At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Market Commentary April 1, 2019

“Fascinatingly counterintuitive…”

That’s how Michael Arone, an investment strategist, described the U.S. market environment to Avi Salzman of Barron’s: “‘Stocks are rallying, but bond yields are reflecting much lower growth.’ Stocks rose during the quarter because the Fed backed away from raising interest rates, and investors grew more confident that the U.S. and China would sign a trade deal, Arone said. The market was also rebounding from a very rough fourth quarter – ‘conditions at the end of the year were wildly oversold,’ he noted.”

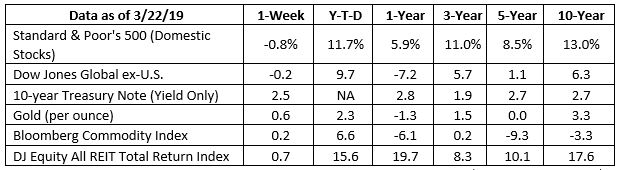

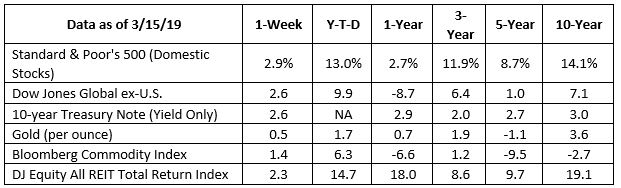

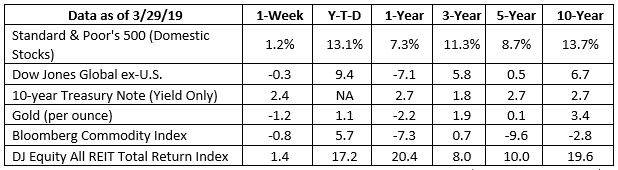

Through the end of last week, the Standard & Poor’s 500 Index was up more than 13 percent year-to-date, despite falling corporate earnings and modest consumer spending gains.

Consumer optimism may have played a role in U.S. stock market gains. The University of Michigan’s Surveys of Consumers Economist Richard Curtin reported: “…the last time a larger proportion of households reported income gains was in 1966. Rising incomes were accompanied by lower expected year-ahead inflation rates, resulting in more favorable real income expectations…Moreover, all income groups voiced more favorable growth prospects for the overall economy…Overall, the data do not indicate an emerging recession but point toward slightly lower unit sales of vehicles and homes during the year ahead.”

The Bureau of Economic Analysis released its report on economic growth in 2018 last week. Real gross domestic product (GDP), which is a measure of economic growth after inflation, was revised down to 2.2 percent in the fourth quarter of 2018. Growth was up 2.9 percent for the year, though, which was an improvement on 2017’s gain of 2.2 percent.

Slowing economic growth gives weight to bond investors’ expectations, while consumer optimism supports stock investors’ outlook. Divergent market performance and conflicting data make it hard to know what may be ahead. One way to protect capital is to hold a well-diversified portfolio.

how much does it cost to make money? You may not have given it much thought, but it costs money to make money. In fact, the costs of the metals required to make some U.S. coins is higher than the value of the coins! George Washington and Abraham Lincoln might not approve, if they knew. Take this quiz to see what you know about the cost and value of U.S. coins.

- How much did it cost the U.S. Mint to make a U.S. penny in 2018?

- 0.5 cents

- 1.25 cents

- 2.06 cents

- 3.0 cents

- How much did it cost the U.S. Mint to make a U.S. nickel in 2018?

- 1.25 cents

- 4.97 cents

- 6.03 cents

- 7.53 cents

- What makes a coin valuable to a collector?

- Metal

- Age

- Rarity

- All of the above

- Which of these coins is the most valuable to collectors?

- 1849 Coronet Head Gold $20 Double Eagle

- 1913 Liberty Nickel

- 1943-D Lincoln Wheat Cent Penny

- 1835 Classic Head Gold $5 Half Eagle

Weekly Focus – Think About It

According to the Federal Reserve, the estimated lifespan of a $10 bill is 4.5 years. The estimated lifespans of a $5 and $1 bill are 5.5 years and 5.8 years, respectively. A $100 bill may last 15.5 years because it circulates less frequently.

Answers:

- It cost 2.06 cents to make a one-cent coin that few people use. A group of citizens has been encouraging the government to retire the penny.

- It cost 7.53 cents to make a nickel in 2018.

- All of the above.

- The 1849 Coronet Head Gold $20 Double Eagle is worth more than $16,600,000. It is one of the rarest U.S. coins.

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/the-s-p-500-is-off-to-its-best-start-since-1998-51553908143?mod=hp_DAY_1 (or go to https://www.barrons.com/market-data/market-lab

http://www.sca.isr.umich.edu (or go to http://www.sca.isr.umich.edu/

https://www.reuters.com/article/us-usa-economy-spending/u-s-consumer-spending-soft-inflation-benign-as-economy-slows-idUSKCN1RA1EK

https://www.bea.gov/news/2019/gross-domestic-product-4th-quarter-and-annual-2018-third-estimate-corporate-profits-4th

https://www.usmint.gov/about/reports (Click on 2018 Annual Report, go to page 10)

https://www.federalreserve.gov/faqs/how-long-is-the-life-span-of-us-paper-money.htm

http://www.retirethepenny.org

https://www.usmint.gov/learn/kids/collectors-club/ten-facts-of-collecting#nine

https://www.usacoinbook.com/encyclopedia/most-valuable-coins/

https://www.usacoinbook.com/coins/4291/gold-20-double-eagle/coronet-head/1849-P/unique-smithsonian-collection/