Market Commentary – December 31, 2018

Investing during the month of December was like traversing an icy mountain stream. It delivered a staggering shock to the senses that triggered the instinct to, “Get Out!”

When it comes to investing, that instinct is called loss aversion. For many people avoiding a loss is more important than realizing a gain. Simply put, not losing $100 is more important than gaining $100. Erica Goode of The New York Times talked with psychologists Daniel Kahneman and Amos Tversky about a series of experiments they had conducted to measure loss aversion. The pair found relatively few people would bet money on a flip of a coin unless they stood to win at least twice as much as they might lose. The desire to avoid losses is the reason many people sell stocks when the value of the stock market is declining. Unfortunately, it may be a poor choice for a variety of reasons. For example,

- Downturns are temporary. The Schwab Center for Financial Research evaluated the performance of the Standard & Poor’s 500 Index since 1966 and found, “the average bull ran for more than four years, delivering an average return of nearly 140 percent. The average bear market lasted a little longer than a year, delivering an average loss of 34.7 percent.”

While past performance is no guarantee of future results, understanding the history of gains and losses in bull and bear markets is critical because it can help investors avoid potentially costly mistakes.

- Markets rebound. Consider December 26. It was the best day for stocks in nearly a decade. The Dow Jones Industrial Average rose 1,000 points, posting its biggest daily gain in history.

Investors who were not invested in stocks missed an opportunity to participate in a market rebound. Despite significant gains late in the month, there is a chance this will be the worst December performance since 1931, reported MarketWatch.

- Your long-term life and financial goals haven’t changed. Sometimes, investors have to traverse an icy stream, or muck across a muddy patch, as they move toward their goals. Your portfolio should be built to help you pursue specific life and financial goals. It may be well diversified to help moderate losses when you encounter challenging market conditions. Consequently, if your long-term goals have not changed, selling during a downturn could make it more difficult to reach your goals.

However, if you’re experiencing a high level of discomfort as the stock market fluctuates, it may be important for you to re-evaluate your risk tolerance and make any changes necessary to your asset allocation.

One of the most important aspects of our work as financial advisors has little to do with asset management or investment selection. It has everything to do with helping our clients make better financial decisions. We try to provide information and advice – coaching, if you will – that may help our clients avoid mistakes that may make it more difficult to achieve their goals. We also encourage clients to embrace choices which are likely to help them work toward their goals.

If you find yourself debating whether to hold your investments or sell them, please give us a call before you do anything. We welcome the opportunity to talk with you about what’s happening and offer some context which may help set your mind at ease.

If changes are necessary, we can help you identify options and weigh the pros and cons of each. Our goal is to help you work toward your goals.

synaptic pruning and habit stacking…If you have some New Year’s resolutions you would really like to keep then you may want to try habit stacking. It’s an idea that harnesses brainpower to help you achieve your goals.

Brains are powerful tools. They help us form connections and, when those connections are no longer used, our brains conduct synaptic pruning to get rid of the connections, according to James Clear author of Atomic Habits.

As a result, our brains are full of strong connections that support certain skills. That’s the good news. The bad news is, by a certain age, we’ve trimmed a lot of neurons, which can make it challenging to form new habits. Clear wrote,

“When it comes to building new habits, you can use the connectedness of behavior to your advantage. One of the best ways to build a new habit is to identify a current habit you already do each day and then stack your new behavior on top. This is called habit stacking… For example:

- After I pour my cup of coffee each morning, I will meditate for one minute.

- After I take off my work shoes, I will immediately change into my workout clothes.

- After I sit down to dinner, I will say one thing I’m grateful for that happened today…”

Once you’ve mastered habit stacking, you can begin to form chains of habits. Imagine where that could take you!

Weekly Focus – Think About It

“Excellence is an art won by training and habituation: we do not act rightly because we have virtue or excellence, but we rather have these because we have acted rightly…”

–Will Durant, American philosopher

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

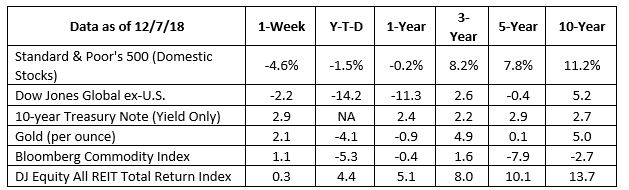

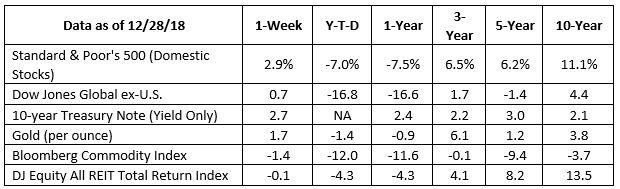

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* This newsletter and commentary expressed should not be construed as investment advice.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95percent of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

[1] https://www.nytimes.com/2002/11/05/health/a-conversation-with-daniel-kahneman-on-profit-loss-and-the-mysteries-of-the-mind.html?pagewanted=all&src=pm&module=inline

[2] https://www.schwab.com/active-trader/insights/content/7-tips-weathering-bear-market

[3] https://www.cnbc.com/2018/12/26/us-futures-following-christmas-eve-plunge.html

[4] https://www.marketwatch.com/story/stock-market-ends-wild-week-in-negative-territory-as-dow-sp-500-set-for-worst-december-since-1931-2018-12-28

[5] https://jamesclear.com/habit-stacking

[6] http://blogs.umb.edu/quoteunquote/2012/05/08/its-a-much-more-effective-quotation-to-attribute-it-to-aristotle-rather-than-to-will-durant/