The Most Common Retirement Mistakes and How to Avoid Them

Taking the time and planning for retirement isn’t just a luxury. It is a necessity. Retirement, as a whole, has become too complex to just randomly select a day and stop showing up to work. And it’s more than complex— retirement will also expensive. It is essential to factor in taxes, expenses, and other spending. There are many ways to pay for it, but which ways are the best ways? How much do you need to save, how should you invest?

Many pre-retirees don’t know the answers to these questions. As a result, there are several common mistakes they tend to make. Each mistake on its own can severely affect your retirement lifestyle. Making several can mean total derailment.

These mistakes are:

1. Failing to have a proper retirement plan.

2. Having improper asset allocation within your investments.

3. Failing to calculate the tax-consequences of retirement.

4. Failing to plan for health-care expenses during retirement.

5. Misusing tax-deferred assets.

6. Failing to maximize social security benefits.

7. Failing to maintain liquidity.

8. Failing to plan for inflation.

9. Not calculating your expected income and expenses during retirement.

10. Falling prey to fraud.

11. You’ll have to get to the end to discover this one.

Take a moment to look at this list. Are there any items that you have not yet planned for? Do you know what tax ramifications to consider after you retire? Are you certain you have maximized your social security benefits? When was the last time you looked at your asset allocation?

If there’s any chance you are making one of the above mistakes, give us a call at Research Financial Strategies – 301-294-7500. We’d be happy to speak with you so we can discuss how to turn potential mistakes into future strengths. In the meantime, here is more information on each one:

Mistake #1: Failing to Have a Proper Retirement Plan

“Failing to plan is planning to fail.”

I’m sure you’ve heard that saying many times before. Most people, when they hear it, nod their heads and think, “Good advice.” But when it comes to their money, are they taking it? Do they have a plan for their finances, or are they, in fact, planning to fail?

There’s a simple way to find out. Go around to different people you know. Mention the quote above. Ask them, “Do you agree with it?” Count how many people nod their heads. Then ask, “Do you have a plan for your finances?” Then stand back and watch how many nods turn to blank stares.

Now it’s your turn: Do you have a plan for your finances?

When it comes to your money—and your retirement especially—failing to plan really is planning to fail. Ask yourself these questions:

Do you know where your income will come from after you retire? Do you know if it will be enough to meet expenses? Furthermore, do you have any idea how much you’ll actually need?

Have you decided what you want to do with your golden years? Have you figured out how you’ll pay for it?

Are your investments suitably liquid so you can meet any unexpected expenses? Do you have a plan for minimizing taxes, both for yourself and your heirs?

Have you planned for what could happen if your health goes bad, or your spouse passes away? Are your retirement accounts protected from inflation?

If the answer to any of these is “No,” don’t feel bad. There’s only one way you could know; by planning. But how do you plan for retirement? Where do you even begin?

Well, you have two basic options. Option #1: fire up Google® and get searching. Of course, you’ll have no way of knowing if the information you get is accurate, or if it’s appropriate for you. And it could take weeks of fruitless searching to find the answer to a question. Many of the articles out there are really just stubs—they give you a few basic points but almost no detail at all. Most are shorter than this letter.

Option #2 is much more promising: actually create a financial plan. A proper plan, when made with the help of a certified financial planner, will help you:

Know how much money you’ll need to meet your expenses and reach your goals.

Know where that money can and should come from. Having a plan can show you how much income you need, how much you should save, and what expenses might need to be cut.

Choose the right investments to provide the income you need, at a suitable, specific level of risk.

Potentially minimize taxes for both yourself and your heirs.

See what areas of your finances are stable and which may need improvement.

Having a financial plan provides peace of mind. It answers questions. But most of all, it’s the instruction manual to assembling your own retirement. Planning ahead, knowing exactly what steps to take and when to take them, is the ultimate tool to success.

Mistake #2: Having Improper Asset Allocation

Improper asset allocation is one of the most common mistakes that a pre-retiree can make. Why is asset allocation so important? Look at it this way: if you were to only eat one food every day for your entire life, your body would be very unhealthy. If you were to exercise only one group of muscles for your entire life, your body as a whole would be very weak. And when you invest all your money in the same way, the same could be true of your finances.

Asset allocation is basically a strategy that spreads your investments across different “asset classes.” The three main classes are equities (stocks), fixed income (bonds), and cash. There are other classes, of course, like commodities and real estate. And there are sub-classes as well. For example, “stocks” can be divided up into many different classes, like international stocks, small, mid, and large-cap stocks, etc.

The thinking behind asset allocation is that by mixing your investments within these different classes, you take on less risk. That’s because if one class goes down in value, the other classes you’ve invested in can compensate.

Here’s an example of why asset allocation is so important. Let’s say that in Year 1, the stock market goes through the roof. So you put all your money into stocks. But in Year 2, the stock market performs poorly. It’s possible you could end up losing a lot of money.

Now let’s say that instead of putting all of your money into stocks, you put 50% into the bond market. When the stock market went down, investors started pouring their money into bonds, causing bond prices to go up. That means that even though your stock holdings decreased in your value, your bond holdings increased, meaning you could still break even or possibly come out ahead.

Of course, this is a very general, very simplified example. I’m certainly not recommending you do anything like that. But hopefully it illustrates the point: putting all your eggs in one basket is rarely a good idea.

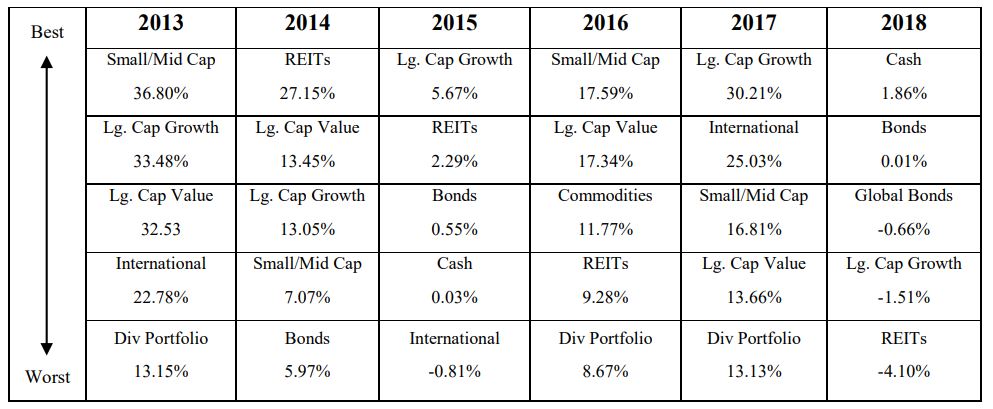

Here’s another reason to believe in the value of asset allocation. Take a look at this chart:

At first glance, this chart might seem incomprehensible, but it’s actually extremely revealing. Stay with me for just a minute, because this will show you why it’s crucial to have proper asset allocation. This chart shows the top-performing asset classes for the past six years. Take a look at the 2013 column. In that year, the best performing asset class was small/mid-cap stocks. That means small and medium-sized companies tended to be a good investment in 2013. The next year, the same class fell to fourth. And in 2015, the class performed so poorly that it doesn’t even show up on this chart. (As a matter of fact, it was -2.90% in 2015.) That might have tempted many investors to bail out, but now look at 2016. Small and mid-cap stocks rose to the top of the table at 17.59%, and did well again in 2017, too. Investors who did bail out missed out on a great opportunity to grow. On the other hand, investors who tried to jump on the small/mid-cap bandwagon got burned in 2018, when the class returned -10.00% for the year.

This is why it’s so important to have a diversified portfolio spread out among numerous asset classes. No one knows what will happen year to year. If you try to time the market, you can end up jumping in at exactly the wrong moment, or bailing out just as things get good again. But by allocating your assets in different areas, you can stabilize your portfolio’s performance. It means you don’t have to ride a constant roller coaster. It means not subjecting your finances to an unhealthy diet.

Now, here’s the most important point. Even if their portfolio is technically diversified, many investors don’t know whether the style of diversification is right for them. Their assets may be allocated in different areas, but are they the correct areas? You see, there’s no magic formula to follow. Proper asset allocation depends on a variety of factors, like your age, goals, ability to take on risk, family situation, and so on. So the question you have to ask yourself is—are your assets properly allocated?

If you are at all uncertain, or would just like a second opinion, please feel free to give us a call at Research Financial Strategies or contact us. We’d be happy to meet with you. Because your time is valuable, here’s my pledge: when we sit down together, my plan is to listen rather than speak. I want to know about you—your goals, your dreams, your needs. What do you want to do with your money? What do you want to protect? It’s my job to learn all these details. Only then will I look to see whether your asset allocation could stand some tweaking.

, but it’s actually extremely revealing. Stay with me for just a minute, because this will show you why it’s crucial to have proper asset allocation. This chart shows the top-performing asset classes for the past six years. Take a look at the 2013 column. In that year, the best performing asset class was small/mid-cap stocks. That means small and medium-sized companies tended to be a good investment in 2013. The next year, the same class fell to fourth. And in 2015, the class performed so poorly that it doesn’t even show up on this chart. (As a matter of fact, it was -2.90% in 2015.) That might have tempted many investors to bail out, but now look at 2016. Small and mid-cap stocks rose to the top of the table at 17.59%, and did well again in 2017, too. Investors who did bail out missed out on a great opportunity to grow. On the other hand, investors who tried to jump on the small/mid-cap bandwagon got burned in 2018, when the class returned -10.00% for the year.

This is why it’s so important to have a diversified portfolio spread out among numerous asset classes. No one knows what will happen year to year. If you try to time the market, you can end up jumping in at exactly the wrong moment, or bailing out just as things get good again. But by allocating your assets in different areas, you can stabilize your portfolio’s performance. It means you don’t have to ride a constant roller coaster. It means not subjecting your finances to an unhealthy diet.

Now, here’s the most important point. Even if their portfolio is technically diversified, many investors don’t know whether the style of diversification is right for them. Their assets may be allocated in different areas, but are they the correct areas? You see, there’s no magic formula to follow. Proper asset allocation depends on a variety of factors, like your age, goals, ability to take on risk, family situation, and so on. So the question you have to ask yourself is—are your assets properly allocated?

If you are at all uncertain, or would just like a second opinion, please feel free to give us a call at Research Financial Strategies or contact us. We’d be happy to meet with you. Because your time is valuable, here’s my pledge: when we sit down together, my plan is to listen rather than speak. I want to know about you—your goals, your dreams, your needs. What do you want to do with your money? What do you want to protect? It’s my job to learn all these details. Only then will I look to see whether your asset allocation could stand some tweaking.

Mistake #3: Failing to Calculate the Tax Consequences of Retirement

Another common mistake is to underestimate the effect of taxes on retirement. Many pre-retirees only think about how much they’ll have to save or invest … not how much they’ll owe Uncle Sam. It’s true that for many people, their tax rates may actually be lower in their retirement years. But there are many retirement decisions to make that can affect your tax situation. Below is a list of some of tax-related issues to think about as you prepare for retirement.

Change in Tax Bracket As stated above, many people will have a change in their tax bracket upon retirement. That’s because their income is lower than when they were working. The benefit of this change, of course, is that you could owe less tax on your income. However, one possible downside is that you may not be able to claim as many deductions.

Some Retirement Savings Qualify as Income When setting aside money for retirement, many people invest in tax-deferred accounts like an IRA or 401(k). These types of accounts allow you to invest your money for retirement without having to pay taxes on it immediately. But this money becomes taxable income the moment you start withdrawing it. When calculating how much money you’ll have for retirement, don’t make the mistake of forgetting to factor in the government’s cut.

Taxes on Social Security Benefits Your Social Security benefits may also count as taxable income. This is a complicated topic, but if you have retirement income in addition to your Social Security benefits, your benefits may be taxable if your combined income is more than a certain amount. Consult with a good Certified Public Accountant to find out more, or feel free to contact my office if you’d like me to put you in touch with one.

Capital Gains and Dividend Taxes A capital gain is an increase in the value of a capital asset, like a stock, that gives it a higher worth than the price for which it was purchased. In other words, if you sell an investment that has risen in value, you have a capital gain. Capital gains are subject to capital gains taxes. The amount is dependent on what kind of asset you sold and how long you held it before selling. The returns you make on your investments can be significantly impacted by capital gains taxes.

The long and short of all this is that many pre-retirees plan for retirement by calculating how much money they’ve saved versus how much they expect to spend. But what they don’t do is consider the tax implications of retirement. Failing to do so can completely alter the equation. You may find out you have less money to retire on than you thought. Again, taxes are a complicated issue. You really have to weigh financial decisions carefully to avoid unpleasant tax consequences. So if you’d like to learn more about the tax implications of retirement, or if you have any specific questions, please feel free to give us a call at Research Financial Strategies. While I do not provide tax advice, I’d be happy to put you in touch with a good tax professional.

Mistake #4: Failing to Plan for Health Care Expenses

What is retirement? Is it a chance for you to travel the world, play with the grandkids, take up that hobby you’ve been putting off, or just relax and read a book? Yes, retirement can be all these things and more. Unfortunately, your retirement years are also when your body starts to slow (and break) down. You may not notice it immediately. Say you retire at 65, full of energy and with no health problems. But in five years? Ten years? Fifteen? By that time, you’ll be eighty. They say age is a state of mind, but it’s also a fact of life, and this fact means inevitable changes to both your health and your pocket book.

There’s no use being anything less than blunt about it. Your medical expenses will go up after retirement and the further into retirement you are, the higher your expenses will likely be. But many pre-retirees fail to plan for these costs. It’s a major mistake that too many pre-retirees make.

Those that do plan often underestimate exactly how much their medical expenses will cost. For example, a 2013 study by Fidelity Investments suggested that 48% of people ages 55 to 65 believe they will need only $50,000 to pay for their health-care costs in retirement.2 But the true number is likely to be much higher than that. According to a more recent Fidelity study, the “average retired couple age 65 in 2018 may need approximately $280,000 saved (after tax) to cover health care expenses in retirement.”3

That’s a lot of money. There are just so many aspects of health care that will have to be covered. Besides medicine, there are regular visits to your doctor, hospital stays, surgeries, long-term care, and more. Hopefully this gives you a little glimpse of how important it is to plan for your medical expenses. But how do you pay for them? The obvious answer is “work longer and retire later,” but let’s delve a little deeper. Here are a few things you can do:

1. Learn your various Medicare options. If you are one of the lucky few who will have employer-provided health care coverage even after retirement, congratulations. But if not, start familiarizing yourself with the intricacies of Medicare now. The Federal government’s health insurance program for seniors is often referred to as a single plan, but in reality, it’s many types of plans rolled into one. From the basic level of coverage (Part A) to “Medicare Medical Insurance” (Part B) which covers outpatient hospital care, physical therapy, and home health care, to the more elaborate “Medicare Advantage” plans, most retirees are confronted with too many options, some of which are more appropriate than others. Choosing the best type of coverage for you will be crucial when it comes to paying for your medical expenses.

- Look at Medigap. Medigap supplemental insurance is sold by private insurance companies and is designed to help pay those costs not covered by Medicare. Medigap isn’t free, and certain criteria must be met before you can purchase it, but it’s definitely a route to consider.

- Invest properly. Your investment portfolio can be an invaluable tool if used wisely. One way to use it wisely is to invest a portion of your money with growth in mind. It’s often thought that growth-oriented portfolios are for younger people, while retirees should trend toward more conservative investments. And while there is some truth to that, it’s important to keep your retirement savings ahead of inflation. Being overly conservative prevents you from being able to do that.

- Consider long-term care insurance. Important disclaimer: not everyone will need long-term care or assisted living in their lives. That said, many people do, and long-term care (LTC) insurance is one of the best ways to pay for it. It can be beneficial to purchase LTC insurance sooner rather than later, as premiums can get higher as you grow older. However, LTC is expensive in and of itself, so give the subject a lot of careful consideration before making a decision.

- Keep your body healthy. I’m a financial advisor, not a doctor or trainer, so I’m not in the business of providing tips on healthy living. But this one is just common sense, and it’s amazing how often it’s overlooked. Keeping yourself healthy now can save you a lot of money in the future. By getting regular exercise, eating a healthy diet, sleeping enough, and quitting smoking (among other things) you can give yourself a better chance of avoiding many of the problems that plague retirees. Conditions like high blood pressure, diabetes, and cancer can extract a high toll on your savings as well as your health. So the single best way to ensure a long, happy, and financially secure retirement is to get your body in as good of condition as possible before you bid bon voyage to employment.

As you can see, paying for health care expenses is a huge part of retirement. As you create your retirement plan, make sure you give the subject all the attention it deserves. Of course, if you have any questions about how to choose the proper Medicare plan, how to invest properly, or whether long-term care insurance is right for you, please feel free to give our office a call at Research Financial Strategies. We would be happy to help you.

Mistake #5: Misusing Tax-Deferred Investments

Tax-deferred investments, to put it simply, are investments that allow your money to accumulate tax-free until you decide to withdraw it, usually after retirement. Withdrawals are then taxed as ordinary income. These types of investments—think traditional IRAs, 401(k)s, and annuities— are a great way to save for retirement, but too many people fall prey to the temptation to plunder them long before they retire. It’s a common mistake, but one that can have major implications on your retirement savings.

First, let’s look at why tax-deferred investments can be a good way to save for retirement. By setting money aside, letting it grow, and deferring taxes, you can potentially have more retirement income after you stop working. This is especially true when you consider that many retirees will enter into a lower tax-bracket than the one they’re in prior to retirement. That means you may be able to have more money for retirement while simultaneously paying less in taxes than you would have if you spent the money immediately after earning it.

Taking withdrawals too early, however, robs your retirement of those extra savings. It can also lead to various penalties. For example, if you make withdrawals from an IRA prior to age 59½, your withdrawals would be subject to a 10% penalty from the IRS in addition to being taxed. There are exceptions. For example, you can withdraw money to pay for certain medical expenses or buy a first home. But most of the time, raiding your retirement cookie jar just isn’t a wise decision.

The point of all this isn’t to recommend you start contributing to a tax-deferred investment today. The point is that if you do currently have tax-deferred investments, resist the urge to tap into them until you’re at or very close to retirement. Give your money the chance to grow until you really need it.

Mistake #6: Failing to Maximize Your Social Security Benefits

Why is this a mistake? After all, you may have heard that Social Security is broken, or that it won’t be around by the time you retire. But the truth is that Social Security is nothing less than a guaranteed stream of income, something no retiree should ever neglect. Even better? There are ways to maximize your Social Security benefits. In other words, you may have the ability to increase your post-retirement income. For these reasons, Social Security should and will play a large part in your retirement plan. Failing to give your Social Security benefits the attention they deserve is basically just a way of denying yourself money for retirement.

To help you avoid this mistake, here are …

Three Ways to Potentially Increase Your Social Security Benefits

- Delay collecting your benefits. Too many people rush to collect their Social Security benefits as soon as they retire. This is sometimes a mistake, especially if you retire early. Technically, you can begin receiving benefits as early as age 62, but if you do so, your benefits will be reduced significantly. For example, if you were born between 1943 and 1954, your payouts would be reduced by 25%. And the reduction isn’t temporary. It’s permanent.

Waiting until your “full retirement age” is probably a better option—it means you won’t face any reduction. What is your “full retirement age?” It’s the age at which a person may first become entitled to “full” or “unreduced” retirement benefits.4 This chart gives you the specifics:

The latest you can begin collecting benefits is at age 70, and there’s good reason to hold off until then if you can afford it. Benefit payments go up 8% for every year you wait after you reach your full retirement age up to age 70. In other words, the longer you can keep your hand out of the cookie jar, the more sweets you’ll eventually receive.

- Claim spousal benefits. This topic is very intricate—too intricate for a single letter. So for now, it’s more important that you simply be aware of your options. Another way to potentially maximize your Social Security is to claim a spousal benefit. Married individuals can claim Social Security based on either their personal earnings record (in other words, their own work history) or on their spouse’s earnings record. If a married individual chooses the latter, they would receive up to 50% of their spouse’s benefit. Why would you choose to claim Social Security based on 50% of your spouse’s earnings record rather than your own? It’s simple: because you can claim whichever number is higher. Be aware, however, that you cannot claim a spousal benefit until your spouse has filed their own claim.

- Claim survivor benefits. Imagine a hypothetical couple, John and Mary. Let’s say that both claimed Social Security based on their own earnings records. Now let’s say that John dies of a heart attack, leaving Mary behind. Under certain circumstances, Mary can file to receive John’s benefit, or increase her own benefit to the same amount that John enjoyed, if John’s number is greater. There are other ways to potentially maximize your Social Security benefits, too. To learn about these, or more about the methods listed here, please feel free to contact our office. We’d be happy to speak with you about your options. Whatever you do, remember: Social Security is a guaranteed stream of income, and should figure highly into your retirement plan. Don’t deny yourself the chance to earn more money for retirement!

Mistake #7: Failing to Maintain Liquidity

When it comes to planning for retirement, few people think about the importance of liquidity. What is liquidity? The definition of liquidity is “the ability to convert an asset to cash quickly.” Technically speaking, cash is the most liquid aspect there is, because it can be used immediately and under almost any circumstance. Other assets have varying degrees of liquidity. Stocks are relatively liquid, since they can usually be sold easily. More tangible objects, like a car or even a prized baseball card, are far less liquid, because it might take longer to find an interested buyer. Items like these might also be harder to sell for their full value. Real estate is one of the least liquid assets of all—ever try selling a house before?

So why is liquidity so important when it comes to retirement? Think of it like this. The basic steps of retirement planning involve the following: first, take stock of your resources. Where will your income come from after retirement, and how much will it be? Then, calculate your expected expenses. If the total of your expected expenses is greater than your expected income, then the solution is simple: try to secure more income. One of the best ways to do that is through investments.

But here’s where some people make a mistake. In the effort to get more income, it can be easy to lock your money up. For example, say you purchase a long-term Certificate of Deposit or an annuity. These could potentially provide you with the income you need, however the payments you receive would be based off a pre-determined schedule. If you wanted access to your money before the schedule allows, you would face a very stiff penalty. Because converting these assets to cash can be difficult and costly, they lack liquidity.

Why does this matter? The main reason is because of the unexpected expenses you will inevitably face after retirement. What if your house is damaged by a storm and needs repairs? What if your car gets stolen? What if you have sudden medical expenses to pay? All those things require cash. You can’t rely on things like Social Security alone, because that will have already been earmarked for your expected expenses. Unexpected expenses are why liquidity is so important. No one can plan for every occurrence. We have to expect the unexpected. It’s why you should always keep a first-aid kit in your car or a flashlight in your house. And it’s why you should always factor in the importance of liquidity when preparing for retirement … even if you have to sacrifice a little bit of income to do it.

Mistake #8: Failing to Plan for Inflation

One word every pre-retiree should know is … INFLATION It’s a scary term that conjures up images of German children stacking useless money, or national governments going broke. But inflation isn’t just a word for economic textbooks. It’s something every retiree and pre-retiree should know. To put it simply, inflation is the rate at which prices for goods and services go up, while the value of currency goes down. For example, let’s say the inflation rate is at 4%. At such a rate, a candy bar that costs $1 will cost $1.04 in a year.

Doesn’t sound like a big deal, does it? Unfortunately, retirement costs a lot more than even the most expensive of candy bars, and it lasts a lot longer, too. As a result, the impact of inflation can hit harder. Here’s another way to look at it:

If you retire at age 65, and inflation remains at 4%, the value of your dollar will decrease by more than half in twenty years. Living until you are 85 has become commonplace nowadays, so this concept isn’t just academic. Here’s one final way to look at the impact of inflation. Let’s imagine that you retire at 65 with $100,000 in annual retirement income. If inflation were to remain at 4%, then the value of your $100,000 would shrink to less than $50,000 in 20 years. In essence, that means you’ll be living on half of your expected income by the age of 85. When you think about all the costs that come with retirement (living expenses, medical expenses, spending on leisure) then the thought of living on half your income should be sobering indeed.

Many retirees make the mistake of forgetting to calculate for inflation when they plan for retirement, but it’s something you have to consider. It’s why sticking all your money into a savings account just isn’t enough. It’s why proper investing is so crucial—it’s the best way for your money to grow in a way that outpaces inflation. Keep in mind that I said proper investing is crucial. There are many ways to invest that, while useful, can also be negatively impacted by inflation. For example, take bonds. When you buy a bond, you basically loan money to an entity (either corporate or governmental) for a specific period of time. During that time, the entity pays you back at a fixed interest rate. When the term has ended, you then receive back the initial amount you invested to do with as you please. Bonds can be a good way to generate consistent income for yourself, but again, you have to factor in inflation. When inflation rises, so too do interest rates. When interest rates rise, the value of bonds decreases. So if inflation rises during the term you hold a bond, then the price of your bond will fall.

Actually, fixed income investments in general can be negatively affected by inflation. As you may know, these types of investments pay a steady stream of money in interest, and then return a predetermined amount to you upon maturity. But with inflation, the value of that money can diminish every year. Let’s say your investment pays out a 5% annual return. But if we stick with same rate of inflation as before, 4%, then your “real” return is only 1%. So while you may have a certain return “on paper,” the “real” return on your investment could be substantially lower than you thought. That makes it much harder to buy the goods and services you need.

The point of all this isn’t to scare you away from bonds, or fixed income investments, or saving for retirement. The point is that inflation should take its place at the top of your list of things to prepare for. If you plan ahead, there are ways to protect yourself from a drop in purchasing power. By truly diversifying your portfolio, you can choose investments that act as “hedges” against inflation…which can make all the difference. You’ve worked hard to earn your money, with the expectation that one day you can retire and truly enjoy it. Don’t fall short of that expectation. You owe it to yourself to see your earnings grow rather than diminish. So if you have questions about how to guard against inflation, or would like to discuss your options, please give us a call. We’d be happy to talk with you.

Mistake #9: Not Calculating Your Expected Income and Expenses

There are a lot of factors to consider when it comes to retiring successfully. But there are two in particular that should be near the top of every list:

Income and Expenses

Why are these two so important? To put it bluntly, it all comes down to this simple rule. You cannot retire successfully unless your income is more than your expenses. It sounds like a no-brainer, and it is. Yet I can’t count the number of people I meet every week who have no idea what their income will be after their retirement…never mind if it will be more than their expenses. These people want to retire, they hope to retire, but they don’t know if they really can.

Of course, there’s more to retiring successfully than just being able to pay the bills. Retirement is all about finally having the time and opportunity to try new things, go new places, and learn new skills. Here again is why income is so important. All those things cost money. So how do you know what you can do after retirement if you don’t know whether you’ll have the money to do it?

This is what you need to do. First, sit down and calculate what your income and expenses are now. Here are some questions you need to answer.

What is your monthly income after taxes?

How much do you pay in monthly utilities?

How much debt do you have, and what are your monthly payments like? Remember, this can include mortgage payments, car payments, credit card payments, etc.

How much do you spend on automobile insurance, home insurance, gas, and other regular expenses? Don’t forget to consider any out-of-pocket medical costs.

Step A: Once you’ve tallied those numbers, subtract your expenses from your income. Whatever number remains is what you have to save for retirement. Now determine what expenses might change after retirement. For example:

What expenses will you have to pay out of pocket that currently come out of your paycheck? An example is health insurance. If you receive health insurance from your employer, your expenses for this could go up after you stop working.

What expenses do you currently have that will decrease after retirement? For instance, if you stop commuting to work on a daily basis, your transportation expenses will probably go down.

What is your current tax bracket? Will it change after you retire and start earning less income? Next comes one of the most important—and hardest—questions to answer.

What will your health care expenses be after retirement?

No one knows what their future health will be like, but as mentioned above, a 2018 study by Fidelity suggests that the “average retired couple age 65 in 2018 may need approximately $280,000 saved (after tax) to cover health care expenses in retirement.”3 Furthermore, the study also suggests that “…the average 65+ year-old retiree should expect to pay around $5,000 a year on health care premiums and out-of-pocket expenses.”3 Of course, those figures could increase if you have any existing health conditions, like diabetes. But whatever your number is, how much of it will you have to pay out of pocket? That’s an important question to consider too, because you may not have the same coverage you did while you were working. Another study suggests that most pre-retirees “severely overestimate the percentage of health care costs covered by Medicare.” 5

Now comes the home stretch. Finish these final steps:

Step B: Take your existing expenses, and then add the amount of expenses that will go up after retirement. Next, subtract the amount of expenses that will go down. Hold on to that number for a moment. Step C: Calculate the amount of income you expect to receive from any retirement accounts you have, like your 401(k), IRA/Roth IRA, etc. Then subtract the tax you’ll owe on these accounts once you start using them. Any withdrawals you make from accounts that were funded with pretax dollars, like a regular IRA, will be taxed as income.

Take the final number from Step C and combine it with the amount you can save from Step A. Then compare it to the number from Step B. Steps A and C combined is your income after retirement. Step B is your expenses. Which number is higher?

Keep in mind that every number you reach from this exercise is just a loose estimate. Too loose, in fact, to make financial decisions by. But at the very least, this should get you thinking.

In the meantime, just remember this fundamental truth: you cannot retire successfully unless your income is more than your expenses. Remember, too, that your income should be enough to cover your wants as well as your needs. So start thinking about it today. It’s a complex topic, but you’ve got plenty of time if you start working on it now. As always, let me know if you have any questions.

Mistake #10: Falling Prey to Fraud

ONE OF THE BIGGEST DANGERS TO YOUR RETIREMENT IS FALLING PREY TO FINANCIAL FRAUD!

You might be thinking, “That’ll never happen to me.” If so, I hope it never will. But don’t we say the same thing about car accidents? About break-ins? About … anything? Yet we still wear our seatbelts when we drive; we still lock our house when we go out. Even if we think these things will never happen, we still take precautions against them. It’s those precautions that actually prevent bad things from happening.

Fraud should be no different. We may think it will never happen, but only by taking precautions can we ensure that it never will. Unfortunately, fraud is a rising problem. According to the Federal Trade Commission, 2.68 million people submitted fraud complaints in 2017, including identity theft, tax fraud, and financial scams.6 Oftentimes, the victims of fraud are seniors or people nearing retirement age. To lose your retirement savings to a scammer can be devastating. Some never recover.

One of the best, subtlest ways that a scammer can target you is through affinity fraud. Affinity fraud is the targeting of specific groups of people with the intention to scam them out of money. The scammer will gain the trust of a group by either being or posing as someone who is just like them. It’s human nature for people to have an easier time trusting those who are similar to them, so scammers make use of this tendency. Their goal will be to convince the group that they can get them much higher returns, or returns with fewer risk, than they could ever earn otherwise. Especially in today’s financial climate, when so many pre-retirees are trying to regain the money they lost in the recession, investors are prone to falling for schemes too good to be true.

Once a scammer has your money, there’s a very good chance you’ll never see it again. A scammer might use your money to create a Ponzi scheme, where older investors are paid off with the money of newer ones. Or the scammer might simply invest your money in vehicles that are unsuitable for you. Either way, the money could get buried in offshore accounts, shell companies, or in a web of confusing paper trails. So how do you protect yourself? The best way is by spotting a scammer before it’s too late. Understanding how affinity fraud works will enable you to do that.

Common Targets of Affinity Fraud

Here are some of the groups scammers like to target:

A particular race or ethnic group. Do you find yourself more trusting of people who belong to your own race? If you do, it’s a sign you might not be as diligent or cautious as you should be.

The elderly. Scammers try to give senior citizens a false sense of security. Or, they may rely on the fact that as we age, our mental acuity often diminishes.

A specific religion. The reason for this is that people will often find it hard to believe a fellow member of their religion could be capable of fraud. They imagine that everyone of their faith has the same morals and values as they do. Unfortunately, many scammers have proven this to be false.5

Companies, professional groups, clubs, etc. Any close-knit community is susceptible. Sometimes, all it takes is one member to be fooled. Once a scammer gets in the door, he can use his existing contacts in the group to convince others. People are more likely to trust a stranger if a friend vouches for them. Besides, no one wants to be left out of what their friends or colleagues are doing. We proved that in grade school.

Ways to Avoid Affinity Fraud

Don’t rely solely on the recommendations of your friends or associates. If anyone approaches you to invest your money, get independent verification of their legitimacy. Additionally, be aware that simply having a website or a business card is not enough.

Don’t allow yourself to be rushed into decisions.

If something sounds too good to be true, then it probably is. Be wary of words like “guaranteed” or “risk-free.”

Watch out for scammers trying to paint themselves as being just like you. This has nothing to do with sound, rational investing. Ultimately, do your research before letting someone else touch your money. Investing your assets is a matter of being smart, prudent, and patient. It’s better to miss out on the perfect opportunity than fall victim to the perfect crime.

Mistake #11: Not Dreaming About All the Amazing Things Retirement Can Be!

This is the last mistake, and while I’m about to have some fun with this one, it’s no less important than all the others. Retirement is about finally having the opportunity to focus on living. It’s no longer about getting ahead in life, but about experiencing life itself. For that reason, retirement should be fun. It should be enlightening. It should be rejuvenating. Above all, retirement should be … whatever it is you want it to be!

However, there are many people who never take the time to dream. They never create their bucket list; never ponder their deepest, sweetest desires. It’s quite possible to spend too much time worrying about how to retire and not enough on why you’re retiring, or what you want to do in retirement. People who make this mistake run the risk of experiencing the worst scenario of all: Boredom. When it comes to retirement, here’s the first thing we at Research Financial Strategies always tell our clients:

“If you want to work for the rest of your life, that’s your business. If you don’t, that’s ours.”

When it comes to retirement, here’s the second thing we always tell our clients:

“If you can dream it, we can help you do it.”

So start today. Close your eyes and dream. Assume for the moment that you’ll have both the money and the time. What do you envision yourself doing? Here are a few suggestions:

You want more? We can help you do more. Like: Create a beautiful garden. Give your spouse a chance at a career. Ski for 100 days a season. Volunteer in the inner-city neighborhood where you grew up. Finally, finally use all of your frequent flyer miles. Create a world that consists of nothing but a hammock, a pitcher of lemonade, and a stack of John Grisham novels. Return to your family’s farm and try to make a go as a farmer. Participate in guided tours of all the ancient wonders of the world. Open your own bed-and-breakfast. Finally get your college degree. Trek to the Himalayas. Visit all 50 states. Start another career. Scuba dive all over the world. Visit every major-league ballpark. Relax. Go on a Safari in Africa. Move to a college town and take all the classes you skipped 40 years ago. Write movie reviews for the local weekly. Climb a 20,000-foot mountain. Rent a barge for a canal tour in Europe. Invest in startup companies. Coach youth soccer, baseball, and basketball. Drive from Alaska to Patagonia. Run the Boston and New York marathons. Play as many of Golf Digests top-100 courses as possible. Play in a garage band. Play bridge for money. Just play! Go on at least three cruises a year. Act in a community theater. Visit all of the churches and museums that you successfully overlooked on your college-semester abroad. Dinner and a movie…every night! Learn to play the piano. Be a couch potato. Fix the sink. Take a trip down the Nile. Read Russian novels. Run for local political office. Do absolutely nothing! Give back to all of those who helped you. Do all of the things you’ve been afraid of— skydiving, bungee jumping and hang gliding. RV along Route 66 with your spouse and your dogs.

Planning for retirement is about more than taxes and investments. It’s about envisioning the life you always wanted to live.

So what are you waiting for? Close your eyes and dream it. We can help you do it.

If you have any questions about the information in this document or would like help with any of the topics discussed, feel free to call us. We’d be happy to help you like we’ve helped so many others. But whatever you decide to do, remember: your retirement is coming up, which means it’s time to start planning. It’s time to start dreaming.

Sources:

1 “20 years of the best and worst,” MFS, accessed February 14, 2019. https://www.mfs.com/wps/FileServerServlet?articleId=templatedata/internet/file/data/sales_tools/mfsvp_20yrsb_fly&servletCom mand=default

2 Shelly Schwartz, “Overlooked health-care costs can destroy retirement planning,” CNBC, November 4, 2013, http://www.cnbc.com/id/101137178

3 “How to plan for rising health care costs,” Fidelity, April 18, 2018. https://www.fidelity.com/viewpoints/personal-finance/planfor-rising-health-care-costs

4 “Retirement Planner: Benefits by Year of Birth,” Social Security Administration, accessed Monday, December 16th, 2013. http://www.socialsecurity.gov/retire2/agereduction.htm

5 Paul Sullivan, “Planning For Retirement? Don’t Forget Health Care Costs,” NY Times, October 5, 2012. http://www.nytimes.com/2012/10/06/your-money/planning-for-retirement-dont-forget-health-carecosts.html?pagewanted=all&_r=0

6 “FTC Releases Annual Summary of Complaints Reported by Consumers,” Federal Trade Commission, March 1, 2018. https://www.ftc.gov/news-events/press-releases/2018/03/ftc-releases-annual-summary-complaints-reported-consumers