Guide on Taking Social Security: 62 vs. 67 vs. 70

Maximize Your Social Security Benefits: A Guide to Claiming Strategies

While you can begin receiving Social Security as early as age 62, delaying your claim can significantly increase your monthly benefits. Understanding the factors that influence this decision is crucial for maximizing your retirement income.

Key Considerations:

- Full Retirement Age: Your full retirement age is determined by your birth year. Claiming benefits before this age results in a permanent reduction in monthly payments.

- Delayed Retirement Credits: For each month you delay claiming beyond your full retirement age, up to age 70, your benefits increase.

- Survivor Benefits: If you’re a surviving spouse or child, you may be eligible for benefits based on the deceased individual’s earnings.

- Tax Implications: A portion of Social Security benefits may be subject to federal income tax, depending on your income level.

Claiming Strategies:

- Early Retirement: If you need to start receiving benefits sooner, consider claiming at age 62. However, be aware of the permanent reduction in monthly payments.

- Full Retirement Age: Claiming at your full retirement age provides the standard benefit amount.

- Delayed Retirement: Delaying your claim beyond your full retirement age can significantly increase your monthly benefits. This strategy is particularly advantageous for those in good health who can afford to postpone their retirement.

Factors to Consider:

- Health: If you have health concerns that may shorten your life expectancy, claiming earlier might be a prudent strategy.

- Financial Situation: Evaluate your financial needs and savings to determine if you can afford to delay claiming.

- Life Expectancy: Consider your expected lifespan to assess the long-term benefits of delaying.

Additional Considerations:

- Future of Social Security: Stay informed about potential changes to the Social Security program that could impact your benefits.

By carefully considering these factors and understanding the available claiming strategies, you can make an informed decision that maximizes your Social Security benefits and helps you achieve a secure retirement.

Would you like to delve deeper into any specific aspect of Social Security benefits or explore other retirement planning strategies?

What’s full retirement age?

You become eligible to receive full Social Security benefits at full retirement age (also known as “normal retirement age”), which depends on your birthday.1 If you were born in 1957 or earlier, you’ve already reached full retirement age. Under current law, if you were born in 1958 or later, your full retirement age can be anywhere between 66 and 8 months and 67 for those born in 1960 and after.

Retirement ages for full Social Security benefits:

Source: SSA.gov

How much will my Social Security benefits be?

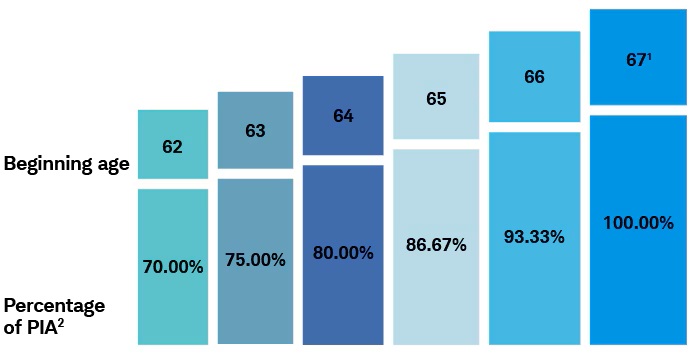

What if I take Social Security benefits early? Age 62 through 67

If you choose to take your own (not your spouse’s) Social Security benefit early, be aware that the payments will be permanently reduced by five-ninths of 1% for each month before your full retirement age. If you start more than 36 months before your full retirement age, the worker benefit decreases further by five-twelfths of 1% per month for the rest of retirement.

For example, if your full retirement age is 67 and you elect to start benefits at age 62, the SSA will calculate your payments based on 60 months—a 20% reduction for the first 36 months (five-ninths of 1% times 36) and another 10% (five-twelfths of 1% times 24) for the remaining 24 months, cutting your monthly Social Security benefits a total of 30%.

Effect of taking retirement benefits early (DOB: January 2, 1960)

Source: SSA.gov

For illustrative purposes only.

1Represents full retirement age based on DOB January 2, 1960

2PIA = The primary insurance amount is the basis for benefits that are paid to an individual.

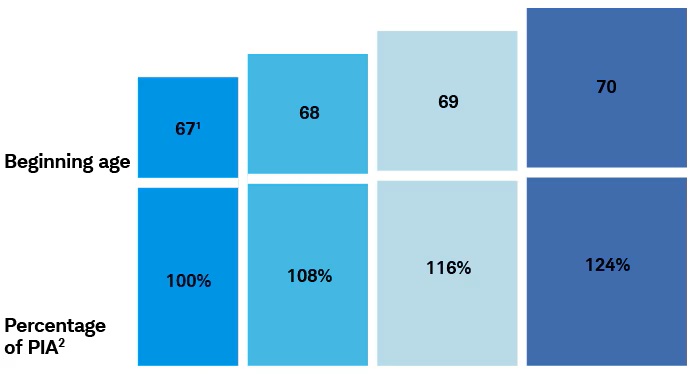

Maximize Your Social Security Benefits: The Power of Delay

If you choose to delay receiving Social Security benefits beyond your full retirement age, you’ll earn “delayed retirement credits” (DRCs). These credits increase your monthly benefit amount permanently.

How DRCs Work:

- Calculation: For each month you delay, up to age 70, you earn an 8% increase in your monthly benefits.

- Lifetime Benefit: The increased benefit amount applies for the rest of your retirement, even if you live well into your 90s.

- Example: If your full retirement age is 67 and you start receiving benefits at 69, you’ll receive a 16% higher benefit amount due to the two years of delayed retirement credits.

Remember: There’s no advantage to delaying benefits beyond age 70.

By strategically delaying your Social Security claim, you can significantly increase your lifetime retirement income.

Effect of delaying retirement benefits (DOB: January 2, 1960)

Source: SSA.gov

For illustrative purposes only.

1Represents full retirement age based on DOB January 2, 1960

2PIA = The primary insurance amount is the basis for benefits that are paid to an individual.

When to Claim Social Security: A Personalized Guide

Deciding when to start receiving Social Security benefits is a significant financial decision influenced by various factors. Here’s a breakdown of key considerations:

Financial Needs:

- Early Retirement: If you have sufficient savings and other income sources, you may have more flexibility in choosing a claiming age.

- Income Dependency: If you rely on Social Security for income, delaying your claim can increase your monthly benefits.

Life Expectancy:

- Early Claiming: While claiming early provides immediate benefits, it results in reduced lifetime payments.

- Delayed Claiming: Delaying your claim increases your monthly benefits, but you receive fewer overall payments.

- Health Considerations: If you have health concerns, claiming earlier might be beneficial.

Marital Status:

- Spousal Benefits: If married, consider your spouse’s age, health, and earnings. The higher-earning spouse may want to delay claiming to maximize survivor benefits.

- Divorced Spouses: If you were married for at least 10 years, you may be eligible for benefits based on your ex-spouse’s earnings.

Employment Status:

- Earnings Limits: If you continue working, your Social Security benefits may be reduced if you earn above certain income thresholds.

- Delayed Claiming: If you’re still working and earning above the income limit, consider delaying your claim until your earnings fall below the threshold.

Strategies for Early Claiming:

- Financial Necessity: If you need the income to meet basic living expenses.

- Poor Health: If you have health concerns that may shorten your life expectancy.

- Maximizing Spousal Benefits: If you’re the lower-earning spouse and your partner plans to delay claiming.

Strategies for Delayed Claiming:

- Maximize Benefits: If you’re in good health and expect to live a long life.

- Reduce Taxable Income: If your income is high, delaying Social Security can help reduce the portion of benefits subject to taxes.

- Protect Survivor Benefits: If you’re the higher-earning spouse, delaying can ensure your surviving spouse receives the maximum survivor benefit.

Remember: Your specific situation is unique. Consulting with a financial advisor can provide personalized guidance and help you make the best decision for your retirement goals.

Social Security and Medicare

Claiming Age and Benefits:

- Early Claiming: While you can claim Social Security as early as 62, this reduces your monthly benefits.

- Delayed Claiming: Delaying your claim up to age 70 increases your monthly benefits significantly.

- Full Retirement Age: Claiming at your full retirement age (determined by your birth year) provides the standard benefit amount.

Tax Implications:

- Combined Income: A portion of Social Security benefits may be subject to income tax based on your combined income, which includes adjusted gross income, nontaxable interest, and half of your benefits.

- Tax Thresholds: As your combined income increases, a larger portion of your benefits becomes taxable.

Changing Your Mind:

- Withdrawal: You can withdraw your Social Security application within 12 months and repay benefits received.

- Restarting Benefits: You can reapply at a later date, but be aware of potential waiting periods.

- Stopping Benefits: After reaching full retirement age, you can voluntarily stop benefits to receive delayed retirement credits.

Survivor Benefits:

- Eligibility: Dependent children and spouses may be eligible for survivor benefits.

- Age Requirements: Eligibility depends on the dependent’s age and relationship to the deceased individual.

Future of Social Security:

- Projected Shortfall: The Social Security Trust Fund is projected to become insolvent in the coming decades.

- Potential Reforms: Congress may need to implement reforms, such as increasing the retirement age or payroll tax, to ensure the program’s solvency.

Key Takeaways:

- Delaying Benefits: If you can afford to, delaying your Social Security claim can significantly increase your lifetime benefits.

- Consider All Factors: Evaluate your financial situation, health, and life expectancy when making claiming decisions.

- Seek Professional Advice: Consulting with a financial advisor can provide personalized guidance and help you make informed choices.

1If your birthday is on the 1st of the month, the SSA determines your full retirement age and benefit as if your birthday were in the previous month (December of the year before if your birthday is on January 1).

2The 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, ssa.gov, 05/07/2024, https://www.ssa.gov/OACT/TR/2024/tr2024.pdf.

GET IN TOUCH

We are dedicated to helping you protect and manage your assets, prepare for retirement and life’s events, and develop a legacy that benefits your loved ones and future generations. As your financial partner, we listen and respond to your needs using clear, simple language. We offer personal service, seek to develop innovative strategies, and pledge to lead you with great care along the path to pursuing your goals.