At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not sure of his investment advice track record, let me dig up the facts for you.” An Examination of a...

Market Commentary – January 28, 2019

Like competitors who’ve completed a difficult section in an endurance race, U.S. stock investors took a breather last week.

The Standard & Poor’s 500 Index, which has gotten off to its best start since 1987, ended the week with a slight loss, while the Dow Jones Industrial Average and Nasdaq Composite finished slightly higher, reported Ben Levisohn of Barron’s.

News the U.S. government shutdown would end, albeit temporarily, appeared to be of little interest to investors. Barron’s suggested the markets’ muted response to the government reopening was in balance with its response to the shutdown – there wasn’t much of one. In fact, the S&P 500 has gained 10 percent since the federal government closed.

Despite apparent disinterest, the shutdown could negatively affect sentiment, according to Sam Fleming and Brooke Fox of Financial Times. They reported:

“The record-breaking US government shutdown is triggering ripple effects across the US economy and risks denting confidence among companies that have already been fretting about trade disputes and stock market turbulence. Shutdowns have historically had only fleeting economic effects, but Jay Powell, the Federal Reserve chairman, warned last week that a dispute that outlasts past impasses could begin to change the picture for the worse.”

Last week, stock investors weren’t all that impressed by earnings, either. Earnings indicate how profitable companies were in the previous quarter. At the end of last week, 22 percent of companies in the S&P 500 had reported earnings and, overall, they were 3 percent above estimates, according to John Butters at FactSet.

However, indications the Federal Reserve may decide to keep more Treasuries on its balance sheet than originally anticipated gave U.S. stocks a boost late in the week, reported Nick Timiraos of The Wall Street Journal. The Fed began shrinking its balance sheet in 2017 by letting Treasury and mortgage bonds mature. We’ll know more after this week’s Fed meeting.

What is going on across the pond? Last November, BBC commentator Chris Mason reflected the frustration of a nation with his report on the rapidly approaching deadline for the British exit from the European Union (EU). He said: “So, where are we in all of this Brexit process…people like me are paid, aren’t we, to have insights and foresights and hindsight about these things, to be able to project where we’re going to go. To be quite honest, looking at things right now, I haven’t got the foggiest idea what is going to happen in the coming weeks. Is the prime minister going to get a deal with the EU? Dunno. Is she going to be able to get it through the Commons? Don’t know about that, either.”

The report went viral. Since then, we’ve gotten some answers. The Prime Minister did indeed negotiate a deal with the EU and, on January 15, the British Parliament soundly rejected it. Heather Stewart of The Guardian reported it was, “…the heaviest parliamentary defeat of any British prime minister in the democratic era.”

The lack of an agreement in combination with a looming Brexit deadline – it’s just 9 weeks out – has created tremendous uncertainty about the future of British trade with the EU. One response has been stockpiling goods. Last week, Sarah Butler of The Guardian reported three-fourths of warehouse space in the United Kingdom is at capacity.

One intrepid entrepreneur has been marketing Brexit survival kits that provide 30 days of food rations for £295 ($380). Reuters reported the kit includes, “…60 portions of freeze-dried British favorites: Chicken Tikka, Chili Con Carne, Macaroni Cheese and Chicken Fajitas, 48 portions of dried mince and chicken, firelighter liquid, and an emergency water filter.”

As they say, necessity is the mother of invention.

Weekly Focus – Think About It

“Courage is like – it’s a habitus, a habit, a virtue: you get it by courageous acts. It’s like you learn to swim by swimming. You learn courage by couraging.”

–Marie M. Daly, Chemist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

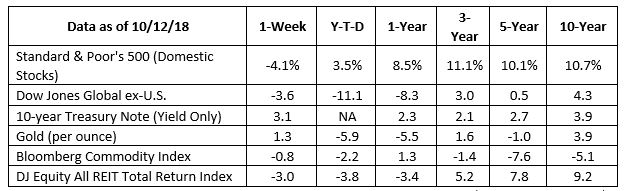

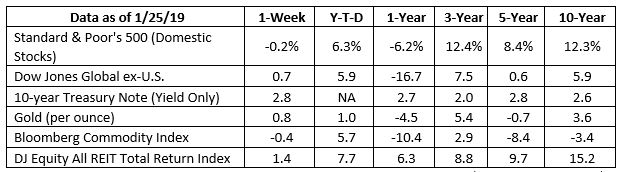

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well. The Treasury Department has announced that it is dropping the penny. Officials say the...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day, we pay tribute to the lives and legacies of those who made the ultimate sacrifice in serving our...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/the-s-p-500-goes-nowhere-after-its-big-runup-51548462969?mod=hp_DAY_8

https://www.ft.com/content/b4970904-1907-11e9-9e64-d150b3105d21

https://insight.factset.com/earnings-season-update-january-25-2019

https://www.wsj.com/articles/fed-officials-weigh-earlier-than-expected-end-to-bond-portfolio-runoff-11548412201

https://www.washingtonpost.com/world/2018/11/14/bbc-reporter-replaced-his-brexit-analysis-with-exasperated-noises-now-hes-hero/?utm_term=.d696c195120b (Watch brief video)

https://www.theguardian.com/politics/2019/jan/15/theresa-may-loses-brexit-deal-vote-by-majority-of-230

https://www.theguardian.com/politics/2019/jan/21/uk-warehouse-space-nears-capacity-firms-stockpile-for-brexit

https://www.reuters.com/article/us-britain-eu-boxes/brexit-survival-kit-helps-britons-face-the-worst-with-freeze-dried-fajita-idUSKCN1PG1G4

https://femaleentrepreneurs.institute/15-amazing-female-scientists/