Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our investment strategy has remained unchanged since my last email on August 22, 2024: we have...

The New Tax Law – A Year Later

Tax season is the time between January 1 and April 15. It is when most people prepare and file their taxes. This year’s tax season is special. It has been just a little over a year since the Tax Cuts and Jobs Act went into effect. It is the largest overhaul of the tax code since 1986 and the still-relatively-new law could have a major impact on your taxes, including your refund. Just for that reason, I thought it would be good to review what the law changed, as well as what you can do to minimize headaches as you file your taxes ahead of the April 15 deadline.

Quick disclaimer: The tax law is a politically charged subject, but you will not find any politics here. While some experts may argue whether the tax law has been good or bad for the country, this letter is only about how the law may affect you. So, without further do, let’s discuss:

Major Changes to Remember as You File

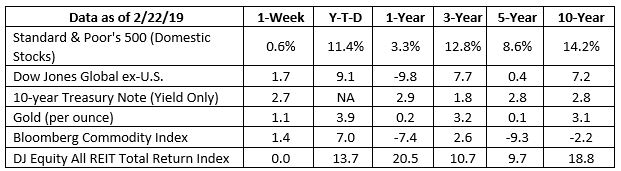

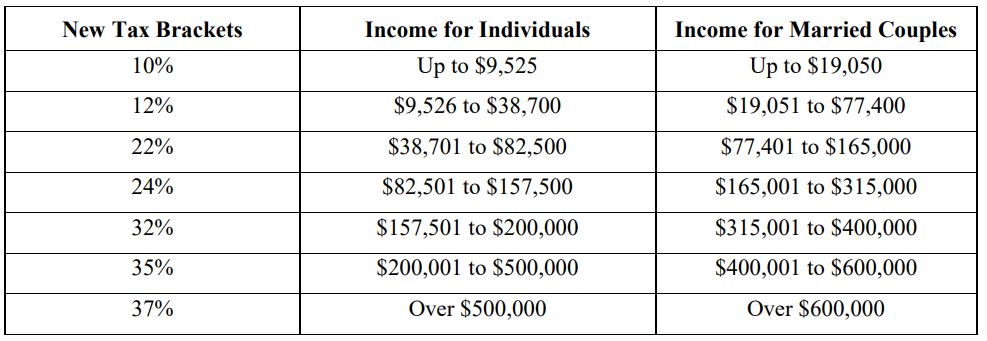

The most obvious major change to remember is that most tax rates have been reduced. That means there’s a good chance you paid less in taxes over the past year. Here’s how the various tax brackets look now: 1

If you receive a paycheck every month, you should pay special attention to your federal income tax withholding this year. This is the amount of federal income tax withheld from your paycheck. Because of the new tax brackets, most people started seeing withholding changes around February or March of last year. And while it’s likely that less of your paycheck went to federal income taxes, you should still scrutinize your withholding carefully to make sure it’s correct. The last thing you want is to find that not enough tax was withheld by your employer! That could require you to pay a penalty when you file your return.

According to the IRS1, people who meet any of the following criteria should be especially careful when checking their withholding:

• Belong to a two-income family.

• Work two more jobs, or only work for part of the year.

• Have children and claim credits such as the Child Tax Credit.

• Have older dependents, including children age 17 or older.

• Claimed itemized deductions on their prior year’s tax returns.

• Earn high incomes and have more complex tax returns.

• Received large tax refunds or had large tax bills for the prior year.

Ensuring the accuracy of your withholding is always important, of course, but because of all the changes to the tax code, it’s more critical than ever that you be thorough! Speaking of changes, let’s now turn to:

Changes to Deductions

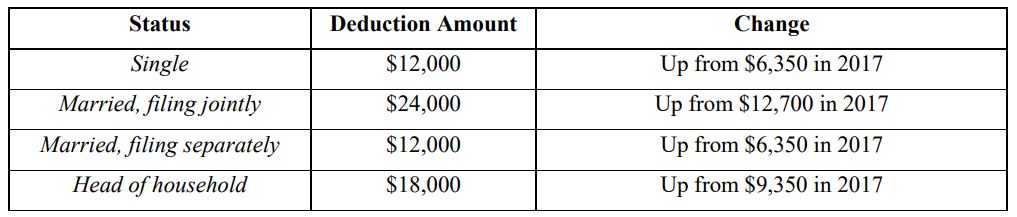

There are two basic kinds of deductions – standard and itemized. As the IRS puts it, “The standard deduction is a dollar amount that reduces the amount of income on which you are taxed and varies according to your filing status.” 1 The new tax law nearly doubled standard deductions. Here’s what the new standard deduction looks like:1

But all this comes with a catch: You can’t take the standard deduction if you also itemize deductions. And for married couples filing separately, both spouses must take the same type of deduction. So if one spouse chooses to itemize, the other spouse must as well. So, here’s what you need to determine: Will you enjoy a larger tax cut by taking the standard deduction, or itemized?

For most people, the standard deduction is probably the way to go. But if you still choose to take itemized deductions, there are changes to those you need to be aware of as well. For instance:

Medical expenses: For your 2018 taxes, you can deduct out-of-pocket medical and dental expenses that exceed 7.5% of your “adjusted gross income”. (This is your total gross income minus specific deductions.) This is down from the previous 10%, although the level returns to normal next year.1

State and local taxes: One of the biggest changes to itemized deductions is that you can now deduct no more than $10,000 of any combination of state and local income taxes, sales taxes, and property taxes. For people living in high-tax states, this is perhaps the single biggest reason why it now makes more sense to take the standard deduction. 1

Mortgage interest: If you took out a mortgage or home equity loan before December 15, 2017, you can deduct up to $1,000,000 in interest. However, the new tax law caps the deduction at $750,000 for loans taken out after that date. 1

Charitable contributions: The limit on charitable contributions in cash is now 60% of your adjusted gross income, up from 50% before the new tax law. That means you may be able to deduct more of any charitable cash contributions you made in 2018. 1

Changes to Child Tax Credits and the AMT

Due to the new law, more families with children under 17 now qualify for a larger child tax credit. For your 2018 return, the maximum credit is now $2,000 per child for individuals earning up to $200,000 and married couples earning up to $400,000, so long as they file jointly. 1

Another major change to this tax season is that fewer people now pay the Alternative Minimum Tax, or AMT. Long considered one of the most complex aspects of the tax code, the AMT was originally designed to prevent using a dizzying array of credits, deductions, and loopholes to avoid taxes altogether. Over the decades, however, the AMT began hitting those who were already paying a host of other taxes.

Calculating what amount people actually pay is a complex process, and that has not changed. What has changed, however, is the threshold at which people are exempt from paying the AMT. For individuals, the exemption level has increased to $70,300, up from $54,300. For married couples who file jointly, the exemption has risen to $109,400, up from $84,500. 1

A few more things to be aware of this tax season

It’s impossible to cover all the ways the new tax law will affect your filing this year. But there are a few more things to be aware of.

Tax Refunds

First, your tax refund could be smaller than in years past. As of this writing, the IRS has reported the average refund to be 8.4% less than last year.2

This shouldn’t come as a surprise. Since many people received a tax cut in 2018, refunds will also go down. That’s especially true for people who previously used itemized deductions on their property and local income taxes. The changes in federal tax withholding also play a major role. It’s possible, too, that many people will end owing money to the government this year.

For that reason, taxpayers should hold off on planning any major purchases until they know exactly what their refund will be.

The IRS is playing catch-up

As you probably know, Washington was paralyzed by the longest government shutdown in history earlier this year. During the shutdown, the IRS operated with only 12% of its staff.3 That means the IRS has a lot to catch up on, including answering questions, preparing reports, processing returns, and distributing refunds. And because the tax code is so different now, you may need to wait longer than normal to get your questions answered or get your refund.

Ways to de-stress your tax filing

Preparing your taxes is never fun, but there are ways to minimize stress. For example:

1. Work with a qualified professional. While there is software aplenty to help you file, nothing beats working with an experienced Certified Public Accountant. I would be happy to put you in touch with a good one if you need assistance with this.

2. File electronically. If you’re doing it on your own, it’s better – and faster – to file electronically than on paper. You can learn more at www.irs.gov/filing/free-file-do-yourfederal-taxes-for-free.

3. Do a “paycheck checkup.” This is a resource the IRS provides to determine if you need to adjust your withholding or make additional tax payments. Visit www.irs.gov/paycheck-checkup to learn more.

4. Start now. If you’ve already finished your tax return, great! But if not, don’t delay. Start gathering documents, writing down questions, and examining your options. The easiest way to ensure tax-related headaches – and make mistakes on your return – is to wait until the last minute.

I hope you found this letter helpful. Of course, if you have any questions, please don’t hesitate to contact us! Finally, remember that we at Research Financial Strategies are here to help you work toward your financial goals. Please let us know if there’s ever anything we can do.

1 “Tax Reform: Basics for Individuals and Families,” Internal Revenue Service, https://www.irs.gov/pub/irs-pdf/p5307.pdf%20

2 “Filing Season Statistics for Week Ending February 1, 2019.” Internal Revenue Service, https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-february-1-2019

3 “Federal shutdown means tax refunds may be delayed,” CNBC, https://www.cnbc.com/2019/01/04/what-the-federal-shutdown-could-mean-for-tax-season.html