2019-06-20

https://www.reuters.com/article/us-japan-economy-boj/bank-of-japan-joins-fed-in-signaling-easing-if-needed-keeps-policy-steady-for-now-idUSKCN1TL06C

https://finance.yahoo.com/news/global-stocks-rally-bond-yields-010510813.html

https://www.abc.net.au/news/2019-06-20/norwegian-island-sommaroey-wants-abolish-time/11230200

https://www.economist.com/books-and-arts/2017/02/09/clock-watching (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-24-19_TheEconomist-Clock_Watching-Footnote_6.pdf)

https://www.goodreads.com/quotes/tag/time