Year-End Tax Tips That Will Trim Your Tax Bill

- December 31 is an essential deadline for taxpayers who want to lower their tax bill and build up their savings.

- There is no better time than now to start to make gifts to loved ones, maximize your 401K contributions, save for college or donate your required minimum distribution

The new tax law has put a whole new spin on year-end tax planning, though it hasn’t eliminated the need to do it altogether. t has been a busy year for taxpayers and accountants, as the end of 2018 signals the first year under the Tax Cuts and Jobs Act.

In all, the tax overhaul roughly doubled the standard deduction to $12,000 for single filers ($24,000 for married-filing-jointly), eliminated personal exemptions and limited itemized deductions.

Despite the changes to the tax law, there are still opportunities to shore up your 2018 finances. Here’s what to consider.

1) Maximize retirement savings

Reduce your taxable income dollar-for-dollar by contributing as much as you can to your 401K or employer’s retirement plan by Dec. 31.

If you are 18 or older, you can save up to $18,500 to your 401(k), and if you are over 50 you can kick in an extra $6,000. With IRAs you can contribute $5,500, and if you are over 50, an additional $1,000. (You have until the April deadline to make those IRA contributions.)

Additionally, if you are self-employed and contribute to SEP IRAs, you can deduct up to 25 percent of compensation or $55,000 for 2018.

Make sure you’ve taken advantage of your employer’s match to your 401K plan. Better yet, make sure you’ve maxed out how much you can contribute. Leaving this benefit underutilized is the same as leaving money on the table.

(If you contribute to a Roth 401K or Roth IRA, you won’t get a tax break, but your money can grow tax-free and generally be withdrawn tax-free in retirement.)

2) Make an extra mortgage payment

Although the number of homeowners who can benefit from the mortgage tax break fell significantly under the new tax law, about 13.8 million taxpayers will still be able to claim the mortgage-interest deduction in 2018.

If you own a home and get a mortgage interest deduction, make an extra mortgage payment on Dec. 31 to get that additional deduction on this year’s taxes.

For new homeowners (or those who bought a home after Dec. 15, 2017) who will still be able to take advantage of the tax break, the interest they can write off is limited to $750,000 in loans, down from the previous $1 million.

3) Unload losers

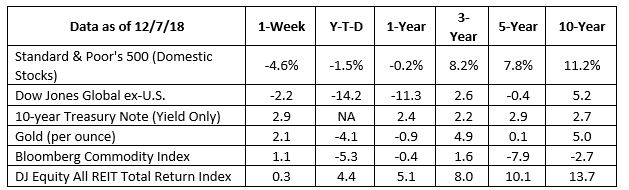

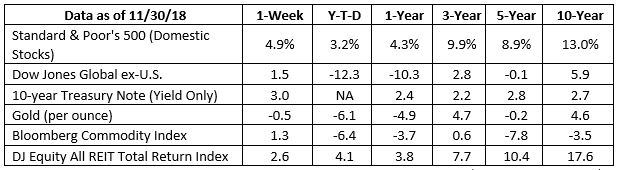

After this week’s market downturn, chances are you have some investments that lost value this year.

You can use those losses to zero out capital gains, and then deduct up to $3,000 a year against ordinary income. Losses in excess of that can be carried forward to future tax years until the balance is used up.

For example, if you have $10,000 of losses and $5,000 of gains, you have an overall loss of $5,000 — and up to $3,000 of that loss can be used to offset your ordinary income. The additional $2,000 in losses can be shifted to next year’s return.

For just that reason, tax-loss harvesting is a popular tool for maximizing after-tax returns, most commonly in the fourth quarter of the year, when investors aim to lower their tax liability. (But this strategy only works on taxable accounts, not your 401(k) or IRA.)

Be aware that if you sell a security at a loss and buy the same or similar security within 30 days before or after the sale, the IRS won’t allow you to claim the loss on your tax return. This is known as a wash sale.

4) Deduct health-care expenses

If your health-care costs exceed 7.5 percent of your adjusted gross income in 2018, you may be able to deduct those expenses.

Tally up how much you spent on health insurance, Medicare premiums, long-term health insurance premiums, nursing home costs, orthodontics and other out-of-pocket expenses to see if the total exceeds the medical expense threshold.

You can deduct everything you spend over that amount (but you can’t double dip and count expenses paid for with tax-advantaged flexible spending or health savings account dollars).

You also can’t take this tax break if you opt for the standard deduction – it only applies if you itemize all of your deductions.

5) Bundle charitable donations

If you want to lower your tax bill by making donations to charity, you have until Dec. 31 to do so.

Even though the deduction for donations is unchanged, you still need to itemize to claim it, and that’s a much higher bar this year.

One way to surpass the new, higher standard deduction is to save money over time and donate every two or three years instead of every year — a strategy called “bunching.”

For example, instead of giving $5,000 to charity annually, accelerate the gift by giving $10,000 every two years. This way, you may get your itemized deductions over the limit one year and take the standard deduction the next.

Maximize your contribution — and the amount you can deduct if you’re able to itemize in 2018 — by stuffing multiple years’ worth of donations into one year. This move is known as “bunching” your charitable contributions.

6) Defer your bonus

If you get a year-end bonus at work, it could bump you up to another tax bracket and increase the taxes you owe.

See if your employer will pay you your bonus in January. You will still receive it close to year-end, but you won’t have to pay taxes on it when you file your tax return.

You don’t want to defer your bonus for too long, but a few weeks might make sense.

7) Donate Your RMD to Charity

If you’re 70½ or older, you have until Dec. 31 to take your Required Minimum Distribution from your IRAs and retirement plans.

Failure to do so could mean you’re on the hook for a 50 percent penalty on the amount you should have taken.

If you’re lucky enough that you won’t need the RMD, consider donating the money directly from your retirement account to your qualifying charity of choice. This is known as a qualified charitable distribution.

You don’t need to itemize deductions on your tax return in order to do this.

The bonus: Your RMDs are normally taxable distributions, but qualified charitable distributions are not, according to the IRS.

8) Give to Heirs

You have until Dec. 31 to make gifts to your loved ones for the tax year. You can give up to $15,000 per recipient to an unlimited number of beneficiaries without paying a gift tax. This is known as the annual gift exclusion.

If you’d like to share even more wealth with your grandkids without being subject to gift taxes, consider paying for their tuition or medical expenses.

All of these payments must be made directly to the provider of these services.

9) Talk to Your Tax Preparer

The single best move anyone can take before the end of the year to cut their tax bill is to consult a licensed tax professional and seek advice for their specific situation. Waiting until January will be too late. Each taxpayer’s situation and each tax year is unique. This year, there are new laws and new forms that will affect everyone. Waiting until the return is calculated is likely to produce a few surprises. The new tax law also changed the way employers withhold taxes, and the IRS is concerned that many taxpayers will be surprised by their refunds or balance due because of the new withholding rules.