When Better Than Today To Start Your Financial Plan

Preparing a game plan is important for any situation you face in life, but even more so when your finances are at stake. A budget now could have a tremendous impact on your financial future, not only for yourself in the coming year but also for generations to come. As soon as possible, it is important to design, develop and implement a financial plan. Think about the amount of time that you spent in researching, booking and mapping out your previous vacations. Was more time spent on planning your vacation or your financial future? I would argue that, in most cases, vacation has always won this battle.

The plan should reflect your current circumstances and address your future needs, wants and wishes. At a minimum, the plan should review your retirement, education funding, estate planning, risk management, asset management and emergency fund strategies. Ultimately, these are all dynamic areas, and simply taking a snapshot of where things stand today will not define your ability to get where you want to be in the future. Some of the most important work that goes into a plan is the reviewing and updating of the plan over time.

If you want to achieve your desired financial future, these are the steps you will need to do:

Establish a budget

When it comes to manage your expenses and savings, a budget is key. Without a budget, it is likely that you will end up spending more than you think and saving less than you should.

Start by keeping a record of all your expenses, writing down even the smallest ones, and compare them to your monthly income. Ask yourself: Were all my purchases necessary? Which can I do without? Then, cut out the superfluous, but leave room to give yourself a whim from time to time. Also, don’t forget about potential unexpected expenses that might occur such as car repair or medical bills.

Set financial goals

You will find it easier to stick to your budget if you have financial goals that are important to you. Split them between short-term goals (buying a new car) and long-term (saving for your children’s college).

Once you have identified your goals, determine a timeline to reach them. That way you’ll know how much to put away each month and what are smart investments.

Then, check your goals occasionally, that way they will always be fresh in your mind. If you get off track a bit, don’t get frustrated or give up. Simply, get back on track and continue working towards your target. Adjustments may have to be made along they way. Life sometimes gets in the way.

Save and invest

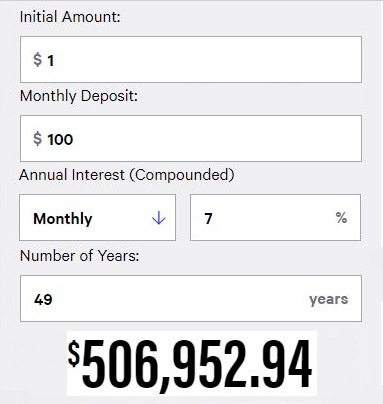

The graphic on the right show the importance of investing over time. If just $25 per week is invested from age 18 to retirement, it could yield a potential $506,000 from $58,800 worth of deposits. This could be exponentially larger if monthly deposit sizes are increased as salary increases over time. This investment graphic assumes the historical return of 7% from the S&P 500.

If you are young, this is the best time to invest, since your money will have more time to grow exponentially. You can start with small amounts of money and take your time. If you withdraw it directly from your salary (paycheck), you probably won’t miss it. Deposits in both retirement plans and investment accounts will pay off over time with the financial security in your retirement years. It is never too late to start.

Saving money is the foundation of all financial success, including investing. Having money saved is what provides the means for you to take advantage of situations, whether it’s going back to college, starting a new business, or buying shares of stock when the market crashes. The saving of money will ultimately provide a foundation and help you answer questions such as, “How much money should I be saving?” and “What is the difference between saving and investing?”

7% annual return is used as an example only

Take out life insurance

Life insurance can prepare you and your family for the unexpected. It can help replace loss of income, help with the mortgage, meet educational needs, or simply leave a legacy for the next generation. Life insurance should be purchased when there is a need to lower or do away with the risk of the insureds death. If you are newly married with no children and no major liabilities to settle, life insurance may not be as important yet. If you are married with a mortgage, student loan debt and young children to educate at some future date, then you may be a candidate for some life insurance. If you die at a young age, how will these obligations be satisfied without life insurance? To further complicate the decision, life insurance gets more expensive as you grow older and gets very expensive if your health deteriorates.

Planning for your child's tuition

Many parents think that they will never be able to save enough to pay for their children’s college education. Fortunately, parents can start saving at any time for college with College Savings Plans. Starting to save for college when the child is young gives the college savings account a chance to grow. Just as with saving for retirement- the earlier, the better!

Read more on College Savings Plans

With an “education first” approach, Research Financial Strategies ensures that our clients understand how their money is being invested, and we guide the development of financial plans that help them achieve their goals for personal wealth and retirement security.

We are here to help!