In the past, retirement has been portrayed as an ending, a grand exit from your years in the workplace. But the rules are shifting. Labor force participation...

Weekly Market Insights: Mixed Feelings and Mixed Earnings

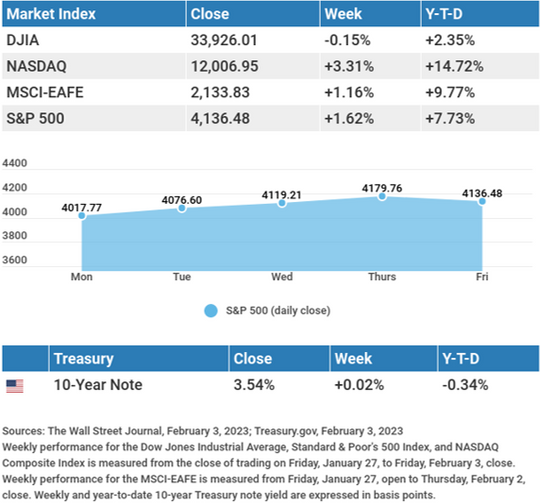

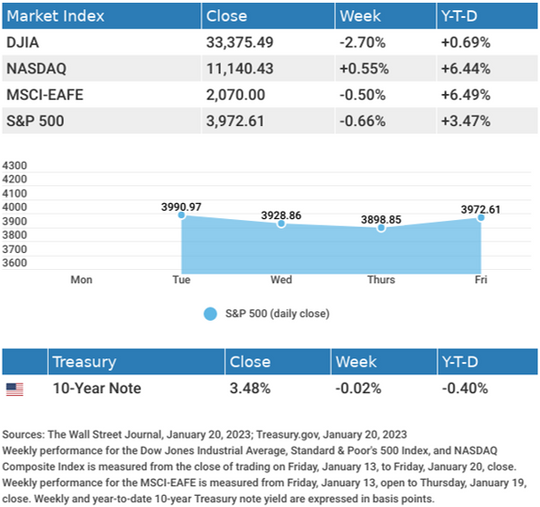

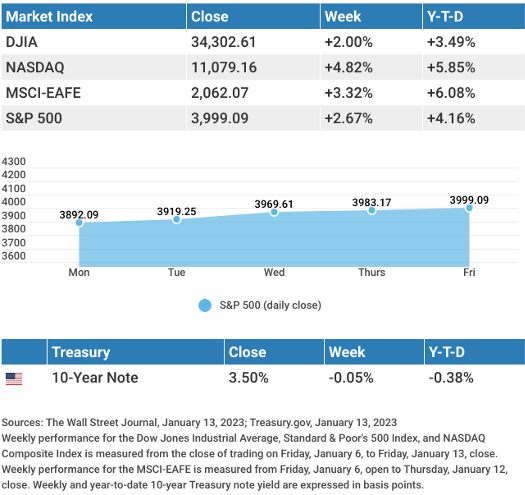

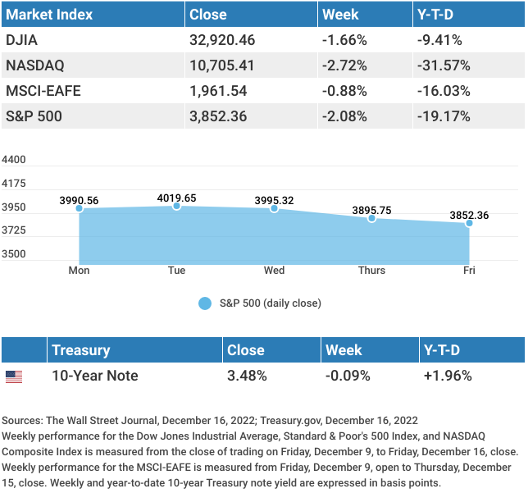

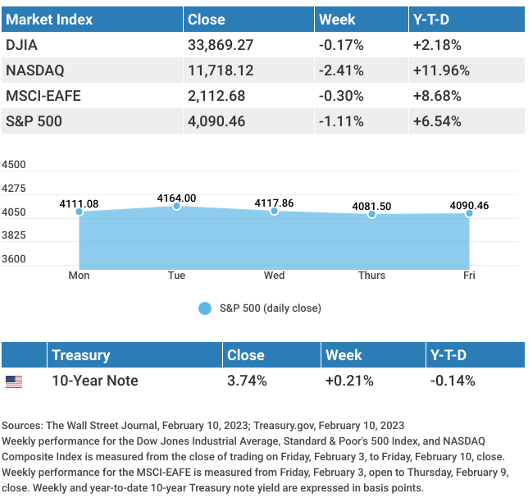

Stocks drifted lower as a week of mixed earnings reports and resurgent worries over Fed monetary policy dragged on investor sentiment.

The Dow Jones Industrial Average slipped 0.17%, while the Standard & Poor’s 500 declined 1.11%. The Nasdaq Composite index lost 2.41%. The MSCI EAFE index, which tracks developed overseas stock markets, dipped 0.30%.1,2,3

Rally Stalls

Stocks struggled last week, weighed down by rising bond yields, a firming U.S. dollar, geopolitical tensions, and generally unimpressive corporate earnings reports. Perhaps the most consequential overhang was the potential direction of monetary policy.

Initially, traders were relieved by comments made by Fed Chair Jerome Powell earlier in the week that he had not struck a more aggressive tone following the strong employment report released after the Federal Open Market Committee (FOMC) meeting. The relief was short-lived, however, as anxieties over future monetary policy resurfaced, exacerbated by comments by one Fed governor who suggested restrictive monetary policy would be necessary for a few years to tamp down inflation.

Powell Repeats Himself

Investors were particularly eager on Tuesday to hear Powell’s first comments following the strong employment report the previous Friday. The concern was that the surprise job number would change Powell’s outlook coming out of the last FOMC meeting.

Powell instead repeated his post-FOMC meeting remarks, which were that a disinflationary trend was underway, and there remained a distance to travel before the measures taken tamed inflation. The Fed would be data-dependent in making future rate decisions. Powell also pointed out that the robust job growth showed why it might take so long to reduce inflation to the Fed’s target level.4

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: Retail Sales.

Thursday: Jobless Claims. Producer Price Index (PPI). Housing Starts.

Friday: Index of Leading Economic Indicators.

Source: Econoday, February 10, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The CocaCola Company (KO), Zoetis, Inc. (ZTS), Marriott International, Inc. (MAR).

Wednesday: Cisco Systems, Inc. (CSCO), Shopify, Inc. (SHOP), Albemarle Corporation (ALB).

Thursday: Applied Materials, Inc. (AMAT), The Southern Company (SO).

Friday: Deere & Company (DE).

Source: Zacks, February 10, 2023

“Thinking about what you can’t control only wastes energy and creates its own enemy.”

– Sandy Fries

The Two Types of IRS Volunteer Programs

Every year, IRS-certified volunteers help people file their tax returns accurately. This volunteer opportunity is perfect for people who want to learn more about tax preparation, need to earn continuing education credits, or want to give back to their community.

The IRS offers the Volunteer Income Tax Assistance program (VITA) and the Tax Counseling for the Elderly program (TCE). VITA offers free help to people who generally earn $60,000 or less, people with disabilities, and limited English-speaking taxpayers. TCE is mainly for people aged 60 or older. Although the program focuses on tax issues unique to seniors, most taxpayers can get free assistance.

*This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov5

4 Potential Benefits of Aloe Vera

Aloe vera is quite a robust plant! Not only is it safe to eat and used in many cosmetic products, but it also has many benefits that stem (pun intended) outside its typical uses.

Here are four potential benefits of Aloe vera:

- One study found that Aloe vera is just as effective as mouthwash at reducing plaque.

- Aloe vera flower and leaf extracts may have antioxidant properties.

- Aloe vera may help lower blood sugar levels for people with type 2 diabetes.

- Aloe may help with burn wounds. Patients with burn wounds treated with Aloe vera healed significantly quicker compared to a group not treated with Aloe vera.

In addition to the above benefits, many people use Aloe vera to soothe sunburns, dry skin, and cuts.

Tip adapted from Every Day Health6

They have no bodies, but you could say they have tails and heads. What are they?

Last week’s riddle: What is the beginning of sorrow and the end of sickness? Something you cannot express happiness without? Something that is always in risk, but never in danger? Answer: The letter “s.”

Hana HIghway, Maui, Hawaii

Footnotes and Sources

1. The Wall Street Journal, February 10, 2023

2. The Wall Street Journal, February 10, 2023

3. The Wall Street Journal, February 10, 2023

4. The Wall Street Journal, February 7, 2023

5. IRS.gov, October 20, 2022

6. EveryDayHealth.com, July 8, 2022

| Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. |