Inflation and Other Hot Topics

When Your Dollar Shrinks

The best of financial planners must consider what happens to investors when their dollar begins to shrink. They planned on spending a certain amount per month in retirement, for example, but … oops … the prices of gasoline and Cheerios went through the roof. If a set amount of dollars buys less, then the only solution is to increase the number of dollars available. Otherwise, the quality of life shrinks along with the U.S. dollar.

How to increase the number of dollars available? How to give yourself a raise?

Well, that’s what we’re here to do for you, our client. And we remain proud of, and steadfast in, that duty, especially these days when inflationary trends are sounding the alarm.

The Federal Reserve Beige Book

According to the Fed’s Beige Book, the recovering U.S. economy is grappling with significant labor shortages and higher prices for consumer goods.

The Outlook

The Federal Reserve’s latest deep dive on the economy confirmed the obvious: U.S. economic growth is picking up steam, but the recovery is being restrained by widespread shortages of labor and supplies.

While the economy has made a lot of progress, Fed Chairman Powell said on Wednesday that it still needs a lot of support from the Fed. He pointed to the millions of people currently out of work.

The Big Picture

The economy has plenty of momentum. Coronavirus cases are low, most government restrictions have been lifted, and Americans are spending plenty of money. Indeed, consumer spending accounts for about 70% of U.S. economic activity.

“The U.S. economy strengthened further from late May to early July, displaying moderate to robust growth,” the Beige Book said.

Cars and Trucks

In 2020, sales of used light vehicles in the United States came to around 39.3 million units. In the same year, approximately 14 million new light trucks and automobiles were sold here.

Currently, about 280 million vehicles operate on the streets of America. an increase of about 1.6 percent over the past year. The rising demand for vehicles means that used vehicle inventories are declining. The impact on prices is not surprising. Just last month, in June alone, the prices of used cars increased 10.5%. In the same month, new car prices rose 2.2%.

Construction

The construction industry in the United States accounts for 3.36% on the country’s GDP. According to economic forecasts, construction in the United States will grow about 15.6% and amass a value of $1.515 trillion in 2021.

Although the construction and building materials industry in the United States has been facing challenges in the recent past that have slowed down its short-term growth, the medium and long-term growth in the industry is projected to remain relatively constant and positive. The expected compound annual growth rate will be 4.7% from the year 2021 to 2025. Moreover, the construction output for the US construction and building materials industry is projected to be as high as $1.819 trillion until the year 2025.

The Pandemic and the Building Industry

As the COVID pandemic has brought about a huge increase in outdoor renovation and construction projects, the demand for construction materials is also expected to rise. Consequently, the prices of construction and building materials have risen accordingly. The norm of social distancing during the pandemic has shifted people’s behavior from relaxing and entertaining visitors indoors to outdoors in patios, fire pits, and outdoor kitchens. Tents are in, ballrooms are out.

Even though construction activities have gained importance as the quarantine and lockdowns have lifted, the industry suffered significantly during the peak of the pandemic due to the weakened economy, disturbances in the supply chain, and delays in schedules. Contractors and construction workers suffered, too, as the lockdown required that they remain in their houses for months on end. Accordingly, the demand for building materials fell drastically.

Lumber

Lumber prices turned negative for the year as demand cooled after a red-hot rally.[1] Lumber futures fell 5.6% on Monday, taking it 0.6% below where it started the year. Home improvement demand has dropped, while suppliers have raised production.

Lumber prices have dropped into negative territory for the year after two months of dramatic falls, as the home improvement boom cools and producers increase supply to meet demand.

On Monday, lumber futures for September delivery fell 5.6% to $712.90 per thousand board feet, Bloomberg data showed. The fall took prices 0.6% below where they started the year.

Lumber soared in the first few months of 2021 as Americans stuck at home due to the pandemic renovated their houses and a booming property market added to demand. Prices peaked at more than $1,730 per thousand board feet in May as suppliers struggled to keep up.

But since the May peak, prices have plunged almost 60%. Analysts have said that the loosening of coronavirus restrictions has caused consumers to spend less on home improvements such as new yard decking and more on services like dining out, getting haircuts, and even going to the movies.

The Housing Market Inflates

An inflation storm is coming for the U.S. housing market. Fast-rising housing costs have helped cause the largest increase in inflation since 2008. But the way that government statisticians track the price of consumer goods may be missing just how explosive home-price growth really has been in recent months.

The cost of shelter rose by 0.5% between May and June, according to the latest edition of the monthly consumer price index released Tuesday by the Bureau of Labor Statistics. Compared with last year, however, shelter costs were up 2.6%.

Altogether, the rise in housing prices accounted for roughly a fifth of the overall increase in inflation in June, a reflection of how heavily government economists weight this spending category.

But much of that increase was actually driven by the rising cost of hotels and motel stays, which are factored into the overall shelter figure. Between May and June, the cost of a hotel room increased nearly 8%. Comparatively, housing costs for renters and homeowners rose 0.2% and 0.3% respectively, per the government’s inflation measure.

The latest edition of the consumer price index indicated housing prices have risen 2.6% over the past year, while other reports suggest home prices are up more than 13%.

In 2021, buyers are driving up home prices and homes sell quickly. Some hyperactive buyers make offers without seeing the property and forego contingencies to win bidding wars in the highly competitive housing market. The record-low mortgage rates have really sparked the increase in demand, especially among millennials. And they are encountering a shrinking supply of available homes.

The housing market is still far from normal, with inventories down over 38% year over year and at historic lows. The current supply of homes on the market registers an all-time low, dating back to the turn of the century. Due to a lack of supply and decreasing interest rates or borrowing costs, home prices have continued to rise in double digits. With the recovering economy, more buyers are entering the market. And because of the still-limited supply of housing inventory, home prices continue to rise.

With increased supply, home price growth will gradually moderate, but a broad price decline appears unlikely. The housing market will continue to attract buyers as a result of the drop in mortgage rates, which have fallen below 3%, as well as an increase in new listings. According to Realtor.com’s Hottest Housing Markets data, as of June 29, the most improved metros over the previous year were Tampa-St. Petersburg-Clearwater, Fla.; Detroit-Warren-Dearborn, Mich.; Nashville-Davidson-Murfreesboro-Franklin, Tenn.; Riverside-San Bernardino-Ontario, Calif.; and Jacksonville, Fla.

· The median existing-home price in May was $350,300, up a record 23.6% from May 2020.

· Supply shortages are holding new home sales back.

· New home sales fell 5.9% in May from April, to 769,000.

· The median sales price of new houses sold in May 2021 was $374,400, up 2.5% from April and 18.1% year-over-year.

According to the latest data from the National Association of Realtors, existing-home sales in May declined 0.9% from a month before a seasonally-adjusted annual rate of 5.80 million from April’s rate of 5.85 million. The 0.9% setback in existing home sales in May was the fourth straight monthly decline. Only one major U.S. region experienced a gain in sales month-over-month, while the other three saw sales fall. Each of the four regions, however, saw double-digit year-over-year growth.

Although housing sales were up 44.6 percent year on year (4.01 million in May 2020), the comparison is heavily skewed because the housing market was effectively shut down for two months at the start of the pandemic. Last summer, the market recovered and remained strong for the rest of the year. In May 2021, the median existing-home price for all housing types was $350,300, up 23.6 percent from last May ($283,500), with price increases in every region.

This is a record high and marks 111 straight months of year-over-year gains since March 2012. The inventory of homes for sale remained relatively low. At the current sales pace, it would take 2.5 months to sell through available inventory—a slight increase from 2.4 months in April, but significantly lower than the 4.6 months of supply at this time last year.

The National Association of Realtors released research earlier this month from the Rosen Consulting Group, estimating that between 5.5 million and 6.8 million new houses are needed to meet the demand. “Home sales fell moderately in May and are now approaching pre-pandemic activity,” said Lawrence Yun, NAR’s chief economist.

Pending Home Sales Rebounded Strongly in May

According to the National Association of Realtors, pending home sales reached their highest level in May since 2005, with gains recorded in all four U.S. regions both month-over-month and year-over-year. Pending home sales increased by 8% in May compared to April and were up 13.1% year on year. Home sales activity had dropped at the same time last year due to the onset of the COVID-19 pandemic.

A pending sale status indicates that the seller accepted an offer from a prospective buyer but that the transaction has not yet closed. Many sellers will prefer to wait for the best and highest offer. Pending home contracts are viewed as a forward-looking indicator of the housing market’s health because they become sales one to two months later.

Existing Housing Sales in May

According to data from the National Association of Realtors:

· In the Northeast, existing home sales decreased 1.4% in May, but the annual rate of 720,000 represents a 46.9% jump from a year ago.

· The median price in the Northeast was $384,300, up 17.1% from May 2020.

· Midwest existing home sales rose 1.6% to an annual rate of 1,310,000 in May, a 27.2% increase from a year ago.

· The median price in the Midwest was $268,500, an 18.1% increase from May 2020.

· In the South, existing-home sales declined 0.4%, posting an annual rate of 2,590,000 in May, up 47.2% from the same time one year ago.

· The median price in the South was $299,400, a 22.6% jump from one year ago.

· In the West, existing home sales fell 4.1%, recording an annual rate of 1,180,000 in May, a 61.6% climb from a year ago.

· The median price in the West was $505,600, up 24.3% from May 2020.

New Residential Home Sales

Buyer demand for new homes remains strong, and builders in most markets have little trouble selling the homes they have built. However, supply constraints limit the number of homes they can build and eventually sell, and the sales volume they can comfortably take on without exposing themselves to additional price risks is somewhat limited. Still, new home sales have risen during the pandemic. Those sales allow builders to raise prices.

Buyer traffic is converting into sales at a record rate. Residential construction ended in 2020 on a strong note. Housing starts rose 5.8% to 1.67 million annualized units in December. Total starts were 2.8% higher than a year ago. The demand remains strong as the prime buying season begins to heat up. Sales of new single-family homes in the United States fell to a one-year low in May 2021, as the median price of newly built houses rose due to high raw material costs, including framing lumber.

New home sales decreased 5.9% in May to a seasonally adjusted annual pace of 769,000, down from an upwardly revised April rate of 817,000, according to estimates released jointly by the U.S. Census Bureau and the Department of Housing and Urban Development. Higher building costs, longer delivery times, and general unpredictability in the construction supply chain are now having measurable impacts on new home prices. The median sales price of new houses sold in May 2021 was $374,400.

The average sales price was $430,600. The seasonally‐adjusted estimate of new houses for sale at the end of May was 330,000. This represents a supply of 5.1 months at the current sales rate. The median sales price of new houses jumped 18.1% from a year earlier to $374,400 in May. The average sales price was $435,400. The seasonally adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.

Because new house sales are recorded when contracts are signed, they are considered a leading housing market indicator. The decrease in new housing sales suggests that demand is diminishing. Applications for house loans have declined this year, as have housing market surveys of potential purchasers.

Shoes? Yes, Shoes

The global footwear market is a multi-billion U.S. dollar industry. The United States has the largest footwear market in the world, amounting to over 91 billion U.S. dollars in revenue in 2019. A part of the clothing and apparel industry, the footwear market is comprised of shoes, sneakers, luxury footwear, athletic footwear, and sporting shoes, as well as other related goods. Footwear products are commonly made of leather, textiles, and a range of synthetic materials.

Nike’s share of US footwear market is 17.9%. Pairs of shoes imported into the USA total 2.47 billion. Advertising spent in the US footwear industry totals $12.6 billion.

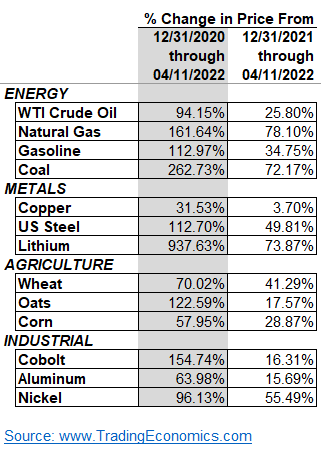

Brace Yourself

We don’t have to look far to see evidence of inflation. And we don’t have to wonder why prices are rising. When the Federal Reserve increases the U.S. money supply at an annual rate of 37%,[2] those dollars have to go somewhere. They go into the stock market, into real estate, into art works, and … into the gasoline for your car and the Cheerios for your breakfast.

When those prices rise, so too must your income.

We keep a constant eye on these developments and recognize our duty of making sure your wealth grows at a rate that will protect your standard of living.

If you’d like to review your assets, please call us at 301-294-7500. We are always happy to answer any questions you have.

[1] https://www.nasdaq.com/market-activity/commodities/lbs

[2] https://mises.org/wire/us-money-supply-was-37-percent-november