Market Commentary – November 19, 2018

Keep your eyes on the horizon.

Motion sickness happens when your body receives conflicting signals from your eyes, ears, and other body parts. One way to manage the anxiety and queasiness that accompany the condition is by keeping your eyes on the horizon.

The motion of the stock markets has been causing some investors to experience similar symptoms. Surprisingly, the remedy is the same: Keep your eyes on the horizon – your financial planning horizon.

A planning horizon is the length of time over which an investor would like to achieve his or her financial goals. For instance, perhaps you want to pay off student loans by age 30, fund a child’s college tuition when they reach age 18, or retire at age 60.

When stock markets are volatile, an investor may receive conflicting signals from various sources, which may induce anxiety and queasiness. When you start to worry about the effects of market volatility on your portfolio, remember stock markets have trended higher, historically, even after significant downturns.

For instance, in 2008, during the financial crisis, the Dow Jones Industrial Average lost about 33 percent. It finished the year at 8,776. The drop sparked tremendous anxiety among investors who wondered whether their portfolios would ever recover.

Last week, the Dow closed at 25,413.

While stock markets have trended higher historically, there is no guarantee they always will. That’s why asset allocation and diversification are so important. A carefully selected mix of assets and investments can reduce the impact of any single asset class or investment on a portfolio’s performance. Keep in mind, of course, past performance is no guarantee of future results.

Last week, stock markets finished lower. MarketWatch reported U.S. stocks moved higher on Friday after President Trump indicated he might not pursue tariffs against China.

What is an apology worth?

John List, an economist at the University of Chicago and Chief Economist for a ride-sharing app, needed to go from his house to the hotel where he was a keynote speaker. So, of course, he called his ride-sharing company. The experience was less than stellar, as he explained to Steven Dubner of Freakonomics Radio: “So I get in the back of the car and it says I’m going to be there in 27 minutes. So I go into my own land of working on my slides, because of course I’m doing things at the last minute. I lose track of time. I look back up about 25 minutes later, and I’m back in front of my house…And I said, ‘Oh my god, what happened?’ The driver said, ‘I got really confused, and the GPS switched, and we turned around and I thought that you changed the destination, so I went back.’ So I told her immediately, ‘Turn around, go back.’ I missed part of my panel.”

List also missed an apology, which neither the driver nor the company offered. He decided to investigate how much mistakes, like the one he experienced, cost the company and whether an apology would reduce the cost. As it turned out, the cost of 5 percent of trips that resulted in customers being 10 or 15 minutes late was 5 to 10 percent in lost revenue.

List enlisted the help of researchers Benjamin Ho of Vassar College, Basil Halperin of Massachusetts Institute of Technology, and Ian Muir of the ride-sharing company, and conducted a field experiment on clients of the ride-sharing company. They discovered apologies are not universally successful at reducing the costs associated with a bad experience. The most successful apologies had a monetary value. In their case, a $5 coupon produced a 2 percent increase in net spending.

The team discovered another important fact. Apologies lose value and can inflict reputational damage when a company has to apologize multiple times. No surprise there.

Weekly Focus – Think About It

“When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotion.”

–Dale Carnegie, American writer and lecturer

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

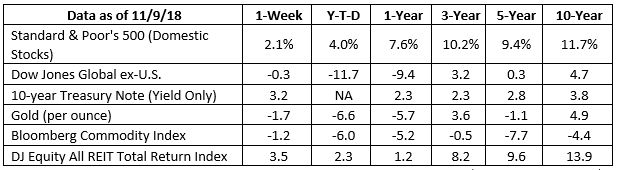

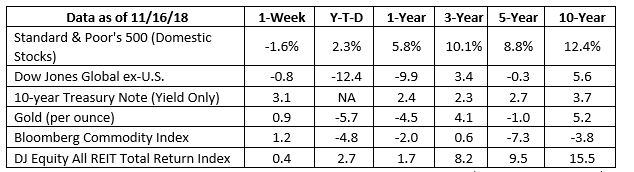

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.sharp.com/health-news/does-looking-at-the-horizon-prevent-car-sickness.cfm

http://afcpe.org/assets/pdf/volume_25_2/09013_pg174-196.pdf

https://finance.zacks.com/longterm-stock-market-trends-6294.html

https://clicktime.cloud.postoffice.net/clicktime.php?U=https%3A%2F%2Ffinance.yahoo.com%2Fquote%2F&E=jim.streight%40rfsadvisors.com&X=XID420wkTXFf6103Xd1&T=RFAD&HV=U,E,X,T&H=c07add89594b427a7910f483583c7695db1d1aae^DJI/history?period1=1167631200&period2=1230789600&interval=1d&filter=history&frequency=1d

https://clicktime.cloud.postoffice.net/clicktime.php?U=https%3A%2F%2Ffinance.yahoo.com%2Fquote%2F&E=jim.streight%40rfsadvisors.com&X=XID420wkTXFf6103Xd1&T=RFAD&HV=U,E,X,T&H=c07add89594b427a7910f483583c7695db1d1aae^DJI?p=^DJI

https://www.investopedia.com/terms/s/systematicrisk.asp

https://www.marketwatch.com/story/nasdaq-poised-to-fall-1-at-the-open-as-nvidia-weighs-on-stock-market-chip-makers-2018-11-16

https://www.reuters.com/article/us-usa-trade-china/trump-says-u-s-may-not-impose-more-tariffs-on-china-idUSKCN1NL28Q

http://freakonomics.com/podcast/apologies/

http://s3.amazonaws.com/fieldexperiments-papers2/papers/00644.pdf

https://www.brainyquote.com/quotes/dale_carnegie_130727