Retirement Income

Do you…

-

Have a retirement plan in place and have tested it against different scenarios to help ensure you will not run out of money during retirement?

-

Follow the steps necessary to maintain the plan? Flexibility is important.

-

Have investments to create an “income stream” in retirement?

-

Have a tax-optimized distribution strategy that creates the least tax impact during retirement?

Things to consider in retirement financial planning

The first rule of retirement planning is to never run out of money. The second rule is to never forget the first rule.

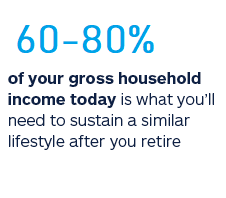

The strategies of a retirement advisor tend to be unique to each individual/couple. A retirement advisor must take into consideration goals, potential future needs and the client’s ability to handle risk. Since you will not be receiving your regular paycheck, you will need to create a consistent, sustainable income stream and at the lowest cost possible. It is also advantageous to make sure that your distribution strategy is tax-optimized to avoid paying unnecessary taxes.

Income diversification

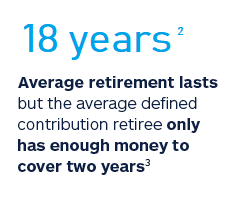

Retirees should have a variety of sources of income, in case one revenue stream dries up. This diversification of income can protect you from outliving your retirement savings. Here are 10 ways to fund your retirement.

Social Security

Almost all Americans will receive monthly payments from the Social Security Administration in retirement, which are guaranteed to keep up with inflation. The longer you wait to sign up between ages 62 and 70, the higher your monthly payments will be.

Retirement accounts

With 401Ks and IRAs, you can defer taxes on your retirement savings and investment earnings until you withdraw the money in retirement. Remember to take required withdrawals each year after age 70½ to avoid a stiff tax penalty.

Roth accounts

Add tax diversity to your portfolio by pre-paying the income tax on some of your retirement savings with a Roth 401(k) or Roth IRA. Contributions to Roth accounts are made with after-tax dollars, and withdrawals after age 59½, including the earnings, are tax-free.

A pension

Although only a small fraction of workers still get them, private-sector pensions are guaranteed by the Pension Benefit Guaranty Corp., a government agency that insures pensions, even if your employer goes bankrupt. Some people create pensions using their own savings, by purchasing an annuity. Find out more about annuities >>

Paid-off house

Owning a home mortgage-free means that you have eliminated one of your biggest monthly expenses. If an emergency crops up later, you may be able to tap the equity in your home using a loan or a reverse mortgage

Health insurance

Health insurance through Medicare and/or a private insurance company is an essential part of any retirement plan. Sign up for Medicare on time to avoid a premium hike for late starters. Also consider purchasing long-term care insurance in case you develop a chronic illness.

Investments

Many healthy individuals can expect to spend several decades in retirement. You may want to keep some of your savings in the stock market in retirement to ensure continued growth in your portfolio and to keep up with inflation.

Bonds

Many bonds may provide a relatively predictable stream of retirement income with limited potential for losses. Some types of bonds, such as Treasury Inflation-Protected Securities, promise a rate of return above inflation

Savings accounts and Money Market Accounts

Many retirees keep one or more years’ worth of living expenses in these conservative accounts, which are backed by the Federal Deposit Insurance Corporation (FDIC). Although interest rates are low, your money will be there when you need it.

Part-time work

Many people continue to work part-time in retirement because they need the money and enjoy their work. Continued employment can make up for a lack of retirement savings, allow you to afford a few retirement luxuries, and provide opportunities to socialize.

Let us help

Speak with a Research Financial Strategies investment advisor to learn how to plan for and provide a monthly income during retirement. We believe anyone can be a successful investor by following some basic principles. But even if you’ve been investing solo for decades, think about whether you might benefit from advice as you begin planning for retirement. During this time, you’ll be making some very important decisions that could make or break your retirement timeline.

1. Social Security Administration — Social Security Basic Facts — 2018

2. As cited in October 2013 HelloWallet White Page — “Debt Savers in Defined Contribution Plans”

3. The Motley Fool — Retirement — What It Will Cost

Address

2273 Research Blvd, Suite 101

Rockville, MD 20850

Phone

(301) 294-7500

info@rfsadvisors.com