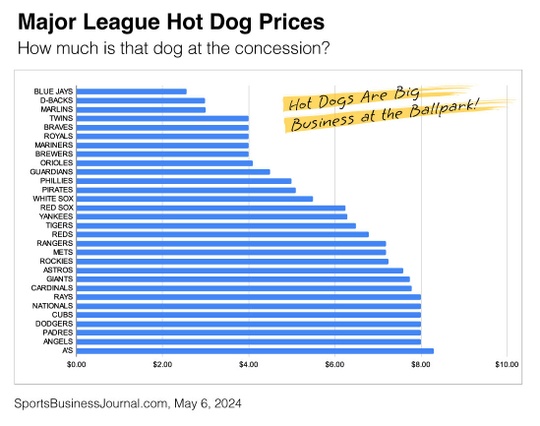

From the chart, you can see that seven of the top ten highest-priced dogs are for teams that may not make the playoffs. On the other hand, eight of the ten least expensive dogs are at stadiums where teams are fighting for a playoff spot.

While consumers are used to seeing a mark-up on concessions at movie theaters, concerts, and sporting events, MLB offers a relatively inexpensive option compared to the National Football League (NFL).

The average cost for a family of four is $180.54, which figures tickets, parking, beverages, and (of course) hot dogs. That range is higher in some cities, over $320 in Los Angeles (the Dodgers) or Boston (the Red Sox), and lower in others. A family can see a game for under $140 in a handful of lower-end markets: the Cincinnati Reds, Colorado Rockies, Cleveland Guardians, Kansas City Royals, and Chicago White Sox.2

The reason for the boosted prices? Concessions play a big part in maintaining the grounds and paying for the teams. Dodgers pitcher Shohei Ohtani inked a $700 million, 10-year contract with the team. That means the Dodgers hope you show up to the game hungry!2

As the season winds down, I hope you have enjoyed a few games, whether at the ballpark or at home. At my house, the dogs always come dressed the way I like them and are considerably less expensive!