The Big Guys Move InOn September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel Securities, and Charles Schwab have launched a new cryptocurrency exchange. In the words of the...

Market Commentary – March 11, 2019

Markets were rattled last week.

The market hates surprises, especially when the surprise comes from a central bank. Last week, the European Central Bank (ECB) unexpectedly reversed course and took a more accommodative stance on monetary policy in an effort to encourage stronger European economic growth. Tom Fairless of Barron’s explained:

“Officials are seeking to shore up an economy that has been rattled by shocks ranging from a slowdown in China to mass protests in France and bottlenecks in Germany’s crucial auto industry. They are threading a careful path between providing sufficient support for the region’s softening economy while avoiding any appearance of panic, which could ricochet through financial markets.”

The Eurozone isn’t the only region feeling the pinch of weaker economic growth. China’s exports were down more than 20 percent in February, reported Investing.com. Analysts had expected a decline of about 5 percent. Concerns about the health of China’s economy have been growing since the publication of ‘A Forensic Examination of China’s National Accounts’ by the Brookings Institute. The authors concluded:

“First, nominal GDP [gross domestic product*] growth after 2008 and particularly after 2013 is lower than suggested by the official statistics. Second, the savings rate has declined by 10 percentage points between 2008 and 2016. The official statistics suggest the savings rate only declined by 3 percentage points between these two years. Third, our statistics suggest that the investment rate has [fallen] by about 3 percent of GDP between 2008 and 2016. Official statistics suggest that the investment rate has increased over this period.”

*Gross domestic product is the monetary measure of the market value of all goods and services produced annually in the country.

As if that weren’t enough, the U.S. jobs report for February reported far fewer jobs had been created than was expected. It will come as little surprise to learn that major U.S. stock indices moved lower last week.

How do you reconcile the beige book and the labor report?

If you have never heard of the Beige Book, it’s a scintillating tale of business and economics published by the Federal Reserve. Okay, maybe it’s not scintillating, but it has some pretty interesting stories.

The March 2019 installation – it’s published eight times a year – includes real world stories about businesses and workers gathered by Federal Reserve Banks across the nation. For instance, the St. Louis Federal Reserve reported their contacts in higher education reported falling enrollment. It seems more potential college and post-graduate students have been choosing to go straight into the workforce.

The Beige Book reported, across the nation, “Labor markets remained tight for all skill levels, including notable worker shortages for positions relating to information technology, manufacturing, trucking, restaurants, and construction. Contacts reported labor shortages were restricting employment growth in some areas.”

Of course, labor is easier to come by in some districts than in others. The Boston Federal Reserve reported contacts in its district have a hard time finding skilled workers in fields like information technology, but retail businesses are having no trouble filling jobs.

Wages have been going up in the Cleveland Federal Reserve’s district. “Bankers raised wages both for low-wage and for high-wage positions, citing competitive labor markets. A couple of construction companies granted large retention-focused merit increases to office staff, but other companies mentioned that they tended to grant raises during busier seasons.”

Hiring was up in the San Francisco Federal Reserve’s territory. “Employment at a large San Francisco software and consulting company grew notably as demand for its services increased. A cattle ranching company in Arizona also increased employment to meet growing demand. In the Mountain West, a regional bank noted that its hiring was limited only by a shortage of qualified labor.”

In light of last week’s incredibly weak jobs report, the Beige Book’s findings seem odd that companies are having trouble hiring enough workers and are raising wages to attract them. How can so few jobs have been created when there is high demand for labor? (Economists’ rule of thumb is 100,000 jobs are needed to accommodate people entering the labor force each month, according to MarketWatch.)

An economist cited by MarketWatch commented, “One poor report should not set off alarm bells, but given that the labor market is the linchpin for the entire economy, it does add to existing concerns and raises the stakes for next month’s report.”

Weekly Focus – Think About It

“Hard work spotlights the character of people: some turn up their sleeves, some turn up their noses, and some don’t turn up at all.”

–Sam Ewing, Professional baseball player

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

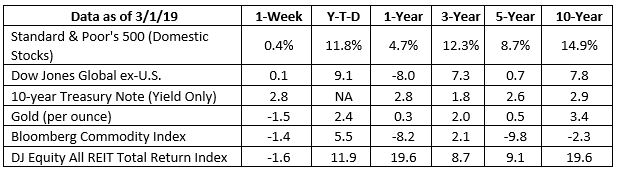

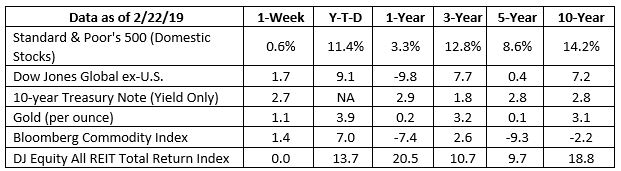

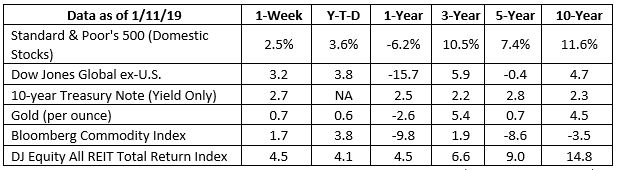

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Bitcoin – There’s No There There

Special Message

Look! Have You Noticed? Listen to any politician or any news commentator these days, and they always begin a discussion or answer a question like this: Look, when I served in the Senate …. Look, as I wrote in my last column …. Look, if the Republicans won’t …. Look,...

Special Market Update

Inflation is proving to be far more tenacious than financial markets had hoped.The idea that inflation peaked in March was put to rest last week when the Consumer Price Index (CPI) showed that inflation accelerated in May. Overall, prices were up 8.6...

Special Update

All,You undoubtedly have heard reports that the world’s supply of wheat and corn are in jeopardy due to Ukraine and Russia both missing this season’s planting window for obvious reasons (click the link above to read more details). Did you know that Russia...

Significant Shrinkage

Significant Shrinkage Buffeted by Inflation Is it time to double check your household budget? Chances are the budgeted expenditures of the vast majority of Americans are about to get buffeted. Or so says the Oracle of Omaha. In the latest shareholder...

How to Manage Your Money and Your Risk Exposure

This is an excellent example of one of our more popular client webinars where we detail what is happening in the market, what makes us so successful and different from other advisors, and how it effects our clients' portfolios.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/european-central-bank-stimulus-51551967979 (or go to https://drive.google.com/file/d/1jDwICeYbsalcb3ZVb5CKf7mVjlvC-N97/view?usp=sharing)

https://www.investing.com/news/economic-indicators/china-exports-tumble-in-february-1801611

https://www.brookings.edu/wp-content/uploads/2019/03/BPEA-2019-Forensic-Analysis-China.pdf (Page 25)

https://www.marketwatch.com/story/us-stock-futures-drop-as-gloomy-china-trade-report-adds-to-global-growth-fears-2019-03-08

https://www.federalreserve.gov/monetarypolicy/beige-book-default.htm

https://www.federalreserve.gov/monetarypolicy/beigebook201903.htm

https://www.marketwatch.com/story/us-adds-meager-20000-jobs-in-february-to-mark-smallest-increase-in-17-months-2019-03-08

https://www.brainyquote.com/quotes/sam_ewing_104937