Sending you warm thoughts and best wishes for a wonderful new year. May the days ahead be filled with joy, laughter, and prosperity for you and those you hold most dear.

Tariffs and Tweets

When Twitter first launched back in 2006, its creators probably never imagined that a single “tweet” could make the stock market plunge. But that’s exactly what happened on Thursday, August 1, when President Trump tweeted the following:

“…the U.S will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%…”1

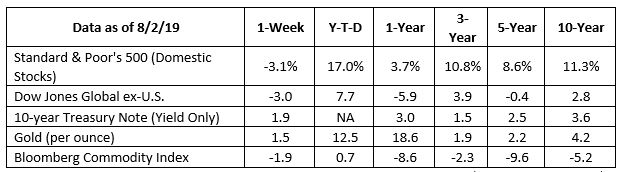

Before the tweet went out, the Dow was up over 300 points. The S&P 500 was also having a good day. By the late afternoon, however, the Dow ended up down almost 300 points.2 That’s quite a swing.

Of course, it wasn’t really the tweet itself that made the markets dip, but the news it contained. As usual, the markets reacted to the announcement of more tariffs with a fit of violent sneezing. So, investors must now ask themselves, “Is this just a brief allergic reaction…or the first symptom of a market cold?”

Let’s break it down.

The “what” and “why” of tariffs

Here’s a quick review of the basics. A tariff is essentially a tax on imported goods. The business doing the importing will pay the tariff, usually as a percentage of the goods’ total value.

Many economists believe, however, that it’s consumers – people like you and me – who end up paying the cost of tariffs. For example, back in 2018, President Trump placed a tariff on imported washing machines. One study found that consumers “bore between 125 and 225 percent of the cost of washing machine tariffs”, mainly because the companies that sold the machines ended up charging far more for them to make up for what they lost in tariffs.3

So, why impose tariffs at all? Some economists argue there are lots of reasons. For instance:

Protecting domestic industries. When imports are more expensive, the thinking goes, consumers – both individuals and other companies – are more likely to buy from domestic companies that produce the same goods at a lower price. For instance, the U.S. has put tariffs on sugar imports dating all the way back to 1789!4

Revenue. Historically, tariffs were once one of the nation’s largest sources of revenue. However, tariffs-as-revenue have largely been replaced by other taxes, especially income and payroll taxes.

Geopolitical negotiating. Tariffs – or at the least, the threat of them – can sometimes be used to drive countries to the negotiating table. That’s probably the single biggest reason President Trump has relied on tariffs so much, as he has persistently used them to persuade countries like China, Canada, and Mexico to negotiate more favorable trade deals.

So, are tariffs good or bad? It’s unclear. Some economists claim they’re worth the cost. Others believe tariffs aren’t effective at doing what they’re supposed to do and just end up hurting consumers far more than they help. And since the American economy is based largely on consumer spending, these economists believe tariffs ultimately do more harm to the economy than good.

Since I’m a financial advisor, not an economist, I won’t come down on one side or the other. Far more pressing for me – and for all investors – is how tariffs affect the markets.

Tariffs and the markets

Since 2018, President Trump has announced new tariffs on Chinese goods on several occasions. Each time, a market drop has typically followed. You only have to look at the most recent announcement to understand why.

As the President tweeted, the U.S. is imposing a new 10% tariff on $300 billion in Chinese goods. This new list includes everything from smartphones to toys to shoes.5 It’s no surprise, then, that the stocks sold off on August 1 were largely for companies that sell these products. As we just discussed, companies must pay more for the goods they need or sell, which can significantly eat into their profits. This, in turn, can lead to shipping delays, supply chain problems, higher prices for consumers, a resulting loss of business – you name it. All these issues, of course, are then reflected in the stock prices of the various companies affected.

Despite this, each of the market drops I mentioned earlier tended to be mere blips on the screen. Some blips lasted longer than others, but in each case, the market sneezed, then moved on. (Or upwards, as the case has been.) The world we live in moves with astonishing speed, and for the markets, the next bit of news often seems to crowd out the previous bit. Those who have predicted doom and gloom with each new round of tariffs are still waiting. Since the overall health of the economy remains strong, it will likely take more than a few tweets, or even a few hundred billion in tariffs, to make the markets truly sick.

The danger of complacency

All that said, there is a danger here. It’s the danger of becoming so accustomed to these here today, gone tomorrow blips that we forget to remember it’s the long-term health of the markets that matters.

Every day, we’re bombarded with short-term news stories that cause short-term reactions. The fact that a single tweet can move markets is proof of that. But repetition often leads to desensitization. Sometimes I wonder if investors will become numb to events like we saw on August 1st. We sneeze, and when nothing else happens immediately, we move on.

As always, though, the long-term is more important than the short. In this case, it’s possible we haven’t actually felt any long-term effects yet, just as we don’t usually feel the symptoms of a cold until the virus has been inside us for some time. Are there long-term effects to come? I don’t know – nobody does. It is important to note, however, that this round of tariffs is a little different than the previous ones. Older tariffs were largely on products like plywood and polyethylene. Important, but not very conspicuous. The newest tariffs President Trump has proposed involve more of the things we use on an every-day basis. Smartphones, for instance. Shoes. Clothing. Things we tend to notice and appreciate just a bit more. What happens if they go up significantly in price? Would that mean anything in the long run?

It seems needlessly pessimistic to say that it definitely will. On the other hand, it also seems hopelessly naïve to say that it definitely won’t.

It’s also possible that older tariffs will become more painful the longer they go on. Some data suggests that many companies have decided to eat the higher costs that come with tariffs rather than passing them onto consumers. But how long will that last?

The point of saying all this is not to suggest that these new tariffs, or tariffs in general, will bring a definitive end to the bull market we’ve enjoyed for so long. In fact, I think the chances are high that the markets will once again absorb the news, sneeze, and move on. Tariffs, as important as they are, represent only a small portion of the total economy – and the economy still looks strong. And of course, President Trump’s strategy could yet pay off and lead to a new, more favorable trade deal with China.

As your financial advisor, though, I am adamant that we avoid feeling complacent about it. (Or rather, that I avoid it. It’s my job to worry; you should enjoy the rest of your summer!) While it’s a mistake to overreact every time the markets dip, it’s also a mistake to stop paying attention.

My diagnosis, then: A sneeze is usually just a sneeze. And the August 1st market dip is likely just a market blip. But I will keep paying attention to everything I can – the markets, the economy, and yes, even Twitter if need be – in case a blip ever turns into anything more.

As always, please let me know if you have any questions or concerns. I love to hear from you. In the meantime, have a wonderful rest of your summer!

1 Twitter account of Donald J. Trump, August 1, 2019. https://twitter.com/realDonaldTrump/status/1156979446877962243?s=20

2 “Trump Threatens New Chinese Tariffs, Rattling Investors Across Markets,” The Wall Street Journal, August 1, 2019. https://www.wsj.com/articles/trump-to-impose-additional-10-tariff-on-chinese-goods-11564681310

3 “The Truth About Tariffs,” Council on Foreign Relations, May 16, 2019. https://www.cfr.org/backgrounder/truth-about-tariffs

4 “The Taxation of Sugar in the United States, 1789-1861. The Quarterly Journal of Economics. https://www.jstor.org/stable/1882993?seq=1#metadata_info_tab_contents

5 “Trump says he will go ahead with new China tariffs that would hit iPhones and toys,” CNN Business, August 1, 2019. https://www.cnn.com/2019/08/01/economy/new-china-tariffs-threat-trump/index.html