Understanding Credit Reporting

Historically low interest rates present a welcome opportunity for many homeowners to improve their financial situation by refinancing their mortgage. But, like everything else in the world of finance, there are no free lunches. To take advantage of these lower rates, homeowners must leap the FICO hurdle.

To qualify for the best loans at the lowest rates, borrowers must qualify financially and are scored by lenders using a computerized model for evaluating credit risk, developed by Fair, Isaac, and Company, known as the FICO score.

Mortgage lenders are in the business of making money by lending it and being repaid on time. They gauge the risks associated with making that loan on a number of factors, not the least of which is the likelihood of timely repayment.

The FICO scoring system compares borrower’s credit capabilities to those of similar borrowers all over the country. A borrower’s credit history gives a strong indication of integrity, attitude, and discipline as well as a measure of their capability to pay bills on time.

Three major credit reporting agencies gather credit information: Experian, Equifax, and Transunion. The firms act independently of each other and use different methods for gathering information, hence the reports of each may differ.

The reporting agencies issue several different types of reports. A Consumer Report is the basic consumer report issued when an individual orders his own credit report. The Merchant Report is more complete and contains the full FICO scores.

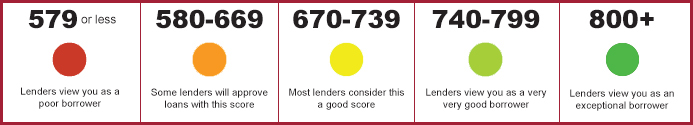

Lenders view these scores as just one of several criteria for evaluating the ability of a borrower to pay back a loan. The scores, ranging from 0 to 850, are numbers that tell lenders how likely an individual is to repay a loan, or make credit payments on time. The higher the score, the better the credit risk. Scores of 700+ make A credit grades, 640+ for a B grade, and below 579 fail.

According to mortgage broker Ron Goerss of Partners Mortgage, the most important factors to mortgage lenders are mortgage history, derogatory credit history, liens or judgments, length of credit history, depth of credit history, proportion of debt to credit balances, and the amount of available credit.

A borrower can improve his FICO score over time by paying bills—especially mortgage payments—on time. Late payments cost points. To get the best scores, one should accumulate at least 36 months of a timely payment history. Generally speaking, a borrower will have an excellent credit score with four major accounts ($1,500 credit limits or higher) all with 36 months of spotless payment history, and all usually maintaining balances that are at or below 60% of available credit limits.

Despite paying bills on time, it is still possible to have a lower credit score. Too many open accounts with higher balances will pull the score down. Too many inquiries hurt the score. Too many monthly obligations weaken the score.

Finally, the real negatives are late mortgage payments, collection history, charge-offs, repossessions, and bankruptcy. While all of those can be worked around, most lenders will refuse a conventional loan to someone with foreclosure history on their report.

It’s a good idea to periodically review your FICO score. Erroneous information may be reported, and if you know ahead of time, you can write a letter to the credit-reporting agency and request a correction. For more information on FICO scoring and obtaining your FICO scores: www.creditline.com and www.creditreporting.com.