Uh oh! Signs of a potential financial market correction may be on the horizon: The S&P 500 is down 4% from its all-time high. Investors are showing increased interest in gold, silver, copper, and other commodities, which are often seen as safe havens during...

Market Commentary – April 29, 2019

It wasn’t an ‘Avengers End Game’ spoiler, but there was big news last week.

Economic growth in the United States was strong during the first quarter. The Bureau Of Economic Analysis (BEA) announced gross domestic product (GDP), which is the value of all goods and services produced in the United States, increased by 3.2 percent.

The estimate came as a surprise. It was well above the consensus forecast of 2.3 percent, according to Randall Forsyth of Barron’s. In addition, as The Economist pointed out,

“This year America’s economy did not get the freshest of starts. A government shutdown, a wobbly stock market and concerns that the Federal Reserve would tighten monetary policy too quickly made for a dim outlook for 2019. With the effects of fiscal stimulus fading, and momentum in the global economy ebbing, most expected America’s economic growth to decelerate.”

Both Barron’s and The Economist cautioned investors to look under the hood, though. The top contributors to accelerating growth were imports and exports, which could be volatile. In addition, consumer spending, which usually accounts for about of two-thirds of GDP growth, rose far more slowly than it did in the previous quarter.

Investors were appreciative of quarter-to-quarter GDP growth. They also were encouraged by first quarter earnings reports. Earnings reflect the health and profitability of public companies. With 46 percent of Standard & Poor’s 500 Index companies reporting, FactSet wrote, “In aggregate, companies are reporting earnings that are 5.3 percent above the estimates, which is also above the five-year average.”

The S&P 500 and Nasdaq Composite Indices ended the week at record highs, while the Dow Jones Industrial Average finished the week lower.

Why do countries stockpile goods? Some countries stockpile goods they have deemed essential for human survival. For instance, Switzerland has been stockpiling coffee, sugar, rice, edible oils, and animal feed since World War II. Earlier this month, the country changed its mind about coffee. The Swiss decided to stop maintaining an emergency supply of java because it is not essential to human survival. Reuters reported that opposition is brewing.

The Canadian province of Quebec has a strategic reserve of maple syrup. The stockpile has little to do with human survival, though. Real maple syrup is a valuable commodity. Ounce for ounce, it is worth more than oil. National Public Radio (NPR) reported, “…the global strategic reserve is actually a way to guarantee that high, high price for maple syrup by removing – totally removing the natural boom-and-bust cycle that would otherwise happen for an agricultural commodity.”

China has been stockpiling grain. Reuters reported the United States Department of Agriculture (USDA) expects 65 percent of the world’s corn and 50 percent of the world’s wheat will be in China this year. In 2020, the government will require all gasoline supplies to be blended with ethanol, which is renewable fuel made from corn.

In the United States, we have been stockpiling cheese. In part, that’s due to an excess of milk production. We use extra milk to make cheese, and Americans eat a lot of cheese – about 37 pounds per capita in 2017, according to NPR. Regardless, our cheese surplus has grown to 1.4 billion pounds or 900,000 cubic centimeters. That’s enough cheese to wrap around the U.S. Capital. The abundance of cheese is driving prices lower.

Weekly Focus – Think About It

“You know, farming looks mighty easy when your plow is a pencil, and you’re a thousand miles from the corn field.”

–Dwight D. Eisenhower, 34th President of the United States

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

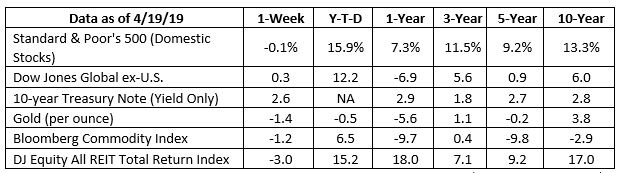

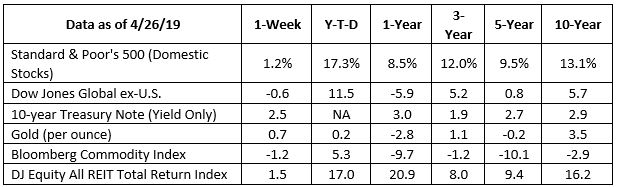

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Special content from Jack, very short read!

Special Edition from Research Financial Strategies

Dear Friends and Clients, This week, a good friend and client brought something significant to my attention. Despite our initial struggles to uncover the full story, my resourceful son-in-law managed to locate it. It comprises three parts and runs approximately 45...

The Fed’s Drive To 2% Inflation

February isn't over yet, but the Cleveland Fed has released its projections for a few key economic markers. Why are these markers important? The Fed likes to look at the Consumer Personal Expenditures (CPE) to gauge whether or not their plan to curb inflation is...

Consumers Expect Better Days Ahead

Many consider the University of Michigan the gold standard for reporting on consumer sentiment and trends. Among its 50 monthly reports, the most well-known is the "UMich Consumer Sentiment" survey, which measures consumer confidence. I also follow the University of...

Another Successful Kids Charity Golf Tournament!

Lollipop Golf TournamentThanks to everyone for helping us make this another successful event! Clients, advisors and friends always make this one of our favorites each year!More about Lollipop Kids and the incredible work they do!

EVs―The Next Big Thing

EVs―The Next Big ThingAn Interesting EmailWe recently received an interesting email from a reader of our RFS website. Katie Griffin is a Senior Communications Specialist at EcoWatch.org, a group devoted to disseminating information on the environment to help reduce...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bea.gov/news/2019/gross-domestic-product-1st-quarter-2019-advance-estimate

https://www.barrons.com/articles/intel-and-3m-are-among-the-losers-in-this-record-setting-market-51556325767?refsec=up-and-down-wall-street

https://www.economist.com/finance-and-economics/2019/04/26/americas-strong-growth-this-year-surprises-economists

https://insight.factset.com/earnings-season-update-april-26-2019

https://www.usnews.com/news/business/articles/2019-04-25/asian-shares-mixed-after-us-stocks-retreat-from-record-highs

https://www.reuters.com/article/us-swiss-coffee/swiss-government-says-coffee-not-essential-stockpiling-to-end-idUSKCN1RM226

https://www.npr.org/2019/04/17/714413348/how-quebecs-maple-syrup-stockpile-can-impact-an-entire-global-industry

https://uk.reuters.com/article/us-china-grains-braun/column-chinas-huge-grain-stockpiles-set-to-linger-through-next-year-idUKKCN1S20UV

https://afdc.energy.gov/fuels/ethanol.html

https://www.npr.org/2019/01/09/683339929/nobody-is-moving-our-cheese-american-surplus-reaches-record-high

https://blog.machinefinder.com/19688/10-memorable-farming-quotes-famous-figures