Look! Have You Noticed? Listen to any politician or any news commentator these days, and they always begin a discussion or answer a question like this: Look, when I served in the Senate …. Look, as I wrote in my last column …. Look, if the Republicans won’t …. Look,...

Market Commentary – January 22, 2019

We’re off to a good start.

Investors who remained steady during December’s wild ride are probably pleased with their decision as stocks have gotten off to a strong start in 2019. Unfortunately, those who reduced their exposure to the asset class may be feeling the sting of missed opportunity.

Last week, the Dow Jones Industrial Average gained about 3 percent. The Index is up 5.9 percent year-to-date, which is its best start in more than a decade, according to Ben Levisohn of Barron’s. The Standard & Poor’s 500 Index (S&P 500) and NASDAQ Composite also moved higher last week.

Barron’s reported investors were encouraged by positive news about trade talks between the United States and China, as well as stronger-than-expected fourth quarter earnings. Eleven percent of S&P 500 companies have reported so far and, altogether, their earnings have beaten expectations by 3.2 percent, according to FactSet. (Quarterly earnings indicate how profitable a company was during the period being reported.)

The FTSE All-World Index also moved higher last week. It is up almost 8.5 percent for the year.

Richard Henderson, Emma Dunkley, and Robin Wigglesworth of Financial Times offered the opinion investors could have been overly pessimistic during December, and their change in attitude might be attributed to a more dovish tone at the U.S. Federal Reserve, as well as evidence the U.S. economy remains strong.

While investor confidence appears to be strengthening, consumer confidence wavered. The University of Michigan Survey of Consumers showed consumer confidence was lower in January 2019 than it was in January 2018. The Survey’s Chief Economist Richard Curtin wrote, “The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies.”

How much would those burgers cost in britain? Purchasing power parity, or PPP, is a straightforward idea with a tongue twister of a name. When two countries have PPP, people pay the same amount for the same goods, after adjusting for the exchange rate. For example, if one British pound is worth 50 U.S. cents, then an item that costs one British pound in the United Kingdom should cost 50 cents in the United States.

The Economist developed ‘The Big Mac Index’ to measure burger parity. It’s an engaging way to look at local prices and exchange rates. The index measures the price of the seven-ingredient, double-decker burger in different countries and offers a rough estimate of whether a country’s currency is overvalued or undervalued relative to the U.S. dollar.

In January 2019, the index served up the news that almost every currency, in developed and emerging economies, is undervalued relative to the U.S. dollar. The only countries with currencies that appear to be overvalued are Switzerland, Norway, and Sweden.

So, how undervalued are other countries’ currencies?

- The Canadian dollar is 8.9 percent undervalued

- The European Union’s euro is 16.8 percent undervalued

- The British pound is 27 percent undervalued

- The Chinese yuan is 45.3 percent undervalued

- The Russian ruble is 70.4 percent undervalued

The Economist explained, “It is not unusual for emerging-market currencies to look weak in our index. But, today the dollar towers over rich and poor alike. The pound, for example, looked reasonably priced five years ago. Today, Americans visiting Britain will find that [burgers] are 27 percent cheaper than at home.”

The U.S. dollar is stronger than usual because higher interest rates and tax cuts made American assets more attractive to investors than other assets in 2018, reported The Economist.

A strong dollar is a boon to travelers, who get more for their money in other countries. It also can make imports from other countries more attractive price-wise. There are disadvantages to a strong dollar, too. For example, it makes the United States a more expensive destination for travelers from other countries, which could discourage tourism. In addition, a strong dollar makes exports more expensive and that could make U.S. goods less competitive in overseas markets.

Weekly Focus – Think About It

“Wealth begins in a tight roof that keeps the rain and wind out; in a good pump that yields you plenty of sweet water; in two suits of clothes, so to change your dress when you are wet; in dry sticks to burn; in a good double-wick lamp; and three meals; in a horse, or a locomotive, to cross the land; in a boat to cross the sea; in tools to work with; in books to read; and so, in giving, on all sides, by tools and auxiliaries, the greatest possible extension to our powers, as if it added feet, and hands, and eyes, and blood, length to the day, and knowledge, and good-will.”

–Ralph Waldo Emerson, American writer

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

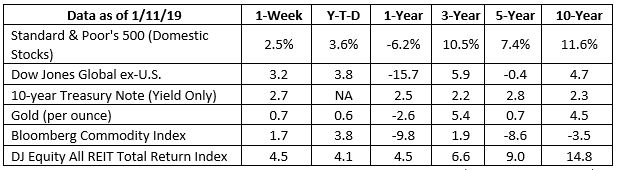

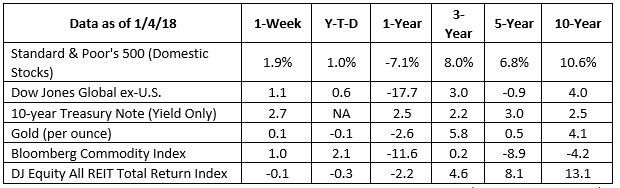

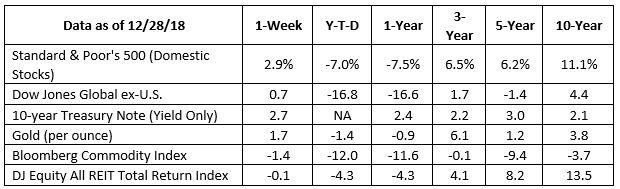

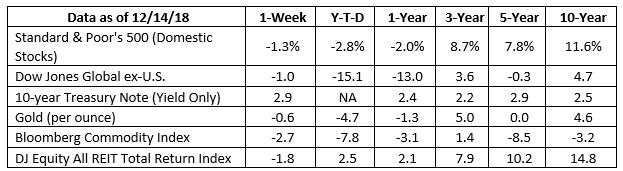

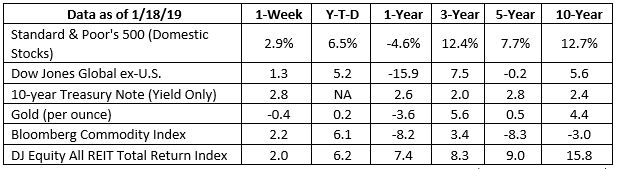

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Special Message

Special Market Update

Inflation is proving to be far more tenacious than financial markets had hoped.The idea that inflation peaked in March was put to rest last week when the Consumer Price Index (CPI) showed that inflation accelerated in May. Overall, prices were up 8.6...

Special Update

All,You undoubtedly have heard reports that the world’s supply of wheat and corn are in jeopardy due to Ukraine and Russia both missing this season’s planting window for obvious reasons (click the link above to read more details). Did you know that Russia...

Significant Shrinkage

Significant Shrinkage Buffeted by Inflation Is it time to double check your household budget? Chances are the budgeted expenditures of the vast majority of Americans are about to get buffeted. Or so says the Oracle of Omaha. In the latest shareholder...

How to Manage Your Money and Your Risk Exposure

This is an excellent example of one of our more popular client webinars where we detail what is happening in the market, what makes us so successful and different from other advisors, and how it effects our clients' portfolios.

Forgotten 401Ks

ZombiesThey’ll eat you alive!Failure to Rebalance - Zombie Sign #1When was the last time you rebalanced your 401(k) or other retirement account? When you set it up, you took a fairly conservative approach and bought 60% stock mutual funds and 40% bond...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-gains-3-for-its-best-start-since-1997-51547857364?mod=hp_DAY_10

https://insight.factset.com/earnings-season-update-january-18-2019

https://www.investopedia.com/terms/e/earnings.asp

https://www.ft.com/content/e5e72cbc-157b-11e9-a581-4ff78404524e

http://www.sca.isr.umich.edu

https://www.economist.com/news/2019/01/10/the-big-mac-index

https://www.economist.com/graphic-detail/2019/01/12/the-big-mac-index-shows-currencies-are-very-cheap-against-the-dollar

https://www.investopedia.com/articles/forex/051415/pros-cons-strong-dollar.asp

https://emersoncentral.com/texts/the-conduct-of-life/wealth/