At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Market Volatility – Precautions are useless after a crisis!

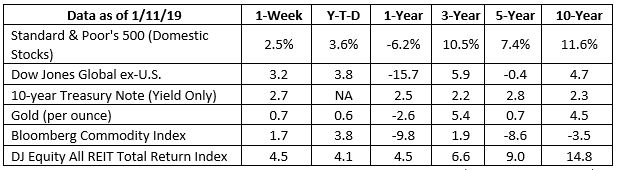

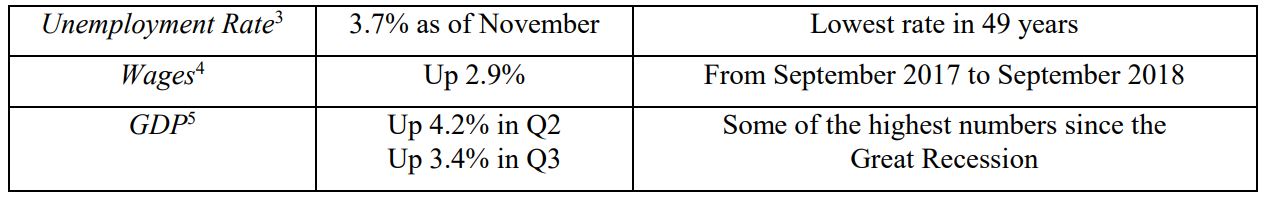

As you probably know, there has been a lot of market volatility in recent months. Being a financial advisor, I get asked a lot of questions, even from people who aren’t my clients! Some ask if it’s a good time to invest in the markets, or if they should be sticking their money under a mattress. Others ask me about what the future holds for the economy. But the most common question I get is this:

“What,” they say, “is the number one financial tip you can give me?”

Here’s my answer:

Precautions are useless after a crisis!

You’re probably wondering what I mean. It’s simple. When is the worst time to buy a home security system? After a break-in. When’s the worst time to check your tire pressure? After you’ve already had a blowout. When’s the worst time to put your seatbelt on?

You get the idea.

It’s a fundamental fact of life, and it extends to your finances, too. I can’t say for sure when the next bear market will come – and the recent volatility is not necessarily an indication that a bear is just around the corner. What I can say, however, is that a bear market is inevitable, because the markets can take hits just like everything else.

Whether the next bear market comes this year or next, there’s only one thing to do about it, and that’s to have a plan. But a plan is nearly useless after the fact.

We’ve known this lesson since we were kids. Aesop, that ancient master of common sense, says it better than I can in his story, “The Caged Bird and the Bat.”

A singing bird was confined in a cage which hung outside a window and had a way of singing at night when all other birds were asleep. One night, a bat came and clung to the bars of the cage. The bat asked the bird why she was silent by day and sang only at night.

“I have a very good reason for doing so,” said the bird. “It was once when I was singing in the daytime that a fowler was attracted by my voice. He set his nets for me and caught me. Since then, I have never sung except by night.” The bat replied, “It is no use your doing that now when you are a prisoner. If only you had done so before you were caught, you might still have been free.”

As your financial advisor, one of my most important responsibilities is to help you do now what people in the future will wish they had done earlier. That includes preparing for more market volatility.

By reviewing your portfolio, your goals, your current vulnerability to risk, and your overall finances, we can do what needs to be done now rather than waiting until it’s too late. We can plan for the future before the future becomes the present. We can take precautions before the next market crisis. Please fill the questionnaire out and return it to me as soon as possible. By doing this, we can determine:

• Whether it’s time to focus on preserving your money over growing your money.

• Whether you currently own investments not under my management that are unsuitable for your financial goals – especially with more volatility knocking on the door.

• How the recent volatility may be affecting you and what we can do about it.

Market volatility is on the rise. By taking suitable precautions with your money, you’ll find that it’s always there to support you.

Because, after all… Precautions are useless after a crisis.

As always, thank you for your business! We look forward to hearing from you soon.