Market Commentary – November 12, 2018

How are you feeling about financial markets?

Some votes are still being counted but investors appear to be happy with the outcome of mid-term elections. Major U.S. stock indices in the United States moved higher last week, and the American Association of Individual Investors (AAII) Sentiment Survey reported:

“Optimism among individual investors about the short-term direction of stock prices is above average for just the second time in nine weeks…Bullish sentiment, expectations that stock prices will rise over the next six months, rose 3.4 percentage points to 41.3 percent. This is a five-week high. The historical average is 38.5 percent.”

Before you get too excited about the rise in optimism, you should know pessimism also remains at historically high levels. According to AAII: “Bearish sentiment, expectations that stock prices will fall over the next six months, fell 3.3 percentage points to 31.2 percent. The drop was not steep enough to prevent pessimism from remaining above its historical average of 30.5 percent for the eighth time in nine weeks.”

So, from a historic perspective, investors are both more bullish and more bearish than average. If Sir John Templeton was correct, the mixed emotions of investors could be good news for stock markets. Templeton reportedly said, “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

While changes in sentiment are interesting market measurements, they shouldn’t be the only factor that influences investment decision-making. The most important gauge of an individual’s financial success is his or her progress toward achieving personal life goals – and goals change over time.

is A Zeal of zebras a better investment than a blessing of unicorns?

Collective nouns are the names we use to describe collections or significant numbers of people, animals, and other things. The Oxford English Dictionary offered a few examples:

- A gaggle of geese

- A crash of rhinoceros

- A glaring of cats

- A stack of librarians

- A groove of DJs

In recent years, some investors have shown great interest in blessings of unicorns. ‘Unicorns’ are private, start-up companies that have grown at an accelerated pace and are valued at $1 billion.

In early 2018, estimates suggested there were approximately 135 unicorns in the United States. Will Gornall and Ilya A. Strebulaev took a closer look and found some unicorns were just gussied-up horses, though, according to research published in the Journal of Financial Economics.

The pair developed a financial model for valuing unicorn companies and reported, “After adjusting for these valuation-inflating terms, almost one-half (65 out of 135) of unicorns lose their unicorn status.”

Clearly, unicorn companies must be thoroughly researched. There is another opportunity Yifat Oron suggested deserves more attention from investors: zebra companies. Oron’s article in Entrepreneur explained: “Zebra companies are characterized by doing real business, not aiming to disrupt current markets, achieving profitability and demonstrating it for a while, and helping to solve a societal problem…zebra companies…are for-profit and for a cause. We think of these businesses as having a ‘double bottom line’ – they’re focused on alleviating social, environmental, or medical challenges while also tending to their own profitability.”

Including both types of companies in a portfolio seems like a reasonable approach.

If you were to choose a collective noun to describe investors, what would it be? An exuberance? A balance? An influence?

Weekly Focus – Think About It

“In his learnings under his brother Mahmoud, he had discovered that long human words rarely changed their meanings, but short words were slippery, changing without a pattern…Short human words were like trying to lift water with a knife.”

–Robert Heinlein, American science fiction writer

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

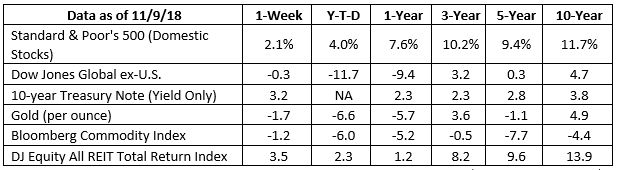

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.aaii.com/sentimentsurvey

https://www.franklintempleton.com/forms-literature/download/SIRJT-POS

https://blog.oxforddictionaries.com/2014/07/11/what-do-you-call-a-group-of/

https://blog.oxforddictionaries.com/2012/08/09/collective-nouns/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2955455

https://www.entrepreneur.com/article/322407

https://books.google.com/books?id=p9UiDQAAQBAJ&pg=PT194&dq=stranger+in+a+strange+land+Long+human+words&hl=en&sa=X&ved=0ahUKEwjunsfS0MreAhVrQt8KHVkbDbgQ6AEILTAB#v=onepage&q=stranger%20in%20a%20strange%20land%20Long%20human%20words&f=false (Page 167)