Weekly Market Commentary – September 17, 2018

All investors are consumers, but not all consumers are investors.

The September installment of University of Michigan’s Consumer Sentiment Survey reported Americans are feeling pretty optimistic. Consumer sentiment rose to the second highest level since 2004, and consumer expectations reached the highest level since 2004. Surveys of Consumers chief economist, Richard Curtin, wrote: “Consumers anticipated continued growth in the economy that would produce more jobs and an even lower unemployment rate during the year ahead…The largest problem cited on the economic horizon involved the anticipated negative impact from tariffs. Concerns about the negative impact of tariffs on the domestic economy were spontaneously mentioned by nearly one-third of all consumers in the past three months, up from one-in-five in the prior four months.”

Investors weren’t as optimistic, according to the American Association of Individual Investors (AAII). Last week, the AAII Investor Sentiment Survey reported bullish sentiment dropped more than 10 percentage points. The results were:

- Bullish 32.1 percent of respondents (historic average: 38.5 percent)

- Neutral 35.1 percent of respondents (historic average: 31.0 percent)

- Bearish 32.8 percent of respondents (historic average: 30.5 percent)

Despite the apparent shift in investor attitudes, stock markets moved higher last week. Vito J. Racanelli of Barron’s wrote: “The stock market radiated confidence this past week, finishing about 1 percent higher despite choppy action. There was a plethora of good economic news – from lower-than-expected inflation to sky-high business and consumer confidence numbers – that drove shares up. Not even a ratcheting up of tough tariff talk Friday on the part of the U.S. could dampen investor enthusiasm for long.”

Some believe the AAII Sentiment Survey is a contrarian indicator. Last week, that may have been the case.

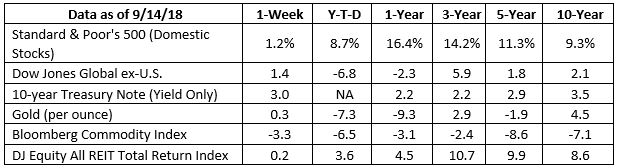

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Wordies unite! The Merriam Webster Dictionary added some new words during 2018. A favorite among fans of dictionaries is ‘wordie,’ which means ‘word lover’ and should not be confused with ‘wordy,’ which describes something with too many words. Dictionary newcomer ‘TL;DR’ (the new word that means ‘too long; didn’t read’) could be used to describe a reader’s response to something that’s wordy.

A few of the new additions are descriptions of dog breeds, including:

- Chiweenie: a cross between a Chihuahua and a dachshund

- Schnoodle: a cross between a schnauzer and a poodle

- Yorkie-poo: a cross between a Yorkshire terrier and a poodle

A number of ‘wanderworts’ – words that have wandered from one language into another – also made the list. These include:

- Harissa: spicy North African chili paste

- Kabocha: a type of Japanese pumpkin

- Kombucha: a fermented, bubbly tea drink

Many of the new entries are abbreviated versions of longer words that have been part of our vocabulary for a long time. This may be the inevitable outcome in a society that adapts to the communication shorthand demanded by text, photo, and social media apps. See if you can guess the longer version of these new words:

- Adorbs

- Avo

- Bougie

- Fave

- Guac

- Marg

- Ribbie

- Zuke

If you get stumped, give us a call.

Weekly Focus – Think About It

“Language is the road map of a culture. It tells you where its people come from and where they are going.”

–Rita Mae Brown, American author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

http://www.sca.isr.umich.edu

https://www.aaii.com/sentimentsurvey

https://www.barrons.com/articles/the-dow-gains-238-points-tariffs-be-damned-1536973652?mod=hp_highlight_6

https://www.aaii.com/journal/article3/is-the-aaii-sentiment-survey-a-contrarian-indicator

https://www.merriam-webster.com/words-at-play/new-words-in-the-dictionary-march-2018

https://www.merriam-webster.com/dictionary/wordy

https://www.merriam-webster.com/dictionary/TL%3BDR

https://www.merriam-webster.com/dictionary/chiweenie

https://www.merriam-webster.com/dictionary/schnoodle

https://www.merriam-webster.com/dictionary/Yorkie-poo

https://www.redlinels.com/text-message-language/

https://www.merriam-webster.com/words-at-play/new-words-in-the-dictionary-september-2018

https://www.ef.edu/blog/language/17-language-quotes-to-turbocharge-your-learning/