No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Whether you own a house or rent an apartment, building a smart home is easier than it has ever been. Homeowners and renters can purchase kits that integrate specific smart items or they can select smart home products, such as light bulbs, crockpots, coffee makers, thermostats, vacuums, ovens, doorbells, mailboxes, window shades, and security cameras. After downloading the appropriate apps, anyone can connect everything together through a Wi-Fi network.1, 2

Smart digital assistants (SDAs) are the handy commanders of the smart home. Analysts estimated, by the end of 2018, SDAs would be active in almost one-half of American homes.3

These devices won’t take down the holiday decorations, but they will instruct the dishwasher to wash the dishes, tell the sound system what you want to hear, and inform the smart feeder it’s time for Fido’s supper. If you’re a road warrior, you can connect your automobile. If you work long hours, you can connect your office, too.4

Here’s the thing.

While smart homes offer tremendous convenience – and can be a lot of fun – they also have the potential to make Americans vulnerable to cybercrime. According to research published by ScienceDirect, security experts anticipate smart homes will become targets for cybercriminals because they are easy to infiltrate.5 For example, hackers could:

Just about everything in a smart home can be hacked, and criminals try all the time. Norton reported, “At times of peak activity, the average IoT [Internet of Things] device was attacked once every two minutes, according to the 2017 Internet Security Threat Report, published by Symantec.”6

Securing your smart home

When building a smart home, it’s critical to look beyond cutting-edge gadgetry and give serious thought to system security. Here are six tips for securing your smart home:

Build a strong foundation. Your router is the front door to your smart home and it should be solid and equipped with strong locks – it is your smart home’s foundational item. It connects all of your devices to the Internet. When you move money from one account to another using a home computer or smartphone, the data flows through your router. When you stream shows and movies, this data also flows through your router. You can’t afford to ignore it.6 The first thing to do is make sure your router is encrypting data. Norton suggests selecting Wi-Fi Protected Access 2 (WPA2) to protect your data. Choose a router that supports WPA2, and then take a few extra minutes to set it up.6

Consumer Reports suggested several steps that can help keep data private. First, ensure your router software is up-to-date. Second, choose strong passwords. Typically, routers will have two passwords, one to control the router’s settings and a second one to provide access to smart devices. Third, turn off any router features you don’t use.4

Set your network to private. Smart devices have default settings. Some devices default to optimize privacy and security, others do not. Instead of assuming manufacturers have your best interests in mind, review the privacy settings for devices as you connect them.6

Choose 2FA. If the app for your smart device offers two-factor authentication (2FA), use it. In order to make changes, you will have to log in and then confirm your log in by entering a code that’s sent via text or email. If you get a code and didn’t try to log in, you know someone is trying to access your system.6

Give guests a network of their own. If you have a smart home, Norton suggests setting up a separate network for visitors. You cannot be certain whether someone else’s devices are secure. By having guests log on to a separate network, you protect your home and connected devices.6

Upgrade your devices. You probably won’t be passing smart devices from one generation of the family to the next. In fact, you shouldn’t.6

Prepare for a power outage. Many smart devices work when the power goes out. Make sure you know which of yours will and which won’t. For example, did your smart thermostat or smart door lock come with regular or rechargeable batteries or some other type of backup?8

It’s particularly important to understand how your home security system will respond. Systems that rely on Voice-over-Internet-Protocol (VoIP) and the Internet must have online connections or they don’t work. Your security cameras may also have issues during power outages, although a battery bank backup could solve the problem, according to MakeUseOf.com.8

Don’t let the excitement of building a smart home cause you to lose sight of the importance of home security. When your household devices communicate with one another, keeping your data safe presents a whole new set of challenges.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Sources:

1 https://www.the-ambient.com/reviews/best-smart-kitchen-devices-469

2 https://arstechnica.com/gadgets/2016/08/the-connected-renter-how-to-make-your-apartment-smarter/

3 https://www.marketwatch.com/story/nearly-half-of-us-homes-will-have-a-smart-speaker-by-years-end-adobe-says-2018-09-10

4 https://www.ecnmag.com/article/2018/08/connected-cars-key-smart-homes-future

5 https://www.sciencedirect.com/science/article/pii/S1877050915030318?via%3Dihub (or go to https://s3-us-west-2.amazonaws.com/peakcontent/Peak+Documents/Feb_2019_ScienceDirect-Cyber_Security_Challenges_within_the_Connected_Home_Ecosystem_Futures-Footnote_5.pdf)

6 https://us.norton.com/internetsecurity-iot-smart-home-security-core.html

7 https://www.marketwatch.com/story/7-ways-to-keep-your-smart-home-from-being-hacked-2016-10-17

8 https://www.makeuseof.com/tag/power-outages-smart-home/

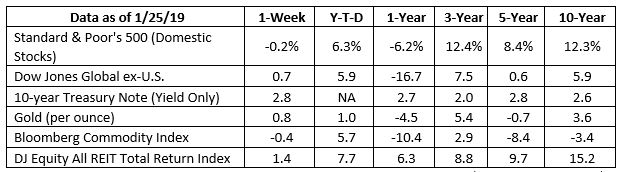

Like competitors who’ve completed a difficult section in an endurance race, U.S. stock investors took a breather last week.

The Standard & Poor’s 500 Index, which has gotten off to its best start since 1987, ended the week with a slight loss, while the Dow Jones Industrial Average and Nasdaq Composite finished slightly higher, reported Ben Levisohn of Barron’s.

News the U.S. government shutdown would end, albeit temporarily, appeared to be of little interest to investors. Barron’s suggested the markets’ muted response to the government reopening was in balance with its response to the shutdown – there wasn’t much of one. In fact, the S&P 500 has gained 10 percent since the federal government closed.

Despite apparent disinterest, the shutdown could negatively affect sentiment, according to Sam Fleming and Brooke Fox of Financial Times. They reported:

“The record-breaking US government shutdown is triggering ripple effects across the US economy and risks denting confidence among companies that have already been fretting about trade disputes and stock market turbulence. Shutdowns have historically had only fleeting economic effects, but Jay Powell, the Federal Reserve chairman, warned last week that a dispute that outlasts past impasses could begin to change the picture for the worse.”

Last week, stock investors weren’t all that impressed by earnings, either. Earnings indicate how profitable companies were in the previous quarter. At the end of last week, 22 percent of companies in the S&P 500 had reported earnings and, overall, they were 3 percent above estimates, according to John Butters at FactSet.

However, indications the Federal Reserve may decide to keep more Treasuries on its balance sheet than originally anticipated gave U.S. stocks a boost late in the week, reported Nick Timiraos of The Wall Street Journal. The Fed began shrinking its balance sheet in 2017 by letting Treasury and mortgage bonds mature. We’ll know more after this week’s Fed meeting.

What is going on across the pond? Last November, BBC commentator Chris Mason reflected the frustration of a nation with his report on the rapidly approaching deadline for the British exit from the European Union (EU). He said: “So, where are we in all of this Brexit process…people like me are paid, aren’t we, to have insights and foresights and hindsight about these things, to be able to project where we’re going to go. To be quite honest, looking at things right now, I haven’t got the foggiest idea what is going to happen in the coming weeks. Is the prime minister going to get a deal with the EU? Dunno. Is she going to be able to get it through the Commons? Don’t know about that, either.”

The report went viral. Since then, we’ve gotten some answers. The Prime Minister did indeed negotiate a deal with the EU and, on January 15, the British Parliament soundly rejected it. Heather Stewart of The Guardian reported it was, “…the heaviest parliamentary defeat of any British prime minister in the democratic era.”

The lack of an agreement in combination with a looming Brexit deadline – it’s just 9 weeks out – has created tremendous uncertainty about the future of British trade with the EU. One response has been stockpiling goods. Last week, Sarah Butler of The Guardian reported three-fourths of warehouse space in the United Kingdom is at capacity.

One intrepid entrepreneur has been marketing Brexit survival kits that provide 30 days of food rations for £295 ($380). Reuters reported the kit includes, “…60 portions of freeze-dried British favorites: Chicken Tikka, Chili Con Carne, Macaroni Cheese and Chicken Fajitas, 48 portions of dried mince and chicken, firelighter liquid, and an emergency water filter.”

As they say, necessity is the mother of invention.

Weekly Focus – Think About It

“Courage is like – it’s a habitus, a habit, a virtue: you get it by courageous acts. It’s like you learn to swim by swimming. You learn courage by couraging.”

–Marie M. Daly, Chemist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/the-s-p-500-goes-nowhere-after-its-big-runup-51548462969?mod=hp_DAY_8

https://www.ft.com/content/b4970904-1907-11e9-9e64-d150b3105d21

https://insight.factset.com/earnings-season-update-january-25-2019

https://www.wsj.com/articles/fed-officials-weigh-earlier-than-expected-end-to-bond-portfolio-runoff-11548412201

https://www.washingtonpost.com/world/2018/11/14/bbc-reporter-replaced-his-brexit-analysis-with-exasperated-noises-now-hes-hero/?utm_term=.d696c195120b (Watch brief video)

https://www.theguardian.com/politics/2019/jan/15/theresa-may-loses-brexit-deal-vote-by-majority-of-230

https://www.theguardian.com/politics/2019/jan/21/uk-warehouse-space-nears-capacity-firms-stockpile-for-brexit

https://www.reuters.com/article/us-britain-eu-boxes/brexit-survival-kit-helps-britons-face-the-worst-with-freeze-dried-fajita-idUSKCN1PG1G4

https://femaleentrepreneurs.institute/15-amazing-female-scientists/

We’re off to a good start.

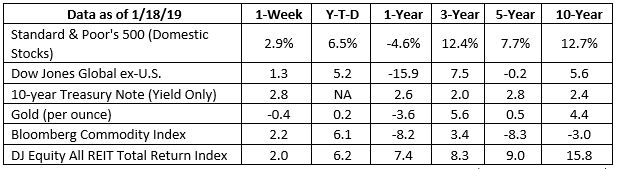

Investors who remained steady during December’s wild ride are probably pleased with their decision as stocks have gotten off to a strong start in 2019. Unfortunately, those who reduced their exposure to the asset class may be feeling the sting of missed opportunity.

Last week, the Dow Jones Industrial Average gained about 3 percent. The Index is up 5.9 percent year-to-date, which is its best start in more than a decade, according to Ben Levisohn of Barron’s. The Standard & Poor’s 500 Index (S&P 500) and NASDAQ Composite also moved higher last week.

Barron’s reported investors were encouraged by positive news about trade talks between the United States and China, as well as stronger-than-expected fourth quarter earnings. Eleven percent of S&P 500 companies have reported so far and, altogether, their earnings have beaten expectations by 3.2 percent, according to FactSet. (Quarterly earnings indicate how profitable a company was during the period being reported.)

The FTSE All-World Index also moved higher last week. It is up almost 8.5 percent for the year.

Richard Henderson, Emma Dunkley, and Robin Wigglesworth of Financial Times offered the opinion investors could have been overly pessimistic during December, and their change in attitude might be attributed to a more dovish tone at the U.S. Federal Reserve, as well as evidence the U.S. economy remains strong.

While investor confidence appears to be strengthening, consumer confidence wavered. The University of Michigan Survey of Consumers showed consumer confidence was lower in January 2019 than it was in January 2018. The Survey’s Chief Economist Richard Curtin wrote, “The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies.”

How much would those burgers cost in britain? Purchasing power parity, or PPP, is a straightforward idea with a tongue twister of a name. When two countries have PPP, people pay the same amount for the same goods, after adjusting for the exchange rate. For example, if one British pound is worth 50 U.S. cents, then an item that costs one British pound in the United Kingdom should cost 50 cents in the United States.

The Economist developed ‘The Big Mac Index’ to measure burger parity. It’s an engaging way to look at local prices and exchange rates. The index measures the price of the seven-ingredient, double-decker burger in different countries and offers a rough estimate of whether a country’s currency is overvalued or undervalued relative to the U.S. dollar.

In January 2019, the index served up the news that almost every currency, in developed and emerging economies, is undervalued relative to the U.S. dollar. The only countries with currencies that appear to be overvalued are Switzerland, Norway, and Sweden.

So, how undervalued are other countries’ currencies?

The Economist explained, “It is not unusual for emerging-market currencies to look weak in our index. But, today the dollar towers over rich and poor alike. The pound, for example, looked reasonably priced five years ago. Today, Americans visiting Britain will find that [burgers] are 27 percent cheaper than at home.”

The U.S. dollar is stronger than usual because higher interest rates and tax cuts made American assets more attractive to investors than other assets in 2018, reported The Economist.

A strong dollar is a boon to travelers, who get more for their money in other countries. It also can make imports from other countries more attractive price-wise. There are disadvantages to a strong dollar, too. For example, it makes the United States a more expensive destination for travelers from other countries, which could discourage tourism. In addition, a strong dollar makes exports more expensive and that could make U.S. goods less competitive in overseas markets.

Weekly Focus – Think About It

“Wealth begins in a tight roof that keeps the rain and wind out; in a good pump that yields you plenty of sweet water; in two suits of clothes, so to change your dress when you are wet; in dry sticks to burn; in a good double-wick lamp; and three meals; in a horse, or a locomotive, to cross the land; in a boat to cross the sea; in tools to work with; in books to read; and so, in giving, on all sides, by tools and auxiliaries, the greatest possible extension to our powers, as if it added feet, and hands, and eyes, and blood, length to the day, and knowledge, and good-will.”

–Ralph Waldo Emerson, American writer

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-gains-3-for-its-best-start-since-1997-51547857364?mod=hp_DAY_10

https://insight.factset.com/earnings-season-update-january-18-2019

https://www.investopedia.com/terms/e/earnings.asp

https://www.ft.com/content/e5e72cbc-157b-11e9-a581-4ff78404524e

http://www.sca.isr.umich.edu

https://www.economist.com/news/2019/01/10/the-big-mac-index

https://www.economist.com/graphic-detail/2019/01/12/the-big-mac-index-shows-currencies-are-very-cheap-against-the-dollar

https://www.investopedia.com/articles/forex/051415/pros-cons-strong-dollar.asp

https://emersoncentral.com/texts/the-conduct-of-life/wealth/

Risk Management

There are more financial advisors than ever before in the US. The most important difference is whether they have an independent and unaffiliated custodian. We do. The investment advisor initiates transactions as part of its portfolio management responsibility. The custodian then clears transactions as part of its safekeeping responsibility. The custodian has no investment authority (unless assigned for overnight excess cash balance sweep management). They serve to provide an audit trail of all the activity within a client’s investment account. We partner with Schwab as our custodian. They manage over $3.5 trillion in assets, have online account access and reporting and some of the strongest credit ratings in the industry.

Over the last several years and even decades, there have been periods of time when all asset classes are under negative pressure and cash is your best investment choice. Although the financial implications of bear markets can vary, typically, bear markets are marked by a 20% downturn or more in stock prices over at least a two-month time frame. Some bear markets have suffered a 40-60% decline in stock prices and have taken many years after to recover losses. In those instances where downside risks significantly outweigh upside potential, we have often chosen to sell investment positions and move to safer cash equivalents.

Using ETFs (Exchange Traded Funds) with very low trading costs has made that defensive play cost-effective for families seeking to preserve wealth. Plus, ETFs can be sold at any time during the trading day, whereas mutual funds can only be sold at the end of the day.

The oldest law of economics is supply and demand. At Research Financial Strategies, we place a premium on when to make an investment decision based on price movements using technical analysis. Technical analysis is an emotionless investment decision making process. It does not allow for getting caught up in the company or industry story. Investments are made through a series of technical factors.

The most notable factor is one called relative strength. When a security price shows a recognizable pattern of higher highs and higher lows, it demonstrates that there is higher demand than supply for that security. Given that reality, we continually evaluate the current market environment to take advantage of opportunistic investments being presented. Research Financial Strategies has the unique capability to create unlimited customized asset allocation blends for our diverse client base.

Our ability to minimize portfolio risk for our clients is a result of having a Sell-Side Discipline. Prior to investing in a security, we establish an exit point based on the % of loss or price our investment advisors determine is acceptable. If the security price is violated, then it is sold. This ensures that profits are protected for our clients. Or worst case, risk to principal is minimized. Only through having an investment approach that has a pre-determined exit strategy for each investment position, can you mitigate portfolio risk during market corrections.

For many clients, allocating a portion of their assets to a strategy that has limited the downside risk is critical to achieving their investment objectives. However, there is no free lunch in investing or in life. There are numerous financial institutions pitching an array of products that are often not suitable to the client’s needs. Some are just loaded with fees. As independent advisors, we help our clients sift through the noise to find the right solution that works within their larger financial plan.

We invest in ETFs ( Exchange Traded Funds) and bonds funds that provide daily liquidity. Our firm is built on the belief that clients should have access to their money when they want it! And these investments allow us to quickly make decisions to help protect your assets should the stock market start to rapidly decline.

Our focus is on your life and priorities. Not just your portfolio. That’s why we start by listening and learning about you. Each individual client has different needs and concerns that need to be addressed. We carefully listen to those concerns and we will gain important information that will help us to best serve our clients and help protect their financial futures.

People love rules of thumb.

Sometimes, mental shortcuts are helpful. Other times they are not. When it comes to investing, seasonal shortcuts are not uncommon. In fact, January boasts two:

The January Effect explains why U.S. smaller company stocks tend to outperform the market in January. The original theory held that tax-loss harvesting pushed stock prices lower in December, making shares more attractive to investors in January. An article published in International Journal of Financial Research explained the effect could also owe something to the optimism that accompanies a new year, as well as year-end cash windfalls.

In his book, A Random Walk Down Wall Street, Burton Malkiel described the January Effect this way, “…the effect is not dependable in each year. In other words, the January ‘loose change’ costs too much to pick up, and in some years it turns out to be a mirage.”

The January Barometer suggests the performance of stocks during the first month of the year offers insight to the direction of stocks for the year as a whole.

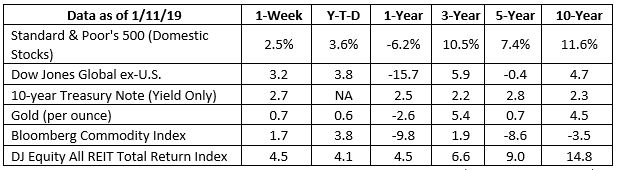

Last week, the Standard & Poor’s 500 Index (S&P 500) was up 2.5 percent. If the Index finishes this month higher, then the January Barometer suggests it should finish the year in positive territory.

Of course, you need look no further than 2018 to see the January Barometer is not completely accurate. In January 2018, the S&P 500 gained 5.6 percent, and it finished the year in negative territory.

According to Fidelity, the theory is flawed because, while stocks move higher for the year a significant percentage of the time after gaining value in January, they also move higher for the year a significant percentage of the time after losing value in January.

This is why mental shortcuts are often poor investment guides.

There is one rule of thumb investors may want to consider adopting: A well-allocated and diversified portfolio that aligns with long-term financial aspirations to help meet goals along with periodic reviews with their financial professional.

Oh, What A Year! Every year brings unexpected events. Here are a few remarkable stories you may have missed in 2018:

Abuzz in NYC

“…a menacing horde of honeybees descended on a hot dog vendor’s umbrella, bringing Times Square to a standstill and drawing swarms of gawking tourists. After a brief flurry of excitement, the buzzing interlopers were apprehended by a police officer armed with a vacuum cleaner-like device that sucked them up. The bees were then whisked away to safety.”

–Reuters, December 17, 2018

Mostly indivisible

“There’s a new behemoth in the ongoing search for ever-larger prime numbers – and it’s nearly 25 million digits long. A prime is a number that can be divided only by two whole numbers: itself and 1… We would write the number out for you, but it would fill up thousands of pages, give or take…”

–NPR, December 21, 2018

Hoop dreams

“Basketball is apparently being embraced by North Korea as a fundamental part of its ideology…‘Promoting basketball is not only a sports-related matter, but an important project that upholds the objectives of the [Workers] Party,’ the North Korean paper reportedly stated. ‘We must rush to elevate the sport to global levels.’”

–NPR, December 21, 2018

None for you

“A California court ruled…in a case involving a Celebes crested macaque who took a selfie using a nature photographer’s camera…the court rejected a lawsuit filed on the monkey’s behalf by People for the Ethical Treatment of Animals, which argued the primate was the legal owner of all photos he took. In a decision that likely left the plaintiffs crestfallen, the court ruled that monkeys cannot sue for copyright protection.”

–Reuters, December 17, 2018

We hope 2019 brings you good health, good humor, and great happiness.

Weekly Focus – Think About It

“As we navigate our lives, we normally allow ourselves to be guided by impressions and feelings, and the confidence we have in our intuitive beliefs and preferences is usually justified. But not always. We are often confident even when we are wrong, and an objective observer is more likely to detect our errors than we are.”

–Daniel Kahneman, psychologist and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of the The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.researchgate.net/publication/321495311_Does_the_January_Effect_Still_Exists Page 51

Burton Malkiel, ‘A Random Walk Down Wall Street,’ W.W. Norton & Company, Page 271, January 1, 2019

https://www.investopedia.com/terms/j/januarybarometer.asp

https://www.fidelity.com/viewpoints/active-investor/january-barometer

https://www.cnbc.com/2018/12/31/stock-market-wall-street-stocks-eye-us-china-trade-talks.html

https://www.fidelity.co.uk/markets-insights/daily-insight/what-the-january-effect-really-tells-us

https://www.reuters.com/article/us-usa-oddly/bees-brothels-and-monkey-selfies-oh-my-2018-abuzz-with-odd-u-s-stories-idUSKBN1OG213

https://www.npr.org/2018/12/21/679207604/the-world-has-a-new-largest-known-prime-number

https://www.npr.org/2018/12/21/679291823/north-korea-promotes-basketball-as-an-important-project

Daniel Kahneman, ‘Thinking, Fast and Slow,’ Farrar, Straus and Giroux, Page 4, April 2, 2013