The bulls are running.

Last week, the Standard & Poor’s 500 Index set a new record, closing above 3,000 for the first time. Other major U.S. stock indices also finished at record highs, reported Barron’s.

Company fundamentals, investor sentiment, and geopolitics all have the power to push stock prices higher. However, according to Financial Times, last week’s gains were attributed to Federal Reserve Chair Jerome Powell’s testimony before Congress and the expectation the Federal Reserve will lower the Fed funds rates in July.

Financial Times reported: “Mr. Powell laid out the case for monetary easing by highlighting some softness in indicators such as business fixed investment and persistently low inflation. But mostly, he stressed the impact of uncertainty stemming from trade tensions, weak global growth, the possibility that the U.S. Congress fails to raise the debt ceiling, and a no-deal Brexit.”

Investors were encouraged by the possibility of monetary easing. Yardeni Research charted data showing the Investors Intelligence bull/bear ratio rose to 3.1 on July 9. It was 2.94 on June 25 and 3.05 on July 2, which indicates bullishness has been increasing.

An Investors Intelligence bull/bear ratio greater than 1 typically indicates high levels of bullishness, while a bull/bear ratio of less than 1 typically indicates high levels of bearishness. The ratio generally is considered a contrarian indicator, explained Investing Answers.

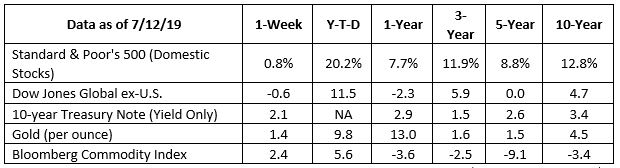

Year-to-date, the Standard & Poor’s 500 Index is up 20.2 percent.

An auction the yelnats would appreciate.

Sneakers play an important role in the film Holes. Stanley Yelnats IV is arrested for stealing a pair and his father, Stanley Yelnats III, spends his time trying to invent a cure for sneaker odor.

The Yelnats would probably be interested in an upcoming Sotheby’s auction which features 100 pairs of rare sneakers. You see, sneakers have become collectibles, like fine art.

The Wall Street Journal explained, “Collecting limited-edition sneakers has evolved from the past time of a loopy subculture to a booming mainstream passion.”

Collectors of fine sneakers are known as sneakerheads. During the Sotheby’s auction, they’ll have opportunities to invest in:

- A pair of sneakers handmade for the 1972 Olympic trials, featuring a waffle tread inspired by the designer’s wife’s waffle iron.

- Two pairs “…inspired by Marty McFly’s kicks in Back to the Future Part II. Both pairs were part of limited releases, originally sold to benefit The Michael J. Fox Foundation for Parkinson’s Research.”

- A pair of sneaks produced “…in collaboration with famed fashion house Chanel. The shoe released only at a special Chanel pop-up shop at Colette in Paris in extremely limited quantities…”

- 2017’s sneaker of the year, which the auction catalogue touted as a “…shoe absolutely everybody wants but few can get.”

- A pair “…released exclusively in NYC at the Museum of Modern Art [MoMA]. All pairs sold out almost instantly at MoMA on January 27 at the shoe’s only release. This design is truly a work of sneaker art.”

In case you’re wondering, the starting bid for the handmade Olympic sneakers is $80,000.

Even if you don’t find sneakers lovely, and wouldn’t display them above the fireplace in your living room or mount them in your trophy room, you may want to check your closets for collectibles.

Weekly Focus – Think About It

“Collecting facts is important. Knowledge is important. But if you don’t have an imagination to use the knowledge, civilization is nowhere.”

–Ray Bradbury, American author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over? Many of us believe that the party may be over. Last Friday, SPY rose. Well, it climbed back to...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our investment strategy has remained unchanged since my last email on August 22, 2024: we have...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-major-ndexes-sett-record-ford-volkswagen-china-trade-outflows-51562964799 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-15-19_Barrons-The_Dow_S_and_P_500_and_Nasdaq_Set_Records_Yet_Investor_Sentiment_is_Low-Footnote_1.pdf)

https://www.ft.com/content/ed3fe53c-a444-11e9-974c-ad1c6ab5efd1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-15-19_FinancialTimes-US_Stocks_Reach_New_Highs_as_Spotlight_Remains_on_Fed-Footnote_2.pdf)

https://www.ft.com/content/7e69f980-a364-11e9-974c-ad1c6ab5efd1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-15-19_FinancialTimes-Federal_Reserves_Dovish_Tilt_Stirs_Debate_on_How_Far_It_will_Go-Footnote_3.pdf)

https://www.yardeni.com/pub/peacockbullbear.pdf (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-15-19_Yardeni_Research-Investors_Intelligence_Sentiment-Footnote_4.pdf)

https://investinganswers.com/dictionary/b/bullbear-ratio

https://www.imdb.com/title/tt0311289/plotsummary?ref_=tt_ql_stry_2

https://www.reuters.com/article/us-auction-sneakers/sneakers-give-art-a-run-for-its-money-at-first-of-a-kind-sothebys-auction-idUSKCN1U62S7

https://www.wsj.com/articles/the-collectible-sneaker-game-a-guide-for-obsessives-and-beginners-1484849746

https://en.wikipedia.org/wiki/Sneaker_collecting

https://www.sothebys.com/en/articles/the-hype-is-real-bid-on-100-of-the-rarest-sneakers-ever-produced

https://www.sothebys.com/en/buy/auction/2019/stadium-goods-the-ultimate-sneaker-collection-online/adidas-pw-x-cc-x-hu-x-nmd-karl-lagerfeld-size-9-5?locale=en

https://www.sothebys.com/en/buy/auction/2019/stadium-goods-the-ultimate-sneaker-collection-online/nike-off-white-x-nike-the-ten-10-pairs?locale=en

https://www.sothebys.com/en/buy/auction/2019/stadium-goods-the-ultimate-sneaker-collection-online/nike-off-white-x-nike-limited-af1-releases-3-pairs?locale=en

https://www.sothebys.com/en/buy/auction/2019/stadium-goods-the-ultimate-sneaker-collection-online/nike-nike-waffle-racing-flat-moon-shoe-size-12-5?locale=en

https://www.brainyquote.com/quotes/ray_bradbury_626618?src=t_collecting