FINANCIAL INDEPENDENCE FOR WOMEN

Avoid Common Financial Mistakes, Set Realistic Goals, and Overcome ChallengesHow Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Financially dependent on no one: Whether you enjoy it or dream about it, it’s a familiar term that you’ve undoubtedly seen on TV programs and radio and magazine ads. But what really does financial independence mean, exactly? Why is it so important, particularly for women? To put it simply, financial independence means three things:

1. You have control of your own finances. You make your own decisions regarding money instead of relying on someone else to make those decisions for you.

2. You can support yourself financially. Whether it’s through your job, your savings, your investments, or a combination of all three, you can stand on your own two feet. You do not have to rely on financial assistance from the government, family, friends, or credit card companies.

3. You have at least a basic level of knowledge about how to manage your finances so that you can make competent decisions. (Otherwise, you would soon find that having the ability to support yourself, as explained above, would fly right out the window.)

No matter who you are or where you come from, it’s important to achieve financial independence. Why? Because without that independence, everything you want or dream will be much harder to achieve. Because without independence, you can only hope to reach your goals instead of actively working towards them. No one can control what happens to them in life, but people with independence can control how they respond. Those without independence don’t have that ability. They are at the mercy of chance. In other words, financially independent people can make plans for the future. People without independence can only hope the future will be kind to them. All of this is especially true for women. That’s because women face a unique set of challenges—challenges that only financial independence can help overcome.

Financial Challenges for Women

There’s no use beating around the bush: for most of Western history, women have traditionally been treated as if they are subservient to men. A woman’s job was to stay at home, cook, clean, and raise children while men worked, built, or hunted. That fact is still true for many women today. Of course, many women want to focus on homemaking and child-rearing, responsibilities which are as important now as they’ve always been. But whether you are the type of woman who prefers to work in the home or outside it, you may well face a byproduct of this centuries’ old tradition: it’s usually men who manage the money.

For generations, many women have relied on their husbands, boyfriends, or fathers to make financial decisions. This mindset is slowly starting to change as more and more women gain the desire for financial independence. Just as importantly, more and more women are realizing the necessity of financial independence. Why is financial independence a necessity rather than just a luxury? Because of this basic fact:

Whether they want to or not, most women will be forced into managing their own finances at some point in their lives.

Here are a few reasons why:

1. Women have a longer life expectancy than men. Many women who have relied on their husbands or fathers to handle financial decisions will suddenly find the responsibility thrust upon them after their loved ones pass away.

2. According to one study, 37% of women over the age of 65 live alone, either because they are divorced, widowed, or never married. When it comes to managing money, these women usually have no one else to turn to but themselves.

3. Statistics released by the Administration on Aging indicate that the poverty rate for women over 65 is significantly higher than it is for men of similar age.1

If you’re a single woman, the chances are that you’ve already assumed responsibility for your finances … or you will have to very soon. If you’re married, you should prepare yourself for the possibility that one day the burden of managing your money will fall entirely on your shoulders. Either way, think how much better it would be to plan ahead, to act now, to achieve financial independence on your terms rather than wait until you have no choice. By being proactive, your financial independence will become a means to helping you achieve your dreams. By being reactive, financial independence becomes more about trying to deal with unexpected challenges, like getting out of debt, outliving your income, paying for medical expenses, and more.

Women face other unique financial challenges, too. For instance:

1. Too often, women receive less pay than their male counterparts. In addition, women still have to contend with the so-called “glass ceiling;” the unseen, but definitely real barrier between themselves and professional success. This ceiling limits many women’s opportunities for promotion and career advancement.

2. For many women, a good portion of their lives is spent raising children. That means they spend less time actually working and collecting an income. (Not that raising children isn’t work!)

3. Women are often charged with taking care of their elderly relatives, which is a drain on both their time and money.

The result is that many women can’t rely as much on regular work-related income as men can. This means more attention must be spent on things like saving, investing, and tax planning in order to accumulate the wealth you’ll need to be financially independent. As you can see, financial independence isn’t just a buzzword. It’s not just a luxury, either. It’s a necessity. By taking steps to become financially independent now, you can secure your family’s future, enjoy more peace of mind, cut down on expenses, and best of all, make your life exactly what you want it to be.

So what are the steps to financial independence? Read on to find out.

THE SIX STEPS TO FINANCIAL INDEPENDENCE

financially independent single woman

STEP #1: DETERMINE WHAT YOU WANT

It was noted before that a key part of financial independence is being able to make your own decisions regarding your money. But what decisions are those, exactly?

To answer that, ask yourself these questions:

1. What do I most want to accomplish? Experience? See? Learn? What do I need in order to feel fulfilled?

2. What do I value most in my life? What do I want to protect?

3. What can I least afford to lose? What am I most afraid of losing?

4. What needs to happen for me to have peace of mind?

The answers to these questions determine what decisions you need to make. Think of it like taking a road-trip. Before you go anywhere, you first need to decide on a destination. That destination will in turn determine what roads to take, what supplies you’ll need, and how long it will take to get there. So in essence, the first step to financial independence is choosing your own life’s destination.

Choosing a destination can be a surprisingly daunting task. But it can also be a very enjoyable one! Take, for example, the story of John Goddard.

If you’ve ever read the book Chicken Soup for the Soul, you might be familiar with Goddard’s name. (His story was included in the book.) But in case you don’t know who he is, prepare to be amazed. He was the first man in history to explore the entire length of the Nile. Still thirsty for more, he also was the first man to ever explore the length of the Congo. He’s climbed the Matterhorn, lived among native tribes in Brazil, Borneo, and New Guinea (among others), and somehow found the time to learn how to fence, fly a jet, and play the violin. How did he manage to do all these things?

It all started like this. One rainy afternoon, when he was 15 years old, he sat down at his kitchen table and wrote three words:

“My Life List”

His list consisted of 127 goals: Climb Mt. Kilimanjaro, Fuji, and Vesuvius. Visit every country in the world. (He made it to all but 30.) Photograph Victoria Falls in Rhodesia (where he was chased by a warthog). Dive underwater to explore the Great Barrier Reef. Visit everywhere from the Great Wall of China to the Taj Mahal, and 119 other goals in between.

Goddard died in 2013 at the age of 88, but not before completing 111 of the goals on his amazing list. You can see the entire list, and which goals he achieved, by visiting his website at www.johngoddard.info/life_list.htm. Or, just Google his name.

It goes without saying that Goddard is inspiring, but I think he’s a great example as well. While not all of us may “study native medicines,” like he did, or even want to, we all can sit down and decide what we really want in life. This is especially important when planning for retirement. With a little imagination and a little planning, retirement can be whatever you want it to be.

There are two things about Goddard that I think contributed to his success:

• He wrote down his goals and kept that list with him. His original list still exists today. Writing down your goals is important. If it’s just in your head, it’s a fantasy. But if it exists on paper, it’s a plan. You can always have it with you to look at, so at any given moment you can study your list and decide if what you’re doing is really what you want … or if you’re giving up what you want the most for what you only want right now.

• Once he wrote his list, he stuck to it. Often when we set a goal for ourselves, we change it too soon. Maybe that’s because we too often choose goals we think we should achieve, rather than ones we actually care about. Goddard wrote down goals that actually meant something to him. Maybe some were small, or even a bit eccentric (“light a match with a .22 rifle”), but he wrote them down because he wanted them. Not because he needed them. That way, achieving his goals was never work. By determining what it is you want, and by answering the four questions listed above, you can choose your destination and begin the journey toward financial independence.

Next up is to …

STEP #2: TAKE CONTROL OF YOUR CASH FLOW

At this point, you know what you want. For example, maybe what you want most is to retire and not have to work at all. Just as important, you also want to make sure your children (or grandchildren) go to college and secure their own financial future. Finally, you want to know you’ll have the money and protection you need to handle any unexpected expenses or health problems. All worthy goals. And all of them cost money. As previously mentioned, the second key aspect of financial independence is being able to support yourself financially. (Check out the box on your right for a quick refresher of all the components.) To do that, and to actually afford the goals you’ve set for yourself, requires that you first take control of your cash flow.

At this point, you know what you want. For example, maybe what you want most is to retire and not have to work at all. Just as important, you also want to make sure your children (or grandchildren) go to college and secure their own financial future. Finally, you want to know you’ll have the money and protection you need to handle any unexpected expenses or health problems.

All worthy goals. And all of them cost money.

As previously mentioned, the second key aspect of financial independence is being able to support yourself financially. (Check out the box on your right for a quick refresher of all the components.) To do that, and to actually afford the goals you’ve set for yourself, requires that you first take control of your cash flow.

To put it simply, cash flow is the total amount of money you have coming in and going out. It goes without saying, then, (or at least it should go without saying) that if you have more money going out than coming in, you have a problem. You won’t be able to reach your goals and you certainly won’t be financially independent. What you probably will be is in debt.

Sadly, too many people don’t pay attention to their cash flow. But women seeking financial independence can’t make that mistake. There are a number of factors to consider when it comes to controlling your cash flow, but there are two in particular that should be at the top of every list:

Income and Expenses

Why are these two words so important? It all comes down to this simple rule: You cannot be financially independent unless your income is more than your expenses. It sounds like a nobrainer, and it is. Yet I can’t count the number of people I meet every week who have no idea what their income will be after retirement … never mind if it will be more than their expenses. These people want to be independent, but they don’t know if they really can.

Of course, cash flow is about more than just being able to pay the bills. Go back to the answers you wrote down a few minutes ago. Here again is why income is so important. All your goals are likely to cost money! So to control your cash flow, start by calculating your expected income and expenses. Stay with me, because we’re about to do some basic arithmetic. (It’s worth it, I promise you!)

First, sit down and calculate what your income and expenses are right now. To do that, here are some questions you need to answer.

• What is your monthly income after taxes?

• How much do you pay in monthly utilities?

• How much debt do you have, and what are your monthly payments like? Remember, this can include mortgage payments, car payments, credit card payments, etc.

• How much do you spend on automobile insurance, home insurance, gas, and other regular expenses? Don’t forget to consider any out-of-pocket medical costs.

Step A: Once you’ve tallied those numbers, subtract your expenses from your income. Whatever number you get is what you have available to put toward your financial goals. But that’s just your current cash flow. Now let’s look at your expected cash flow. For example, let’s calculate how your expenses are likely to change after retirement. See if you can answer these questions:

• What expenses will you have to pay out of pocket that currently come out of your paycheck? An example is health insurance. If you receive health insurance from your employer, your expenses for this could go up after you stop working.

• What expenses do you currently have that will decrease after retirement? For instance, if you stop commuting to work on a daily basis, your transportation expenses will probably go down.

• What is your current tax bracket? Will it change after you retire and start earning less income?

Next comes one of the most important—and hardest—questions to answer.

• What will your health care expenses be after retirement?

No one knows what their future health will be like, but some research suggests that a 65-year-old couple who retired in 2012 will ultimately end up paying $240,000 in health care costs.2 The study cited assumes that the husband will live 17 years and the wife 20, and have no employer provided health care coverage. That equates to paying a little more than $14,000 a year over 17 years, and $12,000 a year over 20. And that’s for a couple! For single women, of course, paying for health care can be even more difficult.

Of course, those figures could increase if you have any existing health conditions, like diabetes. But whatever your number is, how much of it will you have to pay out of pocket? That’s an important question to consider too, because you may not have the same coverage you did while you were working. Another study suggests that most people “severely overestimate the percentage of health care costs covered by Medicare.” 2

Here comes the home stretch. Finish these final steps:

Step B: Take your existing expenses, then add the amount of expenses that will go up after retirement. Next, subtract the amount of expenses that will go down. Hold on to that number for a moment.

Step C: Calculate the amount of income you expect to receive from any retirement accounts you have, like your 401(k), IRA/Roth IRA, etc. (More on these below.) Then subtract the tax you’ll owe on these accounts once you start using them. Any withdrawals you make from accounts that were funded with pre-tax dollars, like a regular IRA, will be taxed as income.

Take the final number from Step C and combine it with the original amount from Step A. Then compare it to the number from Step B. Steps A and C combined is your income after retirement. Step B is your expenses. Which number is higher?

Keep in mind that every number you reach from this exercise is just a loose estimate. Too loose, in fact, to make financial decisions by. But at the very least, this should get you thinking. By understanding what your cash flow is now, and what it’s likely to be in the future, you will know whether changes need to be made. And that’s what taking control of your cash flow is all about!

The good news is that if you’d like a much more concrete projection of your income and expenses after retirement, all you have to do is give us a call. Helping people take control of their cash flow is one of our specialties. We’d be happy to sit down with you, ask some questions, and prepare a comprehensive estimate.

STEP #3: ELIMINATE DEBT

Back on page 2, I listed the three components of financial independence. Do you remember what the second component was? If you need a refresher, here it is:

You Can Support Yourself Financially

Some people, even those with high paying jobs, can’t support themselves financially … at least, not really. That’s because they’re buried up to their eyeballs in debt. In fact, it’s estimated that “1 in 3 adults are so far behind on some of their debt payments that their account has been put ‘in collections.’”3 To make matters worse, women tend to have more debt than men.4 Why? Once again, it mainly comes down to unequal pay. Just like men, many women take on student loans or mortgages, or spend more than they can afford. Unlike men, they don’t make as much income to pay those debts off. For that reason, ridding yourself of debt is an absolutely crucial step to achieving financial independence. Unfortunately, the topic of debt reduction is so vast that it would take a book to cover it thoroughly. Since this is only a white paper, here are just a few tips to consider:

- The best way to get out of debt is to turn bad habits into good habits.

Put aside terms like “debt consolidation,” “debt settlement,” or even “bankruptcy.” Those things have their place, but the most surefire way of getting—and staying—out of debt is to change the habits that got you into debt in the first place.

The plain and simple truth is that we live in a society that values obtaining material things. Everyone wants the newest gadget, the fanciest car, the biggest home, the fastest motorboat, you name it. Now, there’s nothing wrong with wanting those things … except when our desires take precedence over our needs, or when our reach exceeds our grasp. To make matters worse, people don’t just want things—they want them now. And they’re perfectly willing to pay for them on credit, which in reality is not actually paying at all. It’s borrowing.

Here’s another truth: it’s one thing to get out of debt, but actually staying out of debt is something else entirely. That’s why I said to forget terms like “debt consolidation.” You can consolidate your debt, you can declare bankruptcy, you can even cut up your credit cards, but unless you change your fundamental spending habits, chances are those same habits will eventually get you into debt all over again. Changing your habits is not the quickest way to eliminate debt, and it’s certainly not the easiest. But it is the most permanent.

2. Create a budget by taking control of your cash flow.

Here’s some good news! By doing what we’ve already talked about—taking control of your cash flow—you are in essence killing two birds with one stone. That’s because understanding how much money you have coming in versus how much going out will enable you to create a budget. It doesn’t matter if you’re a poor, starving college student or a wealthy, successful business owner. Creating a budget is always a good idea. Having a budget essentially means that you have a plan for your money. It means you determine exactly how much money to save, how much to spend, and what to spend it on. It means no longer being at the mercy of unexpected events or whims. It gives you control of your own finances … which, if you remember, is the first component of financial independence.

3. Consider the order in which you pay off debts.

Some experts recommend paying off your largest debts first. This makes intuitive sense. After all, your largest debts are your biggest problems, right?

While there’s nothing inherently wrong with that advice, you might want to consider an alternative: paying off your smallest debts first. The reason is that when you focus mainly on your largest debts, the task can seem overwhelming. You can pay and pay and pay and not feel like you’re making a dent. Meanwhile, your smaller debts keep piling up.

By concentrating on your smaller debts first, you can effectively remove more of those little monsters sooner. That means less pressure on you. It means less weight on your shoulders. And it will help you build momentum. Momentum is important, because the energy it creates, and the habit it helps you form, will enable you to better tackle your largest debts. Whatever you choose to do, just remember that eliminating debt is a key road to follow on your journey to financial independence.

STEP #4: EARN, SAVE, AND INVEST

Chances are that even after taking control of your cash flow and ridding yourself of debt, you will still need to focus on building your wealth. This is done through a combination of earning, saving, and investing.

How much you earn, of course, is governed by your job. Again, women face some specific challenges here. Per the Department of Labor, women are more likely to work part-time jobs, be compensated less, or have to quit working altogether to care for family members.5 To overcome these challenges, women need to be very committed to saving and investing … especially when it comes to retirement.

Unfortunately, 59% of women only guess at how much they’ll need for retirement.6 That’s not good, because retirement is expensive. In fact, the Department of Labor estimates that most people need to maintain at least 70% of their pre-retirement income (the income you earn while still working) in order to maintain the same lifestyle. Some people need as high as 90%.7 And that’s just to maintain your lifestyle! You can forget about that Mediterranean cruise or motorhome … unless you get serious about saving and investing.

Here are some tips on proper saving and investing:

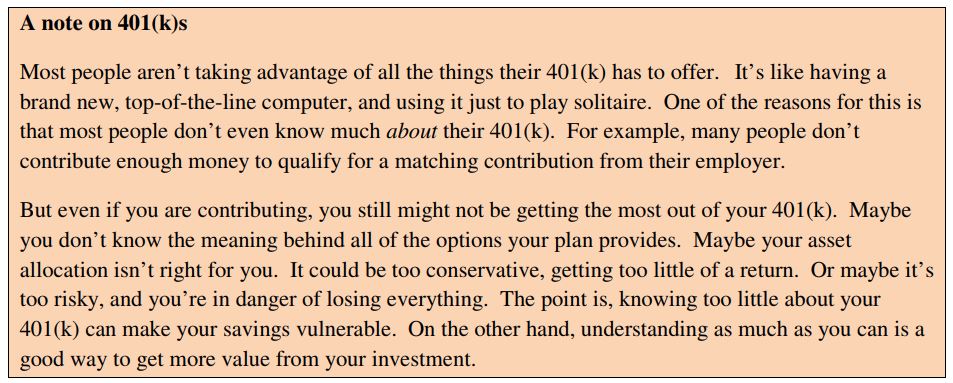

• If your employer offers a retirement plan, like a 401(k), make sure you contribute to it! Also, be sure to contribute as much as the plan allows if possible.

• Many employers will match their employees’ contributions. It’s crucial that you contribute enough to take advantage of any potential matching, because it can dramatically increase your retirement savings.

• If your employer does not offer a retirement savings plan, consider setting up an Individual Retirement Account, or IRA.

• Resist the temptation to prematurely withdraw money out of your retirement savings. For one thing, it will decrease the amount you’ll have available for when you really need it. Even worse, you may have to pay an early withdrawal penalty or lose certain tax benefits.

• Understand the basics of saving and investing, including the different types of investments, and key concepts like inflation, liquidity, risk, and diversification

Liquidity is “the ability to convert an asset to cash quickly.” Technically speaking, cash is the most liquid aspect there is, because it can be used immediately and under almost any circumstance. Other assets have varying degrees of liquidity. Stocks are relatively liquid, since they can usually be sold easily.

More tangible objects like a car or even a prized baseball card are far less liquid, because it might take longer to find an interested buyer. Items like these might also be harder to sell for their full value. Real estate is one of the least liquid assets of all. Ever try selling a house before?

It’s important that a percentage of your assets be fairly liquid so that you will always have the ability to get cash quickly. This enables you to deal with unexpected expenses, like if your car gets stolen, your house gets damaged, or if you start racking up medical bills. If most of your assets are not liquid, you could be stuck with a lot of expenses and no way to pay them, even if you are otherwise wealthy.

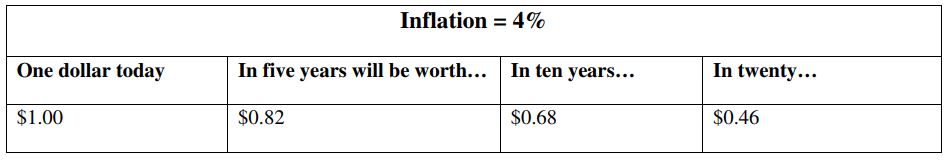

Inflation is the rate at which prices for goods and services go up while the value of currency goes down. For example, let’s say the annual inflation rate is at 4%. At such a rate, a candy bar that costs $1 today will cost $1.04 in a year. Doesn’t sound like a big deal, does it? Unfortunately, retirement costs a lot more than candy bars, and it has to last a lot longer, too. As a result, the impact of inflation can hit harder. Here’s another way to look at it:

So if you retire at age 65, and inflation remains at 4%, the value of your dollar will decrease by more than half in twenty years. Living until you are 85 has become commonplace nowadays, so this concept isn’t just academic. Here’s one final way to look at the impact of inflation. Let’s imagine that you retire at 65 with $100,000 in annual retirement income. If inflation were to remain at 4%, then the value of your $100,000 would shrink to less than $50,000 in 20 years. In essence, that means you’ll be living on half of your expected income by the age of 85. When you think about all the costs that come with retirement (living expenses, medical expenses, spending on leisure) then the thought of living on half your income should be sobering indeed.

Many women make the mistake of forgetting to calculate for inflation when they plan for retirement, but it’s something you absolutely must consider. It’s why sticking all your money into a savings account probably won’t be enough. It’s why proper investing is so crucial—it’s the best way for your money to grow in a way that outpaces inflation.

Risk is “the chance that an investment’s actual return will be different than expected. Risk includes the possibility of losing some or all of the original investment.”8 Every investment comes with some risk. Whether you are buying stock in a company or contributing to a 401(k), risk is involved. What women need to understand is how much risk they can afford. In other words, let’s say you invest $100 in Company ABC. This investment tends to be very stable, and even if you lose most of your money, a $100 loss isn’t a big deal for you. It’s not going to break the bank. Therefore, it isn’t a very risky investment. Next, imagine you invest $10,000 in Company XYZ. This investment’s value often goes up or down without warning … and, in this scenario at least, a $10,000 loss is most certainly a big deal. That means it’s a much riskier investment. Proper investing is all about managing risk. It’s about knowing how much risk you can tolerate and how much you can’t. That way, you can focus on trying to grow your wealth without risking more than you can afford to lose.

Finally, diversification is an investment strategy that spreads your investments across different “asset classes.” The three main classes are equities (stocks), fixed income (bonds), and cash. The thinking behind diversification is that by mixing your investments within these different classes, you take on less risk. That’s because if one class goes down in value, the other classes you’ve invested in can compensate. Proper diversification depends on a variety of factors, like your age, goals, ability to take on risk, family situation, and so on. If you are uncertain, or would like a second opinion, on how to better diversify your investments, please feel free to contact us. We’d be happy to meet with you. When it comes to saving and investing, you don’t need to be an expert to be successful. But it is important that you have at least a basic level of knowledge about how to manage your finances so that you can make competent decisions. (One of the three components of financial independence, if you remember.) Having that basic knowledge will better enable you to earn, save, and invest correctly. This in turn will help you build the wealth you need to reach your financial goals … which in turn means you can support yourself financially. (Another component!) If you have any questions about the basics of saving and investing—and let’s face it, you should have questions—please contact us. Together, we can determine your risk tolerance. We can also determine whether your investments are correctly set up, properly diversified, and calculated to take inflation into account.

STEP #5: ESTATE PLANNING

Estate planning. You’ve probably heard the term before, but what does it mean exactly? Here’s the technical definition: “The collection of preparation tasks that serve to manage an individual’s asset base in the event of their incapacitation or death, including the bequest of assets to heirs and the settlement of estate taxes.” 10 Too complex. I prefer a simpler definition:

Estate planning is a series of predetermined steps designed to help you secure your family’s financial future.

Estate planning is the best way to ensure your loved ones receive their fair share of what you’ve worked so hard to earn. It’s also a critical part of creating your own legacy. Most people want to protect and care for the things they love, but it’s especially important for many women. That’s why most women, even if they were to do everything else mentioned in this guide, don’t feel truly independent until they have both the means and the know-how to secure their family’s long-term future.

Hence, estate planning. The fifth step to financial independence. Now, you may be thinking, “I have a will so I’m all set.” While having a will is a very important part of your estate plan, it’s not the only part. A will doesn’t specify how you want to be treated should your health fail. It doesn’t dictate who will carry out your wishes or handle your financial affairs should you ever become incapacitated. It doesn’t help your heirs limit their tax burden. These are all important issues that estate planning is designed to address. So if these things are important to you, keep reading. To ensure that both you and your loved ones will be cared for, I’ve created a list of four key documents that should be in every estate plan. Creating these documents with the help of a qualified professional is a big part of the estate planning process.

Will

I mentioned that creating your will is a very important aspect of estate planning, so let’s cover that first. A will states how you want your belongings divvied up amongst your loved ones after you pass away. Otherwise, the government will determine how to distribute your property, which may even end up belonging to the state if you don’t have an appropriate will stating otherwise.11

Power of Attorney

Another crucial document is your power of attorney, which allows you to appoint someone to act on your behalf to make legal decisions about your property and finances. That person, usually referred to as an “agent,” could be a trusted friend, a family member, or an experienced, reputable professional. Power of attorney is crucial should you ever become ill or disabled to the point where you can no longer make important decisions yourself. Keep in mind, however, that granting someone power of attorney is a huge decision in and of itself. Give careful thought before making your choice. Whomever you select should be trustworthy, reliable, and mature enough to handle the responsibility.

Advance Medical Directive

A third document is your Advance Medical Directive. This catch-all term refers to health care directives, living wills, health care (medical) powers of attorney, and other personalized directives. All of these documents allow you to legally express your preference for continued health care should you become terminally ill. A word of advice. As you finalize your Advance Medical Directive, make sure you have completed your HIPPA Release Forms as well. By having this special form completed, you enable the individuals named in your Advanced Health Care Directive to have access to your healthcare information. This way, they can deal with insurance matters on your behalf at a time when you cannot.

Letter of Instructions

Last, but not least, is a “Letter of Instructions.” This is a document giving your survivors information about important financial and personal matters to attend to after your passing. You don’t need an attorney to prepare it. Although it doesn’t carry the legal weight of a will, and is in no way a substitute, your Letter of Instructions will clarify any special requests you want carried out after death.12

The four documents listed above are all very important, and every woman should have them in her estate plan. Having each of these important documents prepared ahead of time can relieve your family of needless worry, speculation, and expense. Keep in mind, however, that while this guide is a good overview of some important estate planning documents, it certainly doesn’t cover everything. When it comes to planning for your financial future and those of your loved ones, remember that there are many factors to consider. If you haven’t yet completed the documents described above, or if your circumstances have changed and you haven’t updated your estate plan accordingly, it’s high time to review your plan. Because when it comes to planning, there’s no such thing as starting too early. But there is such a thing as too late. If you have any questions, or need to update your estate plan in any way, please feel free to give me a call. I’d be happy to get you in touch with a great estate planning attorney who can help.

Speaking of help …

STEP #6: GET HELP

Congratulations on making it to the sixth and final step! At this point, I hope it’s clear that financial independence is something every woman should strive for. But no one should have to strive for it alone. The fact is, finances are complicated. There’s so much to know, so much to keep track of. While this guide is enough to give you a head start, it’s impossible to cover all the details and intricacies of financial independence. After all, it takes years of experience for most professionals to master them. That’s why getting professional help is the sixth step to independence. Because let’s face it—if you’re like most people, you have neither the time nor the inclination to spend all day, every day worrying about finances. With the help of a qualified financial advisor, you don’t have to. Then too, take a look at the best athletes, actors, musicians, or even business professionals. Almost all of them work with trainers, coaches, and other experts to improve their chances of success. No matter who we are or what we’re trying to accomplish, we all could stand a little guidance along the way.

Now, I’m not saying that a “qualified financial advisor” has to be me. Of course, I’d love to speak with you and answer any questions you might have about how to become financially independent. But whether we ever work together or not, it’s in your best interest to find a good professional to help you. To put it simply, a financial advisor can help you:

• Know how much money you’ll need to meet your expenses and reach your goals, including how much income you need, how much you should save, and what expenses might need to be cut.

• Choose the right investments to provide the income you need at a suitable level of risk.

• Potentially minimize taxes for both yourself and your heirs.

• Determine which aspects of your financial life are stable and which may need improvement.

• Provide support and guidance during periods of transition or whenever the unexpected happens.

• Answer any questions you may have.

By working with a good financial advisor, and by completing the other steps listed above, you will be able to:

1. Take control of your own finances. You make your own decisions regarding money instead of relying on someone else to make those decisions for you.

2. Support yourself financially. Whether it’s through your job, your savings, your investments, or a combination of all three, you can stand on your own two feet. You do not have to rely on financial assistance from the government, family, friends, or credit card companies.

3. Have at least a basic level of knowledge about how to manage your finances so that you can make competent decisions. (Otherwise, you would soon find that having the ability to support yourself, as explained above, would fly right out the window.)

Put all those things together and what do you have?

FINANCIAL INDEPENDENCE!

To answer any questions you have, and to help you get started on the Six Steps to Financial Independence, we are currently offering a free consultation to women in the Washington, DC metro area. All we’ll do is sit down, have a cup of coffee, and look at your goals and needs. We’ll explain some of the things you’ll need to consider and where to get started. There’s no obligation on your part. If you need further assistance from us, We’d be thrilled to provide it. If not, no matter. We are just happy to help in any way we can! If you want to take us up on my offer, please contact us through the contact form on this website. We’ll set up a time to meet whenever is most convenient for you. Keep in mind that the sooner we meet, the sooner you can start achieving financial independence.

For example, women are seen as more compassionate, thoughtful and open-minded. These qualities can be used to their advantage by making financial decisions that don’t allow them to lose sight of the things they most value. For most women, investing isn’t just about making money.

It’s about being in the position to not only thrive but also to give back — and what that means is different to each person. Some may want time to volunteer, and others may want money to donate.

Women also tend to be more cautious about taking risks, so they invest less aggressively. Using a more consistent investing approach, even if it’s slower, can be ideal and give better long-term results.

- Create a budget.

- Save a specific percentage of income each year.

- Build an emergency savings account.

- Ensure self and future earnings appropriately.

- Invest in a fashion that meets goals and risk tolerance.

Working with a financial advisor can demystify the process. It’s important to work with a financial professional who will take the time to understand their clients’ goals, passions and concerns.

A good advisor will then put those interests first in finding the right way to achieve those goals. A good advisor is proactive, will invoke confidence and motivate, will keep their clients calm through the market’s ups and downs and will shape a financial plan that meets their unique needs.

Remember: almost every woman will have to become financially independent at some point whether they want to or not. By being proactive, you can achieve financial independence on your terms while simultaneously working to achieve your dreams. So don’t waste another minute. Start down the road to financial independence today!

Sources:

1 “A Profile of Older Americans: 2011,” Administration on Aging, November 2011. http://www.aoa.acl.gov/Aging_Statistics/Profile/2011/10.aspx

2 Paul Sullivan, “Planning For Retirement? Don’t Forget Health Care Costs,” NY Times, October 5, 2012. http://www.nytimes.com/2012/10/06/your-money/planning-for-retirement-dont-forget-health-carecosts.html?pagewanted=all&_r=0

3 Jeanne Sahadi, “1 in 3 U.S. adults have debt in collections,” CNN Money, August 7. 2014. http://money.cnn.com/2014/07/29/pf/debt-collections/

4 Bill Fay, “Demographics of Debt”, Debt.org, accessed June 9, 2015. https://www.debt.org/faqs/americans-in-debt/demographics/

5 “Women in the Labor Force,” United States Department of Labor, Women’s Bureau Data & Statistics, accessed July 2015. http://www.dol.gov/wb/stats/stats_data.htm#latest

6 “Fourteen Facts About Women’s Retirement,” TransAmerica Center for Retirement Studies, March 2014. https://www.transamericacenter.org/docs/default-source/resources/women-andretirement/tcrs2014_report_women_and_retirement_14_facts.pdf

7 “Top 10 Ways to Prepare for Retirement,” United States Department of Labor, accessed June 2015. http://www.dol.gov/ebsa/publications/10_ways_to_prepare.html

8 “Definition of ‘Risk’”, Investopedia.com, accessed June 10, 2015. http://www.investopedia.com/terms/r/risk.asp

9 “Women and Retirement Savings,” United States Department of Labor, accessed Jul 2015. http://www.dol.gov/ebsa/publications/women.html

10 “Estate Planning,” Investopedia.com, accessed June 9, 2015. http://www.investopedia.com/terms/e/estateplanning.asp

11 http://www.aarp.org/money/estate-planning/info-06-2009/pond_cornerstone_of_estate_plan.2.html

12 http://www.aarp.org/money/estate-planning/info-06-2009/pond_cornerstone_of_estate_plan.2.html

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

GET IN TOUCH

We are dedicated to helping you protect and manage your assets, prepare for retirement and life’s events, and develop a legacy that benefits your loved ones and future generations. As your financial partner, we listen and respond to your needs using clear, simple language. We offer personal service, seek to develop innovative strategies, and pledge to lead you with great care along the path to pursuing your goals.