ZombiesThey’ll eat you alive!Failure to Rebalance - Zombie Sign #1When was the last time you rebalanced your 401(k) or other retirement account? When you set it up, you took a fairly conservative approach and bought 60% stock mutual funds and 40% bond...

Market Commentary – March 25, 2019

Wonder what the Federal Reserve’s 40-yard dash time is?

On Wednesday, the Fed juked like an NFL running back and left investors wondering whether they should buy or sell. Heather Long of The Washington Post reported the U.S. central bank:

- Lowered its 2019 estimate for U.S. economic growth to 2.1 percent

- Announced its intention not to raise rates in 2019

- Indicated it will stop shrinking its balance sheet in September

Fed Chair Jerome Powell explained, “My colleagues and I have one overarching goal: to sustain the economic expansion with a strong job market and stable prices for the benefit of the American people. The U.S. economy is in a good place and we will continue to use our monetary policy tools to keep it there…We continue to expect that the American economy will grow at solid pace in 2019, although slower than the very strong pace of 2018.”

The Fed’s decision to adopt a looser monetary policy was informed by a variety of factors, including slower economic growth in the United States, China, and Europe, as well as unresolved policy issues like Brexit and ongoing trade negotiations.

Investors weren’t sure what to make of the Fed’s moves. Initially, major U.S. stock indices trended higher as investors celebrated the benefits of accommodative monetary policy. By the end of the week, though, many investors had changed their minds and fled to ‘safe haven’ investments, pushing long-term Treasury rates lower. Alexandra Scaggs of Barron’s reported: “When short-term yields rise above long-term yields, it’s known as an inverted yield curve, which is seen even by central bankers as a sign that an economic contraction could be on the way…Benchmark 10-year Treasuries rallied Friday morning, driving their yields below those of the three-month U.S. Treasury.”

So, is recession imminent in the United States? It’s possible but unlikely. According to a source cited by Barron’s, the last six times the yield curve inverted for 10 days or longer, recession occurred within the next two years.

No matter how the economy and/or markets perform, it may not be a good idea to make sudden portfolio changes. If you’re feeling uncertain, give us a call. We can discuss changes you may want to make to your portfolio.

Scandinavia sweeps again. The 2019 United Nation’s World Happiness Report was published last week. The Finns remain the happiest people in the world. In fact, happiness in Finland has been trending higher since 2014.

People in Denmark and Norway also are happier than they were previously. The average score for the Danes increased by more than the average score for the Norwegians, so Denmark is now second and Norway third.

The report’s authors explained, “…the top countries tend to have high values for most of the key variables that have been found to support well-being: income, healthy life expectancy, social support, freedom, trust, and generosity.”

The 10 happiest countries in the world, according to the report, which aggregated data on 156 countries from Gallup World Polls, are:

- Finland (7.769)

- Denmark (7.600)

- Norway (7.554)

- Iceland (7.494)

- Netherlands (7.488)

- Switzerland (7.480)

- Sweden (7.343)

- New Zealand (7.307)

- Canada (7.278)

- Austria (7.246)

Since the report began, happiness has increased most dramatically in Benin (#102), Nicaragua (#45), Bulgaria (#97), Latvia (#53), and Togo (#139).

The United States came in at #19. Overall, happiness levels in the U.S. have declined by almost 0.5 since the report was first issued. The report stated: “Several credible explanations have been posited to explain the decline in happiness among adult Americans, including declines in social capital and social support (Sachs, 2017) and increases in obesity and substance abuse (Sachs, 2018)…I suggest another, complementary explanation: that Americans are less happy due to fundamental shifts in how they spend their leisure time…the way adolescents socialize has fundamentally shifted, moving toward online activities and away from face-to-face social interaction.”

Weekly Focus – Think About It

“The human race has only one really effective weapon and that is laughter.”

–Mark Twain, American author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

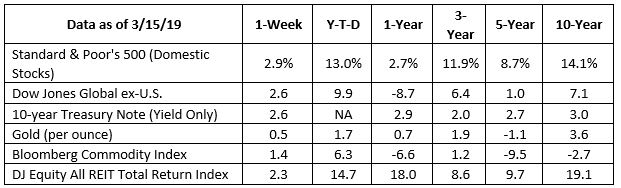

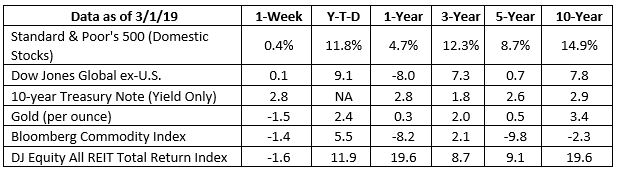

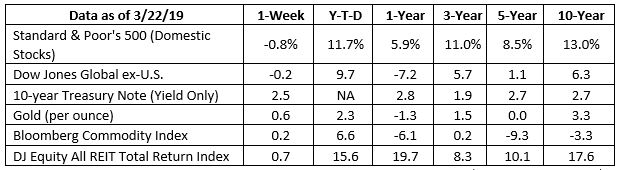

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Forgotten 401Ks

Navigating Bear Market 17 & Covid19 Webinar

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio > This Webinar zeroes in on Technical Analysis and Active Management—two strategies that protect your assets in times of trouble. Our equity...

Six Steps To Financial Independence For Women

Financial independence: Whether you enjoy it or dream about it, it’s a common term that you’ve probably seen in magazine ads, TV commercials and billboards. But what really does financial independence mean, exactly?Read more>>

Active Portfolio Management – How We Do It!

Research Financial Strategies specializes in providing financial advice using a proprietary investment methodology that leverages technical analysis to identify and protect our clients against stock market risk. Research Financial Strategies provides our...

Don’t Be Deceived By Mutual Funds

Best Mutual Funds? Since the bull market run started 10 years ago, how many mutual funds would you guess outperformed the stock market? If you are thinking 500, 200 or even 20, you are very wrong. In fact, not one single mutual fund has beaten the market...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.washingtonpost.com/business/2019/03/20/federal-reserve-cuts-growth-forecast-predicts-no-more-rate-hikes/?utm_term=.3ead92852b27

https://www.federalreserve.gov/newsevents.htm (Video timestamp 0:15 to 3:00 minutes)

https://finance.yahoo.com/quote/^DJI?p=^DJI&.tsrc=fin-srch (5-day chart or historical pricing)

https://finance.yahoo.com/quote/^IXIC?p=^IXIC (5-day chart or historical pricing)

https://finance.yahoo.com/quote/%5EGSPC?p=%5EGSPC (5-day chart or historical pricing)

https://www.barrons.com/articles/the-yield-curve-just-inverted-that-doesnt-mean-sell-stocks-51553267161?mod=hp_BRIEF&mod=article_inline (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/03-25-19_Barrons-The_Yield_Curve_Just_Inverterted-Thats_Not_as_Scary_as_You_Think-Footnote_6.pdf)

https://s3.amazonaws.com/happiness-report/2019/WHR19.pdf (Pages 22-27, 34-37, and 88-89)

https://www.goodreads.com/search?page=5&q=twain&search%5Bsource%5D=goodreads&search_type=quotes&tab=quotes