Why did the stock market do that?

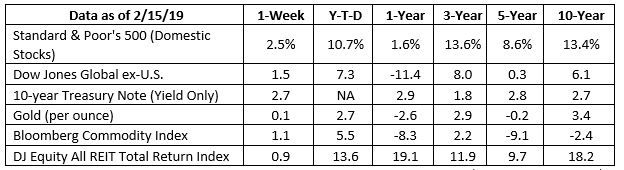

The great mystery of stock markets reared its head last week. With no clear driver, the Dow Jones Industrial Average gained more than 3 percent, while the Nasdaq Composite and Standard & Poor’s (S&P) 500 Index moved higher by about 2.5 percent. It was a puzzler. Ben Levisohn of Barron’s explained: “Given those gains, we’d expect a heaping helping of good news, but not much was forthcoming. Earnings reports from [two large multinational companies] left investors wanting. And economic data were either bad or terrible in the United States – industrial production declined in January, the first drop in eight months, while December’s retail sales fell the most for any month since 2009. But who needs good news when the United States and China are reportedly making progress on trade talks? Yes, the details remain a little fuzzy, but at least the tone is more constructive.”

It probably wasn’t just optimism about China that pushed markets higher. Consumer Sentiment, which gauges Americans expectations for the economy, was up more than 4 percent month-to-month. One driver of consumer optimism was relief the government shutdown had ended. Another driver is a change in inflation expectations, which are at the lowest level seen in half a century. Americans think inflation will remain low and they anticipate wages will rise. The Federal Reserve’s newly accommodative attitude hasn’t hurt, either.

Investor sentiment was leaning bullish last week, too. Willie Delwiche of See It Market reported the Investor Intelligence survey of financial advisors showed 49 percent bullish and 21 percent bearish. The AAII Investor Sentiment Survey reported bulls (40 percent) edged bears (37 percent) by a neck. Those indicators were balanced by the Daily Trading Sentiment Composite from Ned Davis Research which suggested optimism was too high.

When markets rise, as they have during the past few weeks, it may be tempting to take a more aggressive stance and tilt your portfolio toward U.S. stocks. This may not be a good idea.

What’s in your wallet?

You’re at the checkout. How do you pay for your purchase? Do you reach for a credit card, debit card, cash, check, or some form of electronic payment, such as a mobile wallet or wearable?

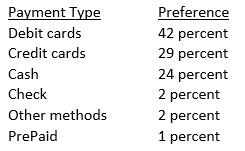

The Federal Reserve Bank of San Francisco’s 2018 Findings from the Diary of Consumer Payment Choice (DCPC) found participants preferred to pay using debit cards. The order of payment preference was like this:

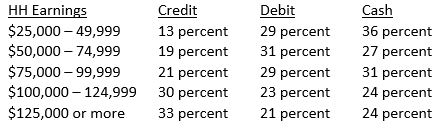

Here’s an interesting side note. The more money a household earned, the more likely they were to pay by credit card.

The shift in preference begs the question: Do wealthier people have more debt? Some do, but wealthier households are more likely to pay off credit card debt each month, according to author Tom Corley who was cited by Credit.com writer Gerri Detweiler.

If you use credit cards frequently and haven’t been paying down your balance each month, it may be a good idea to do a simple calculation to determine how much you are paying in interest each year. Just multiply the interest rate you pay by the amount of debt you carry. The amount may surprise you. Nerdwallet’s American Household Credit Card Debt Study reported, “Households with revolving credit card debt will pay an average of $1,141 in interest this year.”

If retirement is 10 years in the future, saving $1,141 a year, and earning 6 percent annually on the money, could provide about $16,000 in additional savings. If retirement is 30 years away, you could increase your savings by about $96,000*. It’s food for thought.

*This is a hypothetical example and is not representative of any specific investment. Your results may vary.

Weekly Focus – Think About It

“Wealth consists not in having great possessions, but in having few wants.”

–Epictetus, Greek philosopher

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

http://www.sca.isr.umich.edu (or go to http://www.sca.isr.umich.edu/)

https://www.seeitmarket.com/u-s-equities-update-investor-sentiment-full-circle-18971/

https://blog.credit.com/2015/02/5-credit-card-habits-of-the-rich-108720/

https://www.nerdwallet.com/blog/average-credit-card-debt-household/

http://www.moneychimp.com/calculator/compound_interest_calculator.htm

https://www.forbes.com/sites/robertberger/2014/04/30/top-100-money-quotes-of-all-time/#6db006fb4998