No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing well.

The Treasury Department has announced that it is dropping the penny. Officials say the last new pennies will enter circulation in 2026.

Long term—and we’re talking many, many years—don’t expect there to be much difference with your “small change.” After all, there are 114 billion pennies in circulation today. That means roughly 900 for each of the 128 million families in the U.S.

Why the change? Cost, mostly. It costs 3.7 cents to make a penny. Which means the nickel could be next. It costs about 13.8 cents to make those.

“No More Pennies Could Spark Higher Inflation,” read one of my favorite headlines when the Treasury announced the news.

Some inflation hawks concluded that businesses will start to “round up” prices immediately, putting upward pressure on costs. But that seems like a hasty conclusion. When you dig into the details, you see that nearly 70 percent of in-store payments occur with credit or debit cards. Another big chunk utilizes digital wallets. So, not many retailers are handing back coins to customers.

In fact, I went to a baseball game last week, and the ballpark proudly boasted, “It’s a cashless venue.” Each concession only accepts cards or digital wallets for payment.

If anyone should be upset about this penny business, it’s Abraham Lincoln. He’s no longer going to be on a coin and a bill. That club now includes only two presidents!

Sources:

CNBC.com, May 22, 2025. “Get ready to round up: Treasury set to halt penny production”

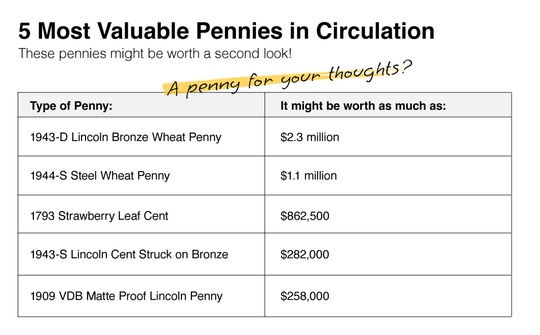

Finance.Yahoo.com, March 29, 2025. “10 of the Most Valuable Pennies”

USMint.gov, 2025. “Coins – Penny”

Capitaloneshopping.com, May 27, 2025. “Cash vs Credit Card Spending Statistics”

MLB.com, 2025. “Information Guides”