The new trade deals are here!

The United States and China signed a preliminary trade deal last week. The next day, the United States-Mexico-Canada Agreement was approved by the Senate.

The phase-one deal between the United States and China has been analyzed, applauded, disparaged, and questioned. Here is a sampling of what’s being said:

“The eight-part deal includes protections for trade secrets and intellectual property, mechanisms for enforceability, and commitments by Beijing to increase purchases of U.S. goods and services by $200 billion over the next two years. It also broadens U.S. companies’ access to China’s markets…”

— Barron’s

“While the deal isn’t insignificant – China has promised $200 billion in purchases…The sweeping U.S. goals to change the way China’s economy functions, from shrinking state-funded industries to strengthening intellectual property laws, are either absent from the deal or described in vague terms.”

— Foreign Policy

“A truly grand pact between the two countries is some way off – and indeed, may never arrive. But this modest trade agreement shows how much the status quo has changed. Tariffs on hundreds of billions of dollars…of imports into both countries remain in place, with an ever-present threat of more. This is not trade peace, but rather a trade truce – and a tense one at that.”

— The Economist

“Moreover, some countries are worried that $200bn of Chinese purchases of US goods that are part of the agreement will enshrine ‘managed trade’ between the world’s two largest economies, possibly flouting market forces, discriminating against their companies and violating WTO commitments.”

— Financial Times

“One aspect that most have not addressed is that this is only a two-year agreement. What happens at the end of the two years is not defined…China has pledged to purchase $36.5 billion in ag products in 2020 and $43.5 billion in 2021. But the issues are no one believes either side will keep up their end of the bargain.”

— AgWeek

Despite a diversity of opinion about the deal, investors were happy. The Dow Jones Industrial Average surpassed 29,000 for the first time and was up 2.8 percent for the year through last Friday, reported Barron’s.

Culinary trends of the 2010s…The way we eat changed during the past 10 years. The Auguste Escoffier School of the Culinary Arts pointed out sales of American cheese have fallen because younger generations prefer artisanal cheeses. Unprocessed cheese isn’t the only food trending last decade.

- Shoot it while it’s hot! Social media has delayed a few meals. More than one-in-four people told Influence.com they had been asked to delay a meal so someone could take a perfect shot to whet followers’ appetites.

- Look at all the rainbows and unicorns. People indulged in rainbow bagels smeared with birthday cake frosting and rainbow grilled cheese sandwiches. If cupcakes, toast, or coffee was sparkly, bright, or shaped – it may have had ‘unicorn’ before its name. Why, you ask? Scientific studies suggest people perceive bright and/or sparkly food to be tastier and less boring than naturally colored food.

- Avocado toast persisted. From simple avocado mashed on crunchy bread to 20-plus ingredient gourmet extravaganzas, avocado toast became a social media sensation. There are even competing origin stories. Was the first avocado (a.k.a. alligator pear) toast created and consumed in Australia? California? Mexico?

- Meatless meat. Vegetables are delicious. They’re versatile, and now they’re masquerading as meat. America has become passionate about plant-based meat products. There is a catch. Vox reported, “…nutritionists who have conducted analyses have largely found that the meatless meat burgers are, well, fine – not any better for you than a beef burger but not worse, with the specific details depending on which health priorities you have.”

What is your favorite food trend from the last decade? Putting an egg on top? Meal kits? Kale? Macarons? Fermentation?

Weekly Focus – Think About It

“There’s a rebel lying deep in my soul. Anytime anybody tells me the trend is such and such, I go the opposite direction. I hate the idea of trends. I hate imitation; I have a reverence for individuality.”

― Clint Eastwood, Actor

Best regards,

John F. Reutemann, Jr., CLU, CFP

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

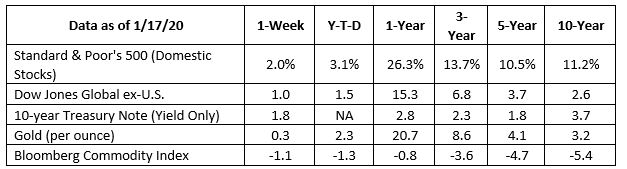

Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend)

and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of

the historical time periods. Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Investment Ponderings from Jack Reutemann

At dinner this past week with a long-time client, I was asked what I thought of Jim Cramer. I kindly said, “He’s a great speaker, entertainer, and educator, but I’m not...

Big Change: No More Pennies

No more passing them by when you see one on the sidewalk. Forget about wasting a couple by putting them in your loafers. And don’t even consider throwing them into a wishing...

This Memorial Day….

Memorial Day is so much more than a long weekend. It is a chance for us to remember those who gave all for this great nation and the freedoms it offers. This Memorial Day,...

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.agriculture.com/news/business/as-senate-passes-usmca-trump-tells-farmers-to-remember-the-trade-war-money

https://www.barrons.com/articles/china-trade-deal-looks-like-a-modest-positive-but-uncertainties-remain-51579303201 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-21-20_Barrons_China_Trade_Deal_Looks_Like_A_Modest_Positive_But_Uncertainties_Remain2.pdf )

https://foreignpolicy.com/2020/01/15/phase-one-us-china-trade-deal-hypothetical-trump-liu-he/

https://www.economist.com/finance-and-economics/2020/01/16/the-new-us-china-trade-deal-marks-an-uneasy-truce (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-21-20_Economist-The_New_US_China_Trade_Deal_Hypothetical_Trump_Lie_He3.pdf )

https://www.ft.com/content/6a6b5548-3877-11ea-a6d3-9a26f8c3cba4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-21-20_FinancialTimes-Content_5.pdf )

https://www.agweek.com/business/markets/4701408-reports-trade-deal-are-let-downs-markets

https://www.barrons.com/articles/the-dow-jones-industrial-average-is-headed-for-30-000-51579311984?mod=hp_HERO (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-21-20_Barrons_The_Dow_Jones_Industrial_Average_Is_Headed_For_30_000_7.pdf )

https://www.escoffier.edu/blog/culinary-arts/a-look-back-at-the-food-trends-of-the-2010s/

https://influence.co/go/content/social-media-etiquette

https://www.eater.com/2016/4/27/11516910/rainbow-food-trend-science-bagels

https://www.nytimes.com/2017/04/19/style/unicorn-food-starbucks.html

https://www.tastecooking.com/really-invented-avocado-toast/

https://food52.com/blog/24876-top-food-trends-2010s

https://www.vox.com/future-perfect/2019/10/7/20880318/meatless-meat-mainstream-backlash-impossible-burger

https://www.goodreads.com/quotes/tag/trends