Market Commentary – December 10, 2018

We’re off to a slow start.

December is usually the best month of the year for the stock market. It has been since 1950, according to Randall Forsyth of Barron’s, but not so far this year.

Two issues made investors particularly uncomfortable last week which helped trigger a sell-off that pushed major U.S. stock indices lower.

- Fading optimism about an easing of trade tensions with China. It looked like the relationship between the United States and China might thaw, and Americans were feeling pretty optimistic about a trade truce. In fact, markets moved higher Monday in anticipation.

Unfortunately, on the same day that Presidents Trump and Xi Jinping shared a cordial dinner, the chief financial officer of a major Chinese telecommunications firm was arrested at the request of the United States. The Economist reported, “[The company] is a pillar of the Chinese economy – and Ms. Meng is the founder’s daughter. The fate of the trade talks could hinge on her encounter with the law.”

- A section of the yield curve inverted. Normally, Treasury yields are higher for longer maturities of bonds than for shorter maturities of bonds. Last week, yields on three-year and five-year bonds inverted, meaning yields for three-year bonds were higher than those for five-year bonds. Ben Levisohn of Barron’s explained:

“Usually when people talk about an inversion, they’re talking about the difference between two-year and 10-year Treasuries, or three-month and 10-year Treasuries, which have been useful, though not perfect, predictors of recessions and bear markets. Last week, though, everyone was talking about the three-year and the five-year Treasury inverting – something that usually doesn’t get much notice…And for good reason.”

Historically, these maturities have inverted seven times. In one instance, the country was already in recession. On the other six occasions, recession didn’t occur for more than two years. Barron’s reported the Standard & Poor’s 500 Index gained an average of 20 percent over the 24-month periods following these inversions.

Investors’ negative response to last week’s news may have been overdone. Financial Times reported European and Asian markets firmed up a bit Friday “…as buyers stepped back in after some savage falls on Thursday.”

About time and money.

Elizabeth Dunn, associate psychology professor at the University of British Columbia in Vancouver, Canada, and Michael Norton, associate marketing professor at Harvard Business School, have been studying whether people should spend money differently. Their goal is to figure out how to get the most happiness for the dollars spent. In Happy Money: The Science of Happier Spending, they explained their experiments: “…We started doling out money to strangers. But there was a catch: rather than letting them spend it however they wanted, we made them spend it how we wanted…changing the way people spent their money altered their happiness over the course of the day. And we saw this effect even when people spent as little as $5…Shifting from buying stuff to buying experiences, and from spending on yourself to spending on others, can have a dramatic impact on happiness.”

In addition, buying time can improve happiness. How do you buy time? By paying someone else to do tasks you don’t like to do – cleaning, grocery shopping, home maintenance, and other tasks. This can relieve time pressure and free up time to do what you really want to do – and that can make you happier.

The authors suggest individuals ask a simple question before making any purchase: How will this purchase change the way I use my time? Make sure the answer aligns with the goal of having an abundance of time.

Weekly Focus – Think About It

“Happiness is when what you think, what you say, and what you do are in harmony.”

–Mahatma Gandhi, Leader of Indian independence movement

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

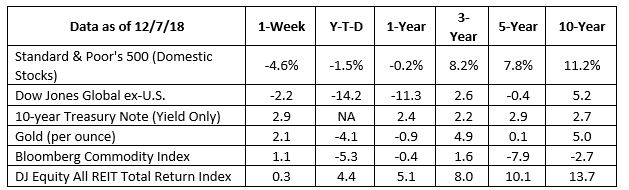

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/the-latest-jobs-report-will-tie-the-feds-hands-next-year-1544208693?mod=hp_DAY_1 (

https://www.economist.com/finance-and-economics/2018/12/08/a-trade-truce-between-america-and-china-is-over-as-soon-as-it-began

https://www.barrons.com/articles/dow-drops-4-5-but-the-market-is-probably-overreacting-1544234320?mod=hp_DAY_6

https://www.ft.com/content/2cda1c8a-f9be-11e8-8b7c-6fa24bd5409c

https://www.simonandschuster.com/books/Happy-Money/Elizabeth-Dunn/9781451665079

https://www.brainyquote.com/quotes/mahatma_gandhi_105593