Market Commentary – October 8, 2018

The stock market tends to be a leading economic indicator. Last week offered some insight to economics and stock market behavior. The U.S. unemployment rate reached its lowest level since 1969 and wages moved higher, yet major U.S. stock indices lost value.

Why didn’t stock markets move higher?

The answer is stock prices tend to be leading indicators. They reflect investors’ expectations for the future. Last week, investors may have been thinking like this:

When unemployment is low, companies cannot always hire enough workers…

To hire more workers, companies raise wages…

Higher wages give workers more spendable income…

More spendable income produces higher demand for goods and services…

Higher demand for goods and services leads to higher prices…

Higher prices (inflation) cause the Federal Reserve to increase the Fed funds rate…

An increase in the Fed funds rate pushes interest rates higher…

Higher interest rates make borrowing more expensive…

Higher borrowing costs may slow business spending…

Slower business spending may cause profits to fall…

Falling profits may cause investors to sell shares…

When investors sell shares, stock prices may drop.

In general, “…while it usually takes at least 12 months for any increase or decrease in interest rates to be felt in a widespread economic way, the market’s response to a change (or news of a potential change) is often more immediate,” explained Mary Hall on Investopedia.com.

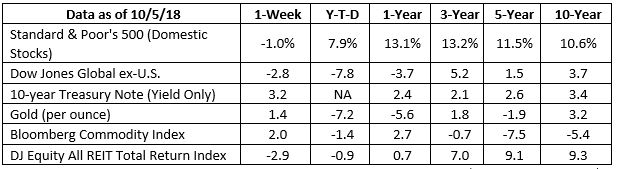

At the end of last week, 10-year Treasuries yielded 3.2 percent. Daniel Kruger of The Wall Street Journal reported, “U.S. government bond yields rose to their highest level in years Friday as investors reconsidered the strength of the U.S. economy while selling off stocks that could be hurt by higher borrowing costs.”

One way to manage stock market volatility is to have a well-allocated and diversified portfolio.

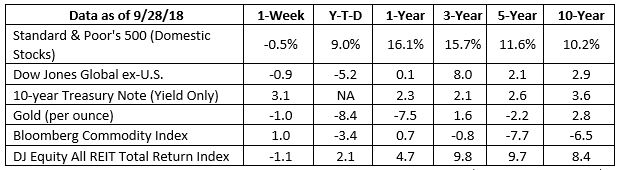

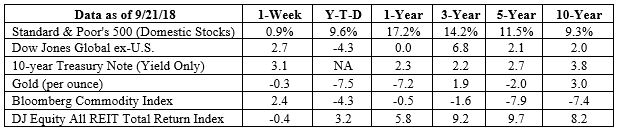

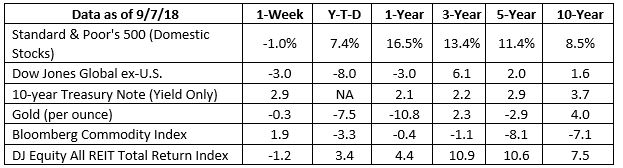

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

What do you think? Athletes who grew up playing pick-up games of baseball, kickball, basketball, street hockey, and other sports with neighborhood kids may have had some advantages they didn’t recognize. A Brazilian research study, cited by Freakonomics Radio’s show Here’s Why You’re Not An Elite Athlete (Ep. 351), found children who played sports in unstructured environments showed more tactical creativity and tactical intelligence than children who played in structured environments. In addition, playing multiple sports may be more beneficial than specializing in a single sport, at least when it comes to soccer.

A study by Manuel Hornig, Friedhelm Aust, and Arne Güllich reviewed the training of soccer players in Germany. Practice and play in the development of German top-level professional football players, which was published in the European Journal Of Sports Science, reported athletes who went on to play for the German national team played more pick-up sports as children, and played more types of sports in adolescence, than players who did not make the German team.

“The trick is not just to get lots of children playing, but also to let them develop creatively. In many countries they do so by teaching themselves…Such opportunities are disappearing in rich countries,” reported The Economist.

Maybe we should rethink our tactics.

Weekly Focus – Think About It

“One man practicing sportsmanship is far better than 50 preaching it.”

–Knute Rockne, University of Notre Dame football coach

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.conference-board.org/data/bcicountry.cfm?cid=1

https://www.barrons.com/articles/dow-tumbles-180-points-jobs-report-inflation-gauge-1538774927?mod=hp_DAY_3

https://www.investopedia.com/investing/how-interest-rates-affect-stock-market/

https://finance.yahoo.com/quote/^TNX?p=^TNX

https://www.wsj.com/articles/bond-yields-reach-new-highs-on-growth-outlook-1538774696

https://www.researchgate.net/publication/45492811_The_effect_of_deliberate_play_on_tactical_performance_in_basketball

http://freakonomics.com/podcast/sports-ep-3/

https://www.tandfonline.com/doi/abs/10.1080/17461391.2014.982204

https://www.economist.com/international/2018/06/09/what-makes-a-country-good-at-football

http://www.keepinspiring.me/100-most-inspirational-sports-quotes-of-all-time/ (Number 89)