No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Whether you own a house or rent an apartment, building a smart home is easier than it has ever been. Homeowners and renters can purchase kits that integrate specific smart items or they can select smart home products, such as light bulbs, crockpots, coffee makers, thermostats, vacuums, ovens, doorbells, mailboxes, window shades, and security cameras. After downloading the appropriate apps, anyone can connect everything together through a Wi-Fi network.1, 2

Smart digital assistants (SDAs) are the handy commanders of the smart home. Analysts estimated, by the end of 2018, SDAs would be active in almost one-half of American homes.3

These devices won’t take down the holiday decorations, but they will instruct the dishwasher to wash the dishes, tell the sound system what you want to hear, and inform the smart feeder it’s time for Fido’s supper. If you’re a road warrior, you can connect your automobile. If you work long hours, you can connect your office, too.4

Here’s the thing.

While smart homes offer tremendous convenience – and can be a lot of fun – they also have the potential to make Americans vulnerable to cybercrime. According to research published by ScienceDirect, security experts anticipate smart homes will become targets for cybercriminals because they are easy to infiltrate.5 For example, hackers could:

Just about everything in a smart home can be hacked, and criminals try all the time. Norton reported, “At times of peak activity, the average IoT [Internet of Things] device was attacked once every two minutes, according to the 2017 Internet Security Threat Report, published by Symantec.”6

Securing your smart home

When building a smart home, it’s critical to look beyond cutting-edge gadgetry and give serious thought to system security. Here are six tips for securing your smart home:

Build a strong foundation. Your router is the front door to your smart home and it should be solid and equipped with strong locks – it is your smart home’s foundational item. It connects all of your devices to the Internet. When you move money from one account to another using a home computer or smartphone, the data flows through your router. When you stream shows and movies, this data also flows through your router. You can’t afford to ignore it.6 The first thing to do is make sure your router is encrypting data. Norton suggests selecting Wi-Fi Protected Access 2 (WPA2) to protect your data. Choose a router that supports WPA2, and then take a few extra minutes to set it up.6

Consumer Reports suggested several steps that can help keep data private. First, ensure your router software is up-to-date. Second, choose strong passwords. Typically, routers will have two passwords, one to control the router’s settings and a second one to provide access to smart devices. Third, turn off any router features you don’t use.4

Set your network to private. Smart devices have default settings. Some devices default to optimize privacy and security, others do not. Instead of assuming manufacturers have your best interests in mind, review the privacy settings for devices as you connect them.6

Choose 2FA. If the app for your smart device offers two-factor authentication (2FA), use it. In order to make changes, you will have to log in and then confirm your log in by entering a code that’s sent via text or email. If you get a code and didn’t try to log in, you know someone is trying to access your system.6

Give guests a network of their own. If you have a smart home, Norton suggests setting up a separate network for visitors. You cannot be certain whether someone else’s devices are secure. By having guests log on to a separate network, you protect your home and connected devices.6

Upgrade your devices. You probably won’t be passing smart devices from one generation of the family to the next. In fact, you shouldn’t.6

Prepare for a power outage. Many smart devices work when the power goes out. Make sure you know which of yours will and which won’t. For example, did your smart thermostat or smart door lock come with regular or rechargeable batteries or some other type of backup?8

It’s particularly important to understand how your home security system will respond. Systems that rely on Voice-over-Internet-Protocol (VoIP) and the Internet must have online connections or they don’t work. Your security cameras may also have issues during power outages, although a battery bank backup could solve the problem, according to MakeUseOf.com.8

Don’t let the excitement of building a smart home cause you to lose sight of the importance of home security. When your household devices communicate with one another, keeping your data safe presents a whole new set of challenges.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Sources:

1 https://www.the-ambient.com/reviews/best-smart-kitchen-devices-469

2 https://arstechnica.com/gadgets/2016/08/the-connected-renter-how-to-make-your-apartment-smarter/

3 https://www.marketwatch.com/story/nearly-half-of-us-homes-will-have-a-smart-speaker-by-years-end-adobe-says-2018-09-10

4 https://www.ecnmag.com/article/2018/08/connected-cars-key-smart-homes-future

5 https://www.sciencedirect.com/science/article/pii/S1877050915030318?via%3Dihub (or go to https://s3-us-west-2.amazonaws.com/peakcontent/Peak+Documents/Feb_2019_ScienceDirect-Cyber_Security_Challenges_within_the_Connected_Home_Ecosystem_Futures-Footnote_5.pdf)

6 https://us.norton.com/internetsecurity-iot-smart-home-security-core.html

7 https://www.marketwatch.com/story/7-ways-to-keep-your-smart-home-from-being-hacked-2016-10-17

8 https://www.makeuseof.com/tag/power-outages-smart-home/

Risk Management

There are more financial advisors than ever before in the US. The most important difference is whether they have an independent and unaffiliated custodian. We do. The investment advisor initiates transactions as part of its portfolio management responsibility. The custodian then clears transactions as part of its safekeeping responsibility. The custodian has no investment authority (unless assigned for overnight excess cash balance sweep management). They serve to provide an audit trail of all the activity within a client’s investment account. We partner with Schwab as our custodian. They manage over $3.5 trillion in assets, have online account access and reporting and some of the strongest credit ratings in the industry.

Over the last several years and even decades, there have been periods of time when all asset classes are under negative pressure and cash is your best investment choice. Although the financial implications of bear markets can vary, typically, bear markets are marked by a 20% downturn or more in stock prices over at least a two-month time frame. Some bear markets have suffered a 40-60% decline in stock prices and have taken many years after to recover losses. In those instances where downside risks significantly outweigh upside potential, we have often chosen to sell investment positions and move to safer cash equivalents.

Using ETFs (Exchange Traded Funds) with very low trading costs has made that defensive play cost-effective for families seeking to preserve wealth. Plus, ETFs can be sold at any time during the trading day, whereas mutual funds can only be sold at the end of the day.

The oldest law of economics is supply and demand. At Research Financial Strategies, we place a premium on when to make an investment decision based on price movements using technical analysis. Technical analysis is an emotionless investment decision making process. It does not allow for getting caught up in the company or industry story. Investments are made through a series of technical factors.

The most notable factor is one called relative strength. When a security price shows a recognizable pattern of higher highs and higher lows, it demonstrates that there is higher demand than supply for that security. Given that reality, we continually evaluate the current market environment to take advantage of opportunistic investments being presented. Research Financial Strategies has the unique capability to create unlimited customized asset allocation blends for our diverse client base.

Our ability to minimize portfolio risk for our clients is a result of having a Sell-Side Discipline. Prior to investing in a security, we establish an exit point based on the % of loss or price our investment advisors determine is acceptable. If the security price is violated, then it is sold. This ensures that profits are protected for our clients. Or worst case, risk to principal is minimized. Only through having an investment approach that has a pre-determined exit strategy for each investment position, can you mitigate portfolio risk during market corrections.

For many clients, allocating a portion of their assets to a strategy that has limited the downside risk is critical to achieving their investment objectives. However, there is no free lunch in investing or in life. There are numerous financial institutions pitching an array of products that are often not suitable to the client’s needs. Some are just loaded with fees. As independent advisors, we help our clients sift through the noise to find the right solution that works within their larger financial plan.

We invest in ETFs ( Exchange Traded Funds) and bonds funds that provide daily liquidity. Our firm is built on the belief that clients should have access to their money when they want it! And these investments allow us to quickly make decisions to help protect your assets should the stock market start to rapidly decline.

Our focus is on your life and priorities. Not just your portfolio. That’s why we start by listening and learning about you. Each individual client has different needs and concerns that need to be addressed. We carefully listen to those concerns and we will gain important information that will help us to best serve our clients and help protect their financial futures.

Every January, it’s customary to look back at the year that was. What were the highlights? What were the “lowlights”? What were the events we’ll always remember? Most importantly, what did we learn?

Before we get into that, though, let’s take a brief jaunt back to the 1800s.

The famous 19th century composer, Robert Schumann, used to moonlight as a music critic when he wasn’t writing his own work. What’s notable about his reviews is that instead of writing from his perspective, he often wrote from the perspective of two imaginary characters, Florestan and Eusebius. Florestan represented Schumann’s passionate, witty side; Eusebius, his thoughtful and introspective side. These two characters would debate a piece of music, each bringing a different perspective to the table because their personalities were so different. Was a composition ardent and exciting – or merely flashy and melodramatic? Sincere and thought-provoking, or dull and trite? Both characters had their own opinions, proving that two people can experience the same thing very differently depending on their personality – or in the case of Schumann, that one person can.

Why am I telling you all this? Because when you look back on the year that was, it’s possible to draw very different conclusions. If you were to Google “2018 year in review in the markets”, you’d find wildly varying opinions from analysts, pundits, bankers, economists, and others. They’re all reviewing the same year – but their interpretations tend to be very different.

So, with that in mind, let’s review the year the way Schumann would. I present to you two characters: Volatilis and Tranquillitas, the Latin words for volatile and calm.

The Markets

Volatilis: “Look, it was a volatile year. The Dow, S&P 500, and Nasdaq all ended the year lower than they started – the first time that’s happened since 2008.1 The S&P and Nasdaq are in or near bear market territory, and the Dow had its worst December since the Great Depression.”2

Tranquillitas: “Oh, come now, the year wasn’t so bad as all that. In fact, the markets spent most of 2018 climbing rather than falling. The Dow soared to never-before-seen heights, and at one point, the Nasdaq was up 17.5% for the year!1 A few down months can’t erase all the good that came before.”

Volatilis: “Quite the contrary. When it comes to the markets, losses can quite literally wipe out gains! In fact, since October, the markets have lost all they gained and more. And even earlier in the year, we still saw dramatic peaks and valleys. The markets shot out of the gate in January after the new tax law went into effect, but then quickly plunged in February. The same pattern occurred in March and April. We’ve already covered what happened in summer and autumn – a tremendous rise, followed by a tremendous fall. My dear Tranquillitas, don’t you know that’s what volatility means?”

The Economy

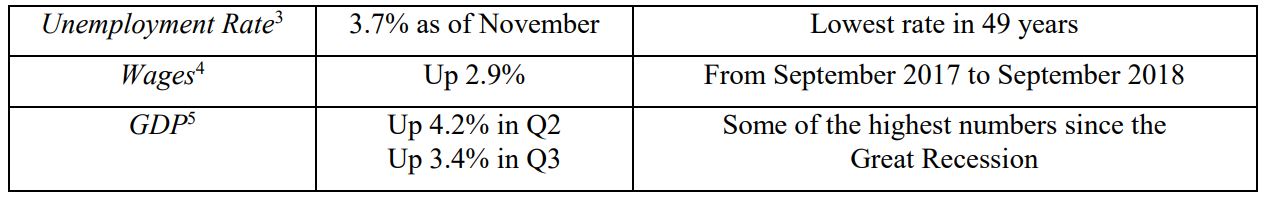

Tranquillitas: “But the markets are not the same as the economy, and the economy soared in 2018. Observe these numbers:

“Those numbers paint a picture of a strong economy – and it’s a beautiful picture, indeed!”

Volatilis: “A lovely chart, but it doesn’t tell the whole story – which is that the economy is likely slowing down. The economic expansion has been driven for years by historically low interest rates – rates the Federal Reserve continues to raise. This, in turn, has affected the housing market and the stock market. Oil prices have plummeted, too, which is good for consumers at the gas pump, but bad for the energy industry. Meanwhile, many of the world’s largest economies are also slowing down, especially in China and Europe. In this ever-more connected global economy we all participate in, that spells trouble. “I don’t need to tell you that if these trends continue, 2019 could be more volatile still.”

The Future

Tranquillitas: “Slowing is not the same as stopping. Interest rates are rising but are still relatively low. Corporate profits remain steady, consumer spending is thriving, as is the labor market. These are all indicators of a healthy economy in 2019, even if it’s not quite producing at the same pace it was before.”

Volatilis: “I see your indicators and raise a few of my own. There’s a ceasefire in the trade war with China, but it could pick up again at any time. The federal government is experiencing another shutdown. Furthermore, a large portion of the economy’s growth over the last decade has been prompted by fiscal stimulus from the government – stimulus that will be harder and harder to provide as the nation’s deficit climbs and climbs.6 Take away that prop, and what happens to growth? “The fact is, investors often tend to be both irrational and impatient – a volatile combination. While the economy may be technically strong, trends are what anxious investors pay attention to. And if the economy looks like it’s trending down, it’s quite possible the markets will follow.”

Tranquillitas: “Yes, Volatilis, but have you considered –”

***

Okay, you get it. In many of Schumann’s reviews, it was at this point that a third character would appear: Master Raro, a teacher who through pure logic and reason would serve as a final arbiter over Florestan’s and Eusebius’ debates. I’ll try to do the same – though I certainly don’t claim to be more capable of “pure logic” than other people!

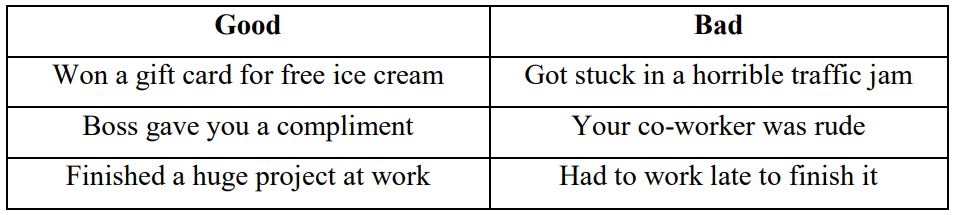

If you look at all the points and counterpoints made above, though, the logical conclusion is that 2018 was neither a “good” year or a “bad” year. It was…a year! The markets were volatile, but the economy was strong. Similarly, there are indicators of economic strength for 2019, as well as signs that market volatility may continue. Both our fictional characters, Volatilis and Tranquillitus, made good points based on actual facts. But their interpretations of those facts were very different – and that says more about them than anything else. Here’s why that’s important. When we form an opinion about something, it’s often colored by which facts we value more than others. For example, think about when someone asks, “How was your day?” Most days are usually a mixture of good and bad things, aren’t they?

This is a trivial example, but the point is, whether you saw your day as good or bad would depend largely on which events mattered more to you. If you’re someone who thrives off praise and accomplishment, it was probably a great day! If you’re someone who is extremely schedule-oriented, the fact you got stuck in traffic and worked extra late would probably make it a bad day – or at least, not one you’d remember with any fondness. Either way, the facts didn’t change – only your interpretation of them.

Similarly, what we expect of 2019 largely depends on which facts we value more than others. As investors, it’s critical that we remind ourselves about this tendency. Whenever we select an investment, formulate a plan, or make a decision, it’s useful to ask ourselves, “Which facts are causing me to think this way? Which facts am I overemphasizing more than others?” By doing this, we can avoid both undue optimism and overt pessimism – becoming more balanced, less emotional investors in the process!

Whatever 2019 has in store, rest assured there will be both obstacles to avoid and opportunities to seize. But whatever happens, we here at Research Financial Strategies will continue analyzing all the facts and data to help you make smart, unbiased, unemotional financial decisions – music to any investor’s ears. As always, please let me know if there is anything I can do for you in 2019.

Happy New Year!

1 “Investors Find Few Places to Hide,” The Wall Street Journal, December 18, 2018. https://www.wsj.com/articles/market-slidefoils-investors-11545154550?mod=ig_2018yearinreview

2 “Dow closes lower, ending a volatile week on Wall Street,” CNBC, December 27, 2018. https://www.cnbc.com/2018/12/28/usstocks-and-futures-dow-sp-and-nasdaq-on-roller-coaster-week.html

3 “Let the Good Times…Stay a Little Longer?” The Wall Street Journal, December 16, 2018. https://www.wsj.com/articles/letthe-good-times-stay-a-little-longer-11544993632?mod=ig_2018yearinreview

4 “U.S. workers see fastest wage growth in a decade,” The Washington Post, October 31, 2018. https://www.washingtonpost.com/business/economy/us-workers-see-fastest-wage-increase-in-a-decade/2018/10/31/3c2e7894- dc85-11e8-85df-7a6b4d25cfbb_story.html

5 “U.S. Economy at a Glance,” Bureau of Economic Analysis, September 19, 2018. https://www.bea.gov/news/glance

6 “U.S. deficits and the debt in 5 charts,” Politifact, November 2, 2018. https://www.politifact.com/truth-ometer/article/2018/nov/02/five-charts-about-debt/

Keep up to date on what’s new for 2019. Check out our handy-dandy tax and financial guide! There were many tax changes made in the Tax Cuts and Jobs Act of 2017. The House Committees and IRS have been navigating these changes for most of 2018. Everyone will be impacted and everyone has questions about how these changes affect them.

Click here>>

It’s been over a year since Equifax, one of the three largest credit reporting agencies in the U.S., revealed they’d been hacked. Because the hackers were able to access everything from Social Security numbers to payment histories to driver’s license numbers, the cyberattack put over 145 million Americans at risk of identity theft.1

What did you do to protect your data?

If you’re like most Americans, the answer is probably, “not much.” According to a survey by AARP, only 14% of adults chose to freeze their credit after the hack – even though freezing your credit is one of the best ways to prevent identity theft.2

One possible reason for this is that credit freezes have traditionally cost money. But now you can freeze your credit for free!

Thanks to the “Economic Growth, Regulatory Relief, and Consumer Protection Act,” a new law enacted in May, credit reporting bureaus like Equifax, TransUnion, and Experian must offer free credit freezes.3

SEC. 301. PROTECTING CONSUMERS’ CREDIT.

“(A) IN GENERAL.— Upon receiving a direct request from a consumer that a consumer reporting agency place a security freeze, and upon receiving proper identification from the consumer, the consumer reporting agency shall, free of charge, place the security freeze not later than…1 business day after receiving a request by telephone or electronic means…[or] 3 business days after a request that is by mail.”3

– Economic Growth, Regulatory Relief, and Consumer Protection Act

What is a credit freeze?

To calculate your credit, agencies like Equifax store important data like loan and payment history, birth dates, Social Security numbers, and more. Whenever you apply for a loan or approval on a credit card, banks and other lenders will request that information from a credit reporting agency.

When you apply for a credit freeze, the agency will essentially lock, or freeze, your file so that it can’t be accessed. That way, even if a lender requests your information, the agency will not release it until you “thaw” the freeze first. It’s an excellent way to keep your personal information from falling into the wrong hands. That’s because it “makes it harder for criminals to use stolen information to open fraudulent accounts, or borrow money, in your name.”4

In many cases, you can safely keep your credit frozen year-round unless you need to apply for a loan. Unfortunately, many people don’t take advantage of this. Some probably didn’t want to pay the money, while others find the process to arduous. And some, likely, don’t think identity theft will ever happen to them. That’s despite the fact that, in 2014 alone, 17.6 million Americans experienced identity theft!5

In our opinion, freezing your credit is definitely an option to consider.

A few things to know:

• To get the most protection, you should freeze your credit at all three of the major credit reporting agencies. Visit these websites to learn how:

TransUnion: transunion.com/credit-freeze

Experian: experian.com/freeze/center.html

Equifax: equifax.com/personal/credit-report-services

• The new law also enables parents to freeze their children’s credit for free if they are under age 16. While a child’s identity is usually not as vulnerable as an adult’s, it still should be protected, and it’s a terrific way to teach children about the dangers of identity theft!

• While a credit freeze is a valuable weapon in the fight against identity theft, it won’t protect you from everything. That’s why you should check your credit report regularly. (You can still request a credit report even if your credit is frozen.)

• Freezing your credit will not affect your credit score.

To learn more, visit the Federal Trade Commission’s website at https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs.

Identity theft is one of the biggest threats to reaching your financial goals. Take steps to protect your identity as soon as possible. Please let me know if you have any questions – and be sure to visit the links listed above to learn more!

1 Stacy Cowley, “2.5 Million More People Potentially Exposed in Equifax Breach”, The New York Times, October 2, 2017. https://www.nytimes.com/2017/10/02/business/equifax-breach.html?module=inline

2 “Up for Grabs: Taking Charge of Your Digital Identity,” AARP National Survey, August 2018. https://www.aarp.org/content/dam/aarp/research/surveys_statistics/econ/2018/taking-charge-of-your-digital-identitynational.doi.10.26419-2Fres.00228.000.pdf

3 “Text of the Economic Growth, Regulatory Relief, and Consumer Protection Act,” https://www.congress.gov/bill/115thcongress/senate-bill/2155/text

4 Ann Carrns, “Freezing Credit Will Now Be Free,” The New York Times, September 14, 2018. https://www.nytimes.com/2018/09/14/your-money/credit-freeze-free.html

5 “17.6 million U.S. residents experienced identity theft in 2014,” Bureau of Justice Statistics, https://www.bjs.gov/content/pub/press/vit14pr.cfm

The new tax law has put a whole new spin on year-end tax planning, though it hasn’t eliminated the need to do it altogether. t has been a busy year for taxpayers and accountants, as the end of 2018 signals the first year under the Tax Cuts and Jobs Act.

In all, the tax overhaul roughly doubled the standard deduction to $12,000 for single filers ($24,000 for married-filing-jointly), eliminated personal exemptions and limited itemized deductions.

Despite the changes to the tax law, there are still opportunities to shore up your 2018 finances. Here’s what to consider.

1) Maximize retirement savings

Reduce your taxable income dollar-for-dollar by contributing as much as you can to your 401K or employer’s retirement plan by Dec. 31.

If you are 18 or older, you can save up to $18,500 to your 401(k), and if you are over 50 you can kick in an extra $6,000. With IRAs you can contribute $5,500, and if you are over 50, an additional $1,000. (You have until the April deadline to make those IRA contributions.)

Additionally, if you are self-employed and contribute to SEP IRAs, you can deduct up to 25 percent of compensation or $55,000 for 2018.

Make sure you’ve taken advantage of your employer’s match to your 401K plan. Better yet, make sure you’ve maxed out how much you can contribute. Leaving this benefit underutilized is the same as leaving money on the table.

(If you contribute to a Roth 401K or Roth IRA, you won’t get a tax break, but your money can grow tax-free and generally be withdrawn tax-free in retirement.)

2) Make an extra mortgage payment

Although the number of homeowners who can benefit from the mortgage tax break fell significantly under the new tax law, about 13.8 million taxpayers will still be able to claim the mortgage-interest deduction in 2018.

If you own a home and get a mortgage interest deduction, make an extra mortgage payment on Dec. 31 to get that additional deduction on this year’s taxes.

For new homeowners (or those who bought a home after Dec. 15, 2017) who will still be able to take advantage of the tax break, the interest they can write off is limited to $750,000 in loans, down from the previous $1 million.

3) Unload losers

After this week’s market downturn, chances are you have some investments that lost value this year.

You can use those losses to zero out capital gains, and then deduct up to $3,000 a year against ordinary income. Losses in excess of that can be carried forward to future tax years until the balance is used up.

For example, if you have $10,000 of losses and $5,000 of gains, you have an overall loss of $5,000 — and up to $3,000 of that loss can be used to offset your ordinary income. The additional $2,000 in losses can be shifted to next year’s return.

For just that reason, tax-loss harvesting is a popular tool for maximizing after-tax returns, most commonly in the fourth quarter of the year, when investors aim to lower their tax liability. (But this strategy only works on taxable accounts, not your 401(k) or IRA.)

Be aware that if you sell a security at a loss and buy the same or similar security within 30 days before or after the sale, the IRS won’t allow you to claim the loss on your tax return. This is known as a wash sale.

4) Deduct health-care expenses

If your health-care costs exceed 7.5 percent of your adjusted gross income in 2018, you may be able to deduct those expenses.

Tally up how much you spent on health insurance, Medicare premiums, long-term health insurance premiums, nursing home costs, orthodontics and other out-of-pocket expenses to see if the total exceeds the medical expense threshold.

You can deduct everything you spend over that amount (but you can’t double dip and count expenses paid for with tax-advantaged flexible spending or health savings account dollars).

You also can’t take this tax break if you opt for the standard deduction – it only applies if you itemize all of your deductions.

5) Bundle charitable donations

If you want to lower your tax bill by making donations to charity, you have until Dec. 31 to do so.

Even though the deduction for donations is unchanged, you still need to itemize to claim it, and that’s a much higher bar this year.

One way to surpass the new, higher standard deduction is to save money over time and donate every two or three years instead of every year — a strategy called “bunching.”

For example, instead of giving $5,000 to charity annually, accelerate the gift by giving $10,000 every two years. This way, you may get your itemized deductions over the limit one year and take the standard deduction the next.

Maximize your contribution — and the amount you can deduct if you’re able to itemize in 2018 — by stuffing multiple years’ worth of donations into one year. This move is known as “bunching” your charitable contributions.

6) Defer your bonus

If you get a year-end bonus at work, it could bump you up to another tax bracket and increase the taxes you owe.

See if your employer will pay you your bonus in January. You will still receive it close to year-end, but you won’t have to pay taxes on it when you file your tax return.

You don’t want to defer your bonus for too long, but a few weeks might make sense.

7) Donate Your RMD to Charity

If you’re 70½ or older, you have until Dec. 31 to take your Required Minimum Distribution from your IRAs and retirement plans.

Failure to do so could mean you’re on the hook for a 50 percent penalty on the amount you should have taken.

If you’re lucky enough that you won’t need the RMD, consider donating the money directly from your retirement account to your qualifying charity of choice. This is known as a qualified charitable distribution.

You don’t need to itemize deductions on your tax return in order to do this.

The bonus: Your RMDs are normally taxable distributions, but qualified charitable distributions are not, according to the IRS.

8) Give to Heirs

You have until Dec. 31 to make gifts to your loved ones for the tax year. You can give up to $15,000 per recipient to an unlimited number of beneficiaries without paying a gift tax. This is known as the annual gift exclusion.

If you’d like to share even more wealth with your grandkids without being subject to gift taxes, consider paying for their tuition or medical expenses.

All of these payments must be made directly to the provider of these services.

9) Talk to Your Tax Preparer

The single best move anyone can take before the end of the year to cut their tax bill is to consult a licensed tax professional and seek advice for their specific situation. Waiting until January will be too late. Each taxpayer’s situation and each tax year is unique. This year, there are new laws and new forms that will affect everyone. Waiting until the return is calculated is likely to produce a few surprises. The new tax law also changed the way employers withhold taxes, and the IRS is concerned that many taxpayers will be surprised by their refunds or balance due because of the new withholding rules.