This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the motherland”, and all the other BS reasons they dream up. There is one reason, and only one. China wants the TSCM foundry.

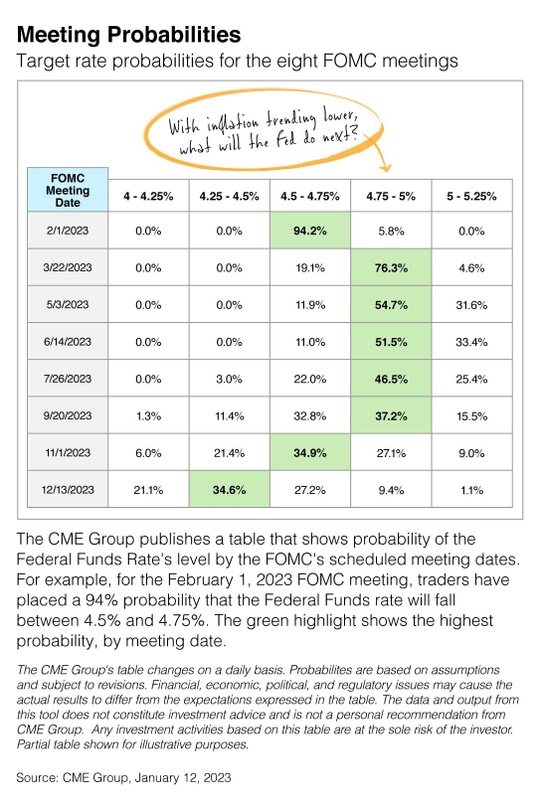

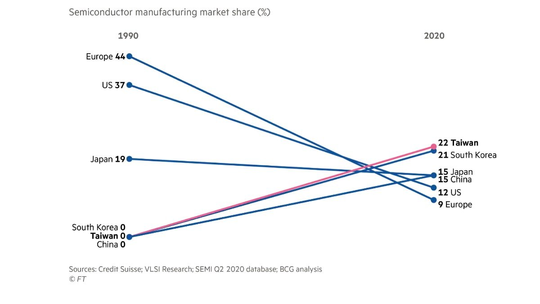

The chart below is very scary. Look at the comparison between semiconductor production by country from 1990 to 2020. 43% comes from Taiwan and South Korea. These chips are used in the production for everything from computers, cell phones, defense weaponry to cars. Wouldn’t be a problem except that China wants to invade Taiwan, and North Korea uses South Korea as a test site for nukes!!

Also, in the detail you will read the other scary stat: TSCM is responsible for 20% of all worldwide production and 92% of the advanced chips. I just don’t understand why the White House, the defense intelligence agencies, and the S&P 500 companies don’t have a high level working relationship to forecast these highly important manufacturing glitches that put the national defense and security of Americans first. Obviously, China does! You don’t need furniture from Vietnam. But life as you know it is OVER WITHOUT SEMICONDUCTOR CHIPS!